IMF flags nine risks for Bangladesh

The International Monetary Fund (IMF) has suggested greater exchange rate flexibility to preserve reserve adequacy, warning failure to do so may create further imbalances in the currency market.

This is one of the nine risks the Washington-based lender has identified as the Bangladesh Bank struggles to lift the international currency reserves, contain inflation and restore macroeconomic stability.

They were cited in the programme document as the lender approved $1.15 billion in the third tranche of the $4.7 billion loan to Bangladesh on Monday to shore up its reserves.

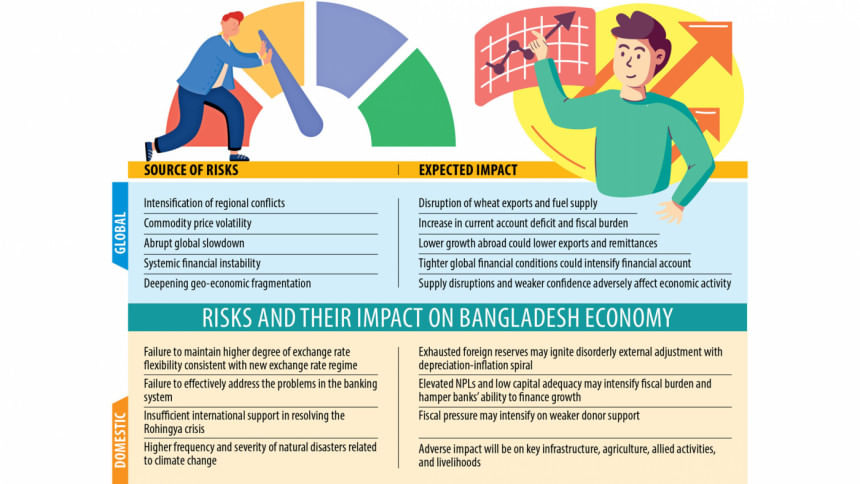

The risks are both external and internal.

They are intensification of regional conflicts; commodity price volatility; abrupt global slowdown; systemic financial instability; deepening geo-economic fragmentation; failure to maintain exchange rate flexibility; failure to address the problems in the banking system; insufficient international support in resolving the Rohingya crisis; and higher frequency of natural disasters.

The central bank will have to take IMF's recommendations seriously as it is set to formulate the monetary policy for the next six months in July.

The failure to maintain a higher degree of exchange rate flexibility consistent with the new exchange rate regime, and to clear the foreign exchange market and support orderly external adjustment has been described as a short-term risk factor.

"Further exchange market imbalances and exhausted BB's foreign reserves may ignite disorderly external adjustment with depreciation-inflation spiral," it said.

So, the IMF recommended further steps to realign the exchange rate, and tightening monetary policy to sustain positive interest rate differential to gain credibility and counter speculations.

On May 8, the Bangladesh Bank relinquished its control over fixation of the exchange rate. It also made the bank interest rate market-oriented after nearly four years.

It came as the gross forex reserves plunged to $19.8 billion in March from its peak of $41.7 billion in August 2021 because of higher outflows against inflows. Official figures suggest continued forex intervention with net sales reaching $7.8 billion as of March 7 of the outgoing fiscal year.

The IMF said realigning exchange rates to a market-clearing level has been critical to rebuild forex reserves. "This should remain a near-term priority."

Furthermore, greater exchange rate flexibility has warranted a tighter monetary policy stance to counter inflationary pressure stemming from the exchange rate pass-through to inflation.

The taka has lost its value by 35 percent against the US dollar in the past two years amid fast depletion of the reserves.

The pass-through of the sharp depreciation of the currency accounted for half of the inflation surge seen in Bangladesh in the last financial year, according to the IMF. Inflation has stayed above 9.5 percent in the current financial year as well.

The IMF said further scaling back of non-monetary use of forex reserves could provide some short-term relief.

Gross forex reserves currently cover about 2.5 months of imports. It is projected to increase to 3.6 months by 2026-27. Over the medium-term, policies to expand and diversify export earnings, and attract FDI inflows should help in maintaining adequate coverage, the IMF said.

It said the monetary policy should continue to focus on addressing internal imbalances.

"Still, elevated inflation and inflation expectations will require continued monetary policy tightening until inflation consistently slows down to BB's medium-term target range of 5-6 percent."

The IMF also identified some global risk factors like the escalation or spread of the conflict in Gaza and Israel, Russia's war in Ukraine, and the disruption facing the trade of energy, food and supply chains, and the remittances, FDI and financial flows.

The main impact will be a disruption of wheat exports from Ukraine while fuel supply from Russia may increase import prices and reduce food availability, with adverse effects on activity, current account and inflation.

The commodity price volatility will widen the current account deficit and fiscal burden, pressures on the exchange rate, and the reserves.

The lender suggested targeted support to the poor and adopting an automatic fuel pricing mechanism.

Apart from externalities, the government's wrong policies and some local factors have also been responsible for the lingering macroeconomic instability over the last two years, local economists say.

The government has adopted a crawling peg as a transitional step toward greater exchange rate flexibility to address elevated inflation and falling reserves, said Finance Minister Abul Hassan Mahmood Ali in a letter to the IMF.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments