New rules in the making to give more autonomy to Bangladesh Bank

The government is going to amend the Bangladesh Bank Order, 1972 to align it with global best practices and give the central bank more autonomy so that it can initiate steps to help the economy deal with pressure.

The central bank authorities have prepared the primary draft to modify the order and sent it to the government for approval.

It comes as the BB faces criticism for its failure to restore macroeconomic stability, bring down inflation, and bring back good governance in the ailing financial sector.

The International Monetary Fund (IMF) also raised questions about the current level of the autonomy enjoyed by the BB and recommended changes to the order.

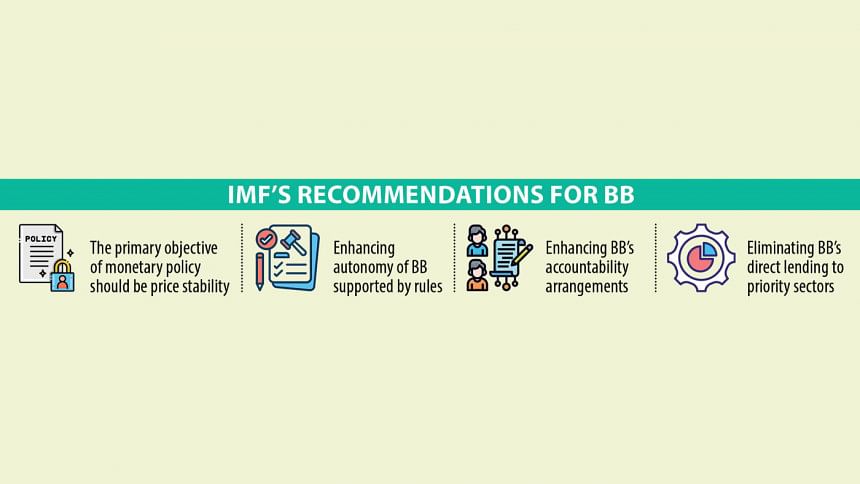

"The order needs to be substantially amended so that price stability is the overriding objective of the new monetary policy regime, and governance arrangements are aligned accordingly," said the IMF in its technical assistance report regarding the central bank's activities.

There is no doubt that the central bank should enjoy full autonomy. At present, there is autonomy when it comes to rules and regulations. However, it is being impacted by the political economy

Due to a lack of autonomy, the IMF said that the central bank is not able to take steps necessary for the economy, which has been witnessing one of its worst crises in recent times.

It said the Bangladesh Bank Order (BBO) saw improvements following changes in 2003. However, no changes have occurred to the BB's governance arrangements regarding its autonomy, transparency and accountability since an assessment undertaken in 2018.

"BB's de jure autonomy …. could constrain BB actions in times of pressure."

"The amendment is needed so that it can enhance the de jure autonomy of the BB, enhance its accountability arrangements, and limit its direct lending to priority sectors."

The BB governor's post can be a constitutional one or the tenure of the post can be six years. If the post of the PSC chairman and ACC chairman can be constitutional, why not the governor's post?

The IMF said amendments should be considered as soon as possible, taking advantage of the momentum provided by the BB's announcement of the transition to an interest rate-targeting monetary regime.

The government told the Washington-based lender during the second review of the $4.7 billion loan programme in April that it would seek IMF's assistance while reviewing the draft amendments to the BBO to ensure that the order is consistent with international best practices by December.

It intends to submit the amendments for the cabinet's approval within the programme period. The 42-month programme was approved in January last year.

According to the draft amendments, notwithstanding anything contained in any other law in force, the BB will have the sole authority to issue any directive, directly or indirectly, to any bank or financial institution.

Mohammed Farashuddin, a former central bank governor, said if the central bank has strong power, it is good for the country. On the other hand, if it lacks power, its activities are still not disrupted.

Atiur Rahman, also a former governor, said there is no doubt that the central bank should enjoy full autonomy.

"At present, there is autonomy when it comes to rules and regulations. However, it is being impacted by the political economy."

According to Rahman, if the central bank enjoys autonomy, it would be helpful to keep the economy stable. When the government realises the autonomy's importance, it will be in favour of independence.

Both Rahman and Farashuddin emphasised making the post of the governor constitutional.

The tenure of the governor can be six years, said Farashuddin, who held the post from November 1998 to November 2001.

"However, when I say this, I get the response that the governor enjoyed limited power when you were the governor, but you were not blocked by anyone."

He said a governor has power legally. "The power is a symbolic issue. It depends on who uses the power."

The ninth governor of the BB said he did not allow the government to take any loans from the central bank.

Farashuddin said he depreciated the currency several times before informing the then finance minister though the power was vested with the finance ministry.

The seventh governor of the BB said there were strict policies about the number of people who could sit on a board of banks and their tenure.

However, in recent years, the rules have been relaxed. For example, the forbearance for loan repayments and the relaxed loan rescheduling policy had been offered by the central bank. Still, it has failed to rein in the upward trend of non-performing loans (NPLs).

Another mistake on the part of the BB was to introduce a 9 percent lending rate ceiling in April 2020, which made loans cheaper. The interest rate was made market-based only on May 8 this year following advice from the IMF.

"Loan rescheduling is being allowed nine or ten times too. Interest waiver was given but it has to be stopped," Farashuddin added.

The IMF said some provisions of the order have given the government power that could constrain the BB's ability to "do whatever it takes" to achieve its objectives of price stability.

"The BBO section 82 also places the BB under the de facto control of the government of Bangladesh," it said.

A provision of the order called for establishing a council comprising the finance and commerce ministers, the governor, the secretary of the finance division, the secretary of the Internal Resources Division, and a member of the Planning Commission, for the co-ordination of fiscal, monetary and exchange rate policies.

The BB will ensure that the macro-economic framework as coordinated by the council is reflected in the policies of the BB, according to the provision.

"Therefore, the autonomy of the BB is not guaranteed," the IMF said.

The establishment of a dedicated body chaired by the ministry of finance to perform such coordination could also constrain BB actions in times of pressures, it added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments