Investors barely show interest in bank, NBFI stocks

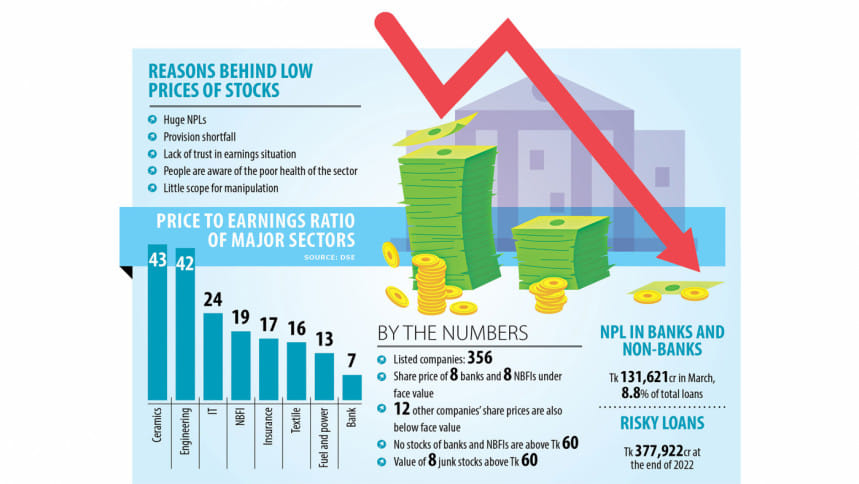

Investors are hardly showing any interest to buy stocks of banks mainly due to the sector's key indicators portraying a gloomy outlook.

Moreover, manipulation is a big draw for investors here. With a higher free float of banking stocks than what companies have on an average, there is little scope for manipulation.

As a result, stocks of eight banks have remained below their face-value of Tk 10 for the last couple of months amidst the scarcity of buyers.

The scenario is almost the same for stocks of eight non-bank financial institutions (NBFIs).

Once stocks of banks and NBFIs were the most lucrative in the market.

"The intrinsic value of the banks and NBFIs are below their par value, if we calculate, so their share price also remains low," said Prof Mohammad Musa, a stock market analyst.

As there is a massive number of shares of the banks and NBFIs, the big investors do not target those for manipulation, said Prof Mohammad Musa, a stock market analyst.

Dean of the school of business and economics at United International University, Musa has a number of publications on the capital market in international platforms.

The intrinsic value is low for two reasons, one of which is for banks not being able to generate required cash flow for non-performing loans (NPLs) being too big, he said.

The other is that investors believe the banks and NBFIs are not adequately keeping provision, for which their income may not prevail for long, he added.

The banking sector's NPLs stood at Tk 131,621 crore in March, up 16 per cent year-on-year, data from the Bangladesh Bank showed.

The NPLs accounted for 8.8 per cent of the banking sector's total outstanding loans of Tk 14,96,346 crore.

The banking sector's total risky loans amounted to Tk 377,922 crore at the end of last year, according to the Bangladesh Bank's Financial Stability Report.

Prof Musa also blamed the huge free float of companies for the low share price. As there is a massive number of shares of the banks and NBFIs, the big investors do not target those for manipulation, he said.

General investors too do not buy these products because their tendency is to mainly rush for stocks undergoing manipulation, he said.

There are 35 banks listed with the stock exchanges. Of them, stocks of AB Bank Limited, First Security Islami Bank Limited, Global Islami Bank PLC, ICB Islamic Bank Limited, National Bank Limited, ONE Bank Limited, Standard Bank Ltd and Union Bank Limited are now less than Tk 10.

Those of another 12 are slightly above the face value.

There are a number of examples of stock prices of companies being high only due to them having a lower number of shares, Musa added.

Junk stocks of Jute Spinners Ltd were traded at Tk 334 yesterday. The company has 17 lakh shares.

Imam Button Industries Limited, Northern Jute Manufacturing Company Limited, Zeal Bangla Sugar Mills Limited and Shyampur Sugar Mills Limited saw their junk stocks trade at over Tk 100 though their par value is Tk 10.

They have shares ranging from 22 lakh to 70 lakh, the DSE data shows.

Banks and NBFIs have shares in the range of 70 crore to 160 crore.

Banks and NBFIs are more regulated than the average company, so investors should have had more confidence in them, said Shekh Mohammad Rashedul Hasan, managing director and CEO of UCB Asset Management.

However, analyses of the banking sector based on facts and figures are being published in newspapers almost every day and almost all of these are saying that the banks are going through a tough period, he said.

So, investors are finding it difficult to properly perceive the quality of the sector's assets, he said.

Moreover, they are confused over whether the sector was losing strength or not. As a result, their participation in the sector is low, he said.

Among 23 NBFIs, stocks of Bangladesh Industrial Finance Company Limited, Fareast Finance & Investment Limited, FAS Finance & Investment Limited, First Finance Limited, International Leasing and Financial Services Limited, People's Leasing and Financial Services Limited, Premier Leasing and Finance Limited and Union Capital Limited were under their face value.

A lack of confidence is plaguing the whole sector, for which some bank stocks are undervalued, added Hasan of UCB Asset Management.

No bank and NBFI stocks are above Tk 60 while eight junk stocks, out of a total of 23, are being traded above the amount, the DSE data showed.

A top official of a listed bank, preferring anonymity, said some of the banks and NBFIs were feeling the pressure of the high NPLs but they abide by some corporate governance and were under regulations of the central bank.

Some of the banks and NBFIs are paying dividends too, so, in some cases, they are undervalued mainly due to most investors paying heed to rumours, he said.

And manipulating bank and NBFI stocks is tough due to them prevailing in high numbers, he clarified.

"If you see the stock market, many other listed companies do not even have any factories, or production has remained stopped for many years, (yet) these stocks are also traded above the share price of banks and NBFIs," he said.

It means that most investors of the stock market rush for stocks undergoing manipulation, he added.

In the banking sector, stock prices of 28 percent or 16 banks and NBFIs are under the par value. In comparison, 4 percent or 12 companies in all other sectors combined are prevailing below the face value, the DSE data shows.

Among the 12 companies, 10 are in the textile sector. Most of the companies' performances are not up to the mark and they have a huge number of shares.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments