Interest cap, NPLs did more damage than Covid, war

The business sector in Bangladesh has been going through severe challenges for the past four years, which, for many, have been the toughest period in decades, with the coronavirus pandemic being the dominant factor in the early part before the Russia-Ukraine war broke out. Today, we are running the second report of a series to present how various sectors fared in the face of the two unprecedented shocks.

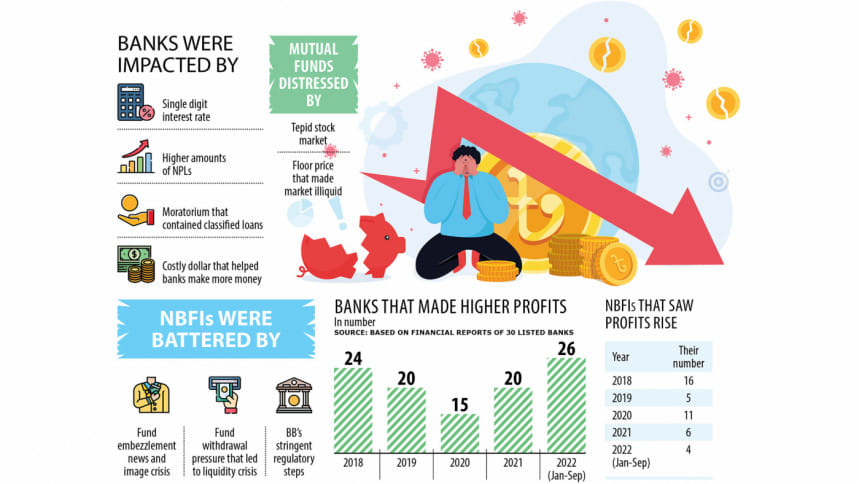

Banks and non-bank financial institutions of Bangladesh might have been largely immune from the devastating impacts of the Russian-Ukraine war and the coronavirus pandemic, but the interest rate cap, higher bad loans and a tarnished image spelt trouble for them in the past several years.

The financial sector was unscathed throughout the pandemic thanks to a central bank's moratorium, which ordered banks and non-banks not to classify loans and follow relaxed rescheduling conditions. This, in turn, prevented them from setting aside funds to cover loan losses that come from profits.

On the other hand, many banks posted huge profits from their foreign exchange-related businesses since the outbreak of the Russia-Ukraine war as costly global commodities became costlier owing to the disruptions caused by the conflict. The crisis sent the prices of the US dollar to a record high against the local currency amid the fast depletion of the foreign currency reserves.

In 2018, of the 30 banks listed on the Dhaka Stock Exchange, 24 reported higher profits. Their number fell to 20 in 2019. It stood at 15 and 20 in 2020 and 2021, respectively.

In the first nine months of 2022, twenty-six banks booked higher profits, year-on-year.

"Despite the fallout of the pandemic, most banks logged higher profits because of higher commission and fee incomes from a spike in remittance flows and the opening of letters of credit," said Nurul Amin, a former chairman of the Association of Bankers, Bangladesh.

BB PERKS AND EXCHANGE RATE WINDFALL FOR BANKS

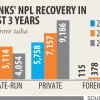

The pandemic was supposed to deal a major blow to the business of banks but the central bank's several benefits saved the day for them as they were able to show lower non-performing loans, according to Amin.

On March 19, 2020, less than two weeks after the government first reported the country's maiden coronavirus cases, the BB asked lenders not to consider business-people as defaulters if they failed to repay instalments until June 30 that year.

The central bank later extended the deadline several times to 2022, allowing borrowers to avoid becoming defaulter by paying a smaller portion of instalments.

The BB also ordered banks to follow a single-digit interest regime from April 1 of 2020. As a result, the profits of most of the banks dropped in the year as interest income dropped.

This prompted lenders to redirect their focus to securities and bonds. The move paid off and most banks logged higher profits in 2021.

The policy on loan rescheduling of defaulted loans was also relaxed. Defaulters who took term loans have been given a repayment period of six to eight years compared to the previous tenure of 9-24 months.

Non-performing loans were expected to witness a surge during the pandemic since sales plummeted and businesses were in a tight corner. But the BB steps prevented NPLs from ballooning and thus, cutting provisioning requirements. This helped banks show higher profits.

Still, default loans in the banking sector jumped 17 per cent year-on-year to Tk 120,656 crore in 2022. The ratio of bad loans rose to 8.16 per cent in December from 7.93 per cent in the same month in 2021, data from the Bangladesh Bank showed.

Banks made a turnaround in the January to September period of 2022 riding on the higher income from foreign exchange dealings, an analysis of their financial reports showed.

The listed banks generated incomes worth more than Tk 4,900 crore in the nine months, up 206 per cent from the Tk 1,632 crore seen in the identical period a year earlier.

Banks also increased charges for most of their services, such as internet banking, SMS service and statements, pushing up their incomes.

There are about 60 banks in Bangladesh.

Private commercial banks control 75 per cent of the money market and major private commercial banks are listed with the stock market, so their data depicts the real scenario of the overall banking industry, according to Amin.

STRUGGLE CONTINUE FOR MOST NBFIS

The NBFI sector was already in a tight corner because of the irregularities at some companies. Their crisis deepened when Covid-19 arrived on the shores of Bangladesh. And the impacts of the crisis were more severe in the case of NBFIs than banks.

Among 21 listed NBFIs, 16 booked higher profits in 2018. The number fell to five in 2019, 11 in 2020 and six in 2021. The number of NBFIs that posted higher profits in the January-September period of 2022 stood at four.

In 2020, NBFIs were impacted by three major shocks: the single-digit interest rate, the impact of the pandemic and negative news that surfaced centring some low-performing financial companies.

"The NFBI sector was mainly hurt by the erosion of confidence when news came about the irregularities of a few companies," said Mominul Islam, chairman of the Bangladesh Leasing and Finance Companies Association.

In January 2020, the Anti-Corruption Commission filed five cases against PK Halder and 32 others for laundering about Tk 350 crore from International Leasing Financial Services, an NBFI. Later, it found that they siphoned off more than initially thought.

"Individual and corporate depositors started to withdraw deposits and the flow of new deposits dried. As a result, most NBFIs passed a tough period in 2020," Islam said.

Some large NBFIs, however, did not face much trouble as they maintain good governance and have a good reputation. Rather, they received more deposits that departed trouble-hit companies.

The pandemic also hurt the business of NBFIs to some degree, said Islam, also the managing director of IPDC Finance.

After the scams became known, the central bank carried out a thorough inspection in order to restore good governance. This exposed the flaws of many NBFIs, handing a blow to their profits.

Besides, the regulator toughened rules. In the cases such as keeping deferred tax and provisioning, the rules are tougher for NBFIs than those faced by banks, according to Islam.

"Though it has impacted the profitability of the sector, it will bring benefit in the long run."

Mutual funds were hit in the last few years as the stock market suffered.

Among the listed 36 mutual funds, 32 saw lower profits in 2019. Their number fell to 10 and 8 in 2020 and 2021. All mutual funds reported lower profits last year.

Mutual funds pool money from investors to channel them into securities such as stocks and bonds. Depending on the profits earned, investors are paid their shares as dividends.

"Mutual funds do business in the stock market. Since the market did not perform well most of the time in the last few years, asset managers had nothing to do," said Mohammad Emran Hasan, chief executive officer of Shanta Asset Management Limited.

The DSEX, the benchmark index of the Dhaka Stock Exchange, plummeted 18 per cent, or 1,013 points, in 2019.

It surged 21 per cent in 2020 and 20 per cent in 2021 although the market was bearish in most months. In 2022, the index fell around 5 per cent, DSE data showed.

In 2020, the Bangladesh Securities and Exchange Commission introduced floor prices to halt a free-fall and it was maintained more than one year before scrapping. The regulatory measure was brought back in July last year after the impacts of the war began to take its toll on the local economy.

"Because of the floor price, most asset managers can't trade shares. So, their profits fell," said a fund manager.

The introduction of a price floor in July led to a sharp decline in market liquidity. Morgan Stanley Capital International has applied special treatment for Bangladesh in its equity indexes as a result,

excluding stock market performance in Bangladesh from its frontier markets index, said the World Bank last week.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments