Islamic banks post higher profit despite troubles

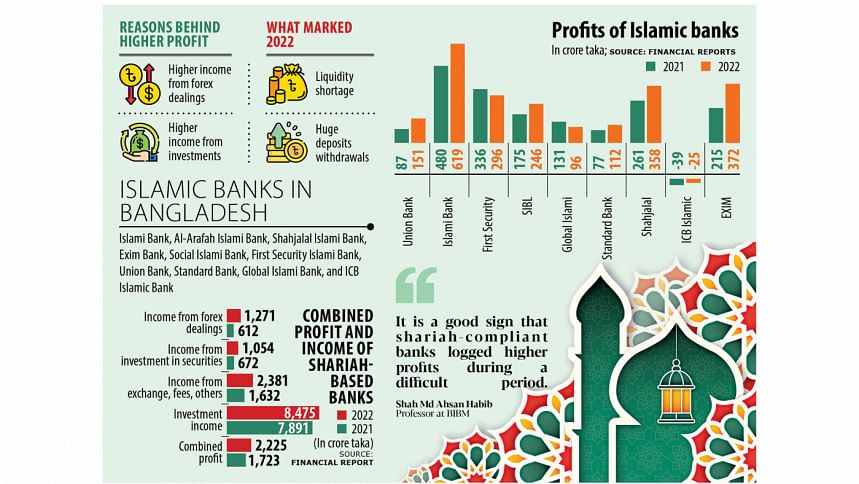

Most of the Shariah-compliant banks in Bangladesh clocked higher profits in 2022 despite a fall in deposits and the unprecedented fund withdrawal by customers and liquidity crunch.

Last year, Islamic banks faced one of the toughest periods in recent times.

The banks that were awash with extra cash found themselves suffering from a liquidity dearth resulting from withdrawals by many depositors after reports on alleged loan scams surfaced.

The situation prompted the central bank in December to pump funds into a number of Islamic banks to enable them to meet emergency financing needs and comply with regulatory requirements.

Still, combined profits of the banks surged 29 per cent year-on-year to Tk 2,225 crore last year, driven by higher income growth from the investments in the government's Islamic bonds known as sukuks and the foreign exchange-related business.

But the net investment income, which refers to the net interest income for conventional banks, grew comparatively at a lower rate.

"As some of the Shariah-based banks faced sudden problems in attracting deposits owing to several factors related to corporate governance, they redirected their focus to sukuks and commission and fees related services from investments," said Shah Md Ahsan Habib, a professor at the Bangladesh Institute of Bank Management.

Islamic banks term loans and advances as investments.

When banks face difficulty in attracting deposits, they usually shift their attention from lending to investments in securities and services to receive higher commissions and fees, in a bid to generate revenues and keep lending.

Deposits in Islamic banks declined to Tk 409,949 crore at the end of December 2022, down 2.71 per cent from Tk 421,375 crore in September, the first decline in eight years. This means they lost Tk 11,426 crore in deposits in the quarter, according to the October-December quarterly report on Islamic banking of the central bank.

Full-fledged Islamic banks were the biggest sufferers as they lost Tk 11,842 crore in the fourth quarter from the third quarter. They collectively held deposits worth Tk 379,951 crore in December, a decrease of 3 per cent from Tk 391,792 crore in September.

"The change in focus has worked well for banks, so they are recovering and they have logged profits. It is a good sign that Shariah-compliant banks logged higher profits during a difficult period," said Habib.

There are 10 Shariah-based banks in Bangladesh: Islami Bank Bangladesh Ltd (IBBL), Al-Arafah Islami Bank, Shahjalal Islami Bank, Exim Bank, Social Islami Bank, First Security Islami Bank, Union Bank, Standard Bank, Global Islami Bank, and ICB Islamic Bank.

Of them, Al-Arafah is yet to publish its financial reports for 2022.

Of the nine banks that published financial reports, seven saw higher profits, two reported lower earnings, and one remained in loss.

The banks' combined income from securities surged 57 per cent to Tk 1,054 crore last year while the income from commission and fees soared 46 per cent to Tk 2,381 crore.

Net investment income grew 7 per cent to Tk 8,475 crore.

IBBL, the largest Shariah-based bank in the country, logged the highest profit as it returned to the high-profit growth trajectory. Profits climbed 29 per cent to Tk 619 crore.

In 2021, IBBL's profits stood at Tk 480 crore. It was Tk 479 crore in 2020 and Tk 548 crore in 2019.

Mohammed Monirul Moula, managing director of IBBL, told The Daily Star: "Clients and shareholders have kept their faith in our bank while the regulators have played a supportive role as we work for the national interest."

He cited the contribution of the sukuks to the profits of Shariah-compliant banks.

The instruments were almost non-existent in Bangladesh a couple of years ago.

"The Shariah-based banks lacked diversified investment tools. Sukuks have helped banks diversify the investment portfolio," Moula added.

Exim Bank's profits rocketed 73 per cent to Tk 372 crore and Union Bank's profits jumped 73 per cent to Tk 151 crore.

In line with global trends, Islamic banking in Bangladesh is witnessing robust growth due to strong public demand and policy support from the Bangladesh Bank, said the central bank in a report.

At the end of December, Islamic banks represented a 25.81 per cent share of the entire banking system in terms of deposits and 29.20 per cent when it comes to investments.

The number of branches of Islamic banks, including Islamic branches and windows of conventional commercial lenders, rose to 2,217 in 2022 from 2,080 a year ago. They employed 49,851 at the end of December, central bank data showed.

Eleven conventional banks have Islamic banking branches and 14 banks have Shariah-compliant windows.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments