Used car import soars despite dollar crisis

Reconditioned car imports surged by more than 75 per cent year-on-year in July-October despite the ongoing economic uncertainty and the government's efforts aimed at discouraging the purchases of luxury items from external sources, traders say.

In July, the central bank asked banks to take 100 per cent cash advance payments from businesses before opening letters of credit (LC) for luxury items such as cars, electronics, gold, and precious metals with a view to stopping the depletion of the foreign currency reserves.

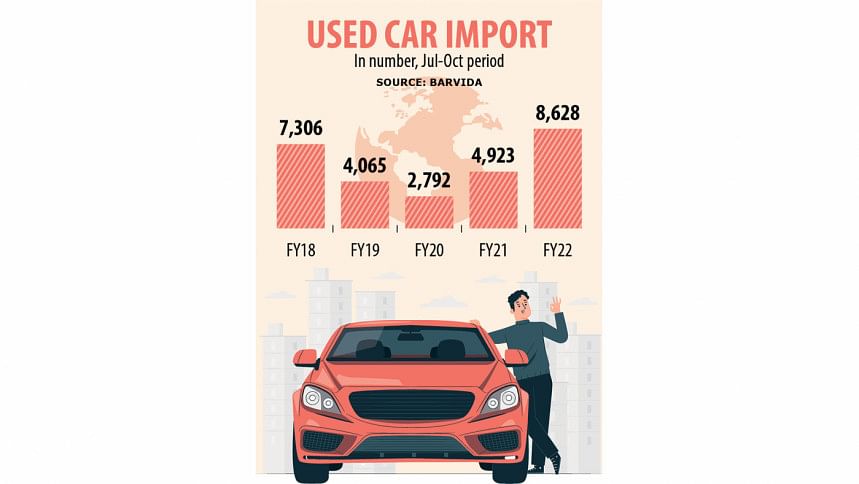

Dealers imported 8,628 units of cars, mostly passenger cars and micro-buses between July and October, while it was 4,923 units during the same four-month period in the last fiscal year, data from the Bangladesh Reconditioned Vehicles Importers and Dealers Association (Barvida) showed.

"The importers opened the LCs against the cars in the last four months. But now we can't open any new LC," said Md Habib Ullah Dawn, president of the Barvida.

According to Dawn, importers usually open LCs before a national budget is placed fearing that duties and other taxes might go up.

"The import of cars increased in the first four months of the fiscal year as the demand is stable," said Abdul Haque, a former president of the Barvida.

Traders, however, are facing trouble in opening LCs to import reconditioned cars even with a 100 per cent margin as banks don't want to open them owing to a dearth of the US dollar in their stock.

Bangladesh has been forced to limit imports as reserves have been falling amid escalated import bills. Reserves stood at $35.73 billion on November 2, down more than 23 per cent at $46.48 billion on the same day a year earlier, BB data showed.

The BB has also asked banks to inform it about the opening of LCs whose value is $3 million and above so that the import of non-essential items can be checked.

"The opening of LCs for car imports has almost stopped," said Abdul Haque, managing director of Haq's Bay Automobiles Ltd, a used car importer and retailer.

He said cars are coming from Japan against which the LCs were opened three to four months ago.

Abdul Mannan Chowdhury Khoshru, owner of Nippon Autos Trading and a former president of the Barvida, said the 100 per cent LC margin and the dollar price hike have compelled importers to increase investment.

He said the duty structure in Bangladesh and the price in Japan have remained the same but the appreciation of the dollar has sent the price of cars higher.

Against the backdrop, small importers who have no cash can't import cars directly due to the mandatory 100 per cent LC margin.

Khoshru is worried that some traders would have to shut their businesses amid the liquidity crunch.

"Then only big importers will remain in the market. If this happens, there will be no level playing field and this may affect the market and some people may even lose jobs."

According to importers, the costs of imports and the price of passenger cars increased in the ongoing fiscal year as the National Board of Revenue hiked the supplementary duty for vehicles with engine capacities of more than 2,000 cc.

Md Shafiqul Islam, head of operations of HNS Automobiles, said importers are facing a huge crisis due to the restrictions on LC opening and the appreciation of the dollar.

The taka has lost its value by 25 per cent against the US currency in the past one year. In the open market, the depreciation would be 30 per cent.

"Importers are trying to import required cars as they feared that imports may be stopped," he said.

According to him, dealers and importers are continuing their business by bringing in more cars riding on the borrowing from other sources.

The higher import came although the sale of cars declined almost 50 per cent during the last three months due to an increase in the price because of the depreciation of the local currency, Islam said.

"Sales were very impressive earlier this year."

Car sales data for the July-October period were not readily available.

Data from the Bangladesh Road Transport Authority showed that 13,502 units of passenger cars were registered from January to September. In the entire 2021, some 16,049 units were registered.

During the nine-month period this year, 8,133 units of sport utility vehicles were registered. It was 7,602 units last year.

Similarly, 5,800 units of microbuses were registered between January and September. The figure was 4,941 units in 2021.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments