Power companies’ profits fall amid dollar crisis

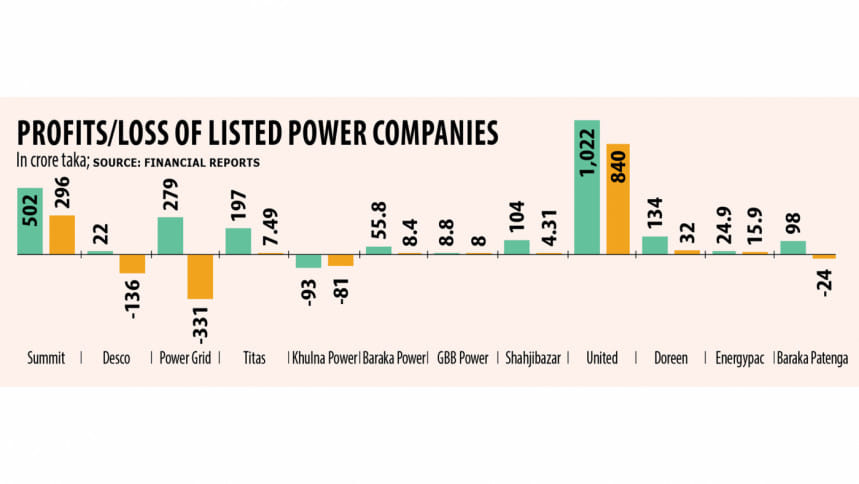

Profits of all power generation companies dropped in the July-March period of fiscal year 2022-23 and some of them even incurred huge losses mainly due to a huge depreciation of the value of the taka against the US dollar that ultimately increased their costs.

Besides, profits of state-run power and gas distribution companies were hit due to a regulatory decision which cut their charges on transmission.

However, three state-run oil supplying and lubricant companies were able to log higher profits.

Power generation companies making use of heavy fuel oil (HFO) were severely impacted due to a dollar shortage, which ultimately raised raw material costs, said Yeasin Ahmed, company secretary of Shahjibazar Power Company Limited.

The Shahjibazar's profit eroded 96 per cent year-on-year to Tk 4.31 crore.

"When the power generation companies opened deferred LCs (letters of credit) to import furnace oil, the dollar price was Tk 85 to Tk 86 but the companies had to pay the dollar by spending Tk 105 to Tk 115," said Ahmed.

Though the input costs rose, revenue did not as the companies had to submit their invoices on the basis of the price of dollar during the LC opening period. So, the companies had to absorb the losses, he added.

Having the biggest power generation capacity and revenue, the United Power Generation and Distribution Ltd witnessed a 17.8 per cent year-on-year drop in its profit to Tk 840 crore.

As it is supplying power to the export processing zones and its sales agreements are different from others, it faced a lesser impact, according to a mid-level official of the company.

Meanwhile, Khulna Power Company Ltd incurred a loss of Tk 81 crore whereas its loss was Tk 9.34 crore in the previous year. Profit of the Doreen Power Generations and Systems Limited declined 76 per cent to Tk 32 crore.

Baraka Power Limited's profit plunged around 85 per cent to Tk 8.40 crore. Baraka Patenga Power Limited incurred a loss of Tk 24 crore whereas it had logged a profit of Tk 98 crore in the previous year.

The company attributed it to a significant increase of foreign exchange loss in foreign currency transactions incurred in associate companies and a decrease in the power supply demand.

A top official of a power generation company, preferring anonymity, said the power producers urged the government to let them charge higher prices since the price of the dollar had gone up.

"However, no positive feedback was given from the government," he said.

Profit of Summit Power Limited, another top power generation company, declined 41 per cent year-on-year to Tk 296 crore. However, the company's revenue rose 41 per cent to Tk 4,692 crore.

General and administrative expenses soared 619 per cent to Tk 259 crore and net finance cost also soared 70 per cent to Tk 193 crore that ultimately downed the company's profits.

Distribution Companies

The Titas Gas Transmission and Distribution Company's profit plunged 96 per cent year-on-year to Tk 7.49 crore. Meanwhile, its revenue increased 26 per cent to Tk 17,097 crore.

Bangladesh Energy Regulatory Commission refixed the company's distribution margin from June 2022 from Tk 0.25 to Tk 0.13 per cubic metre, so the profit dropped, cited the company in its financial reports.

"On the other hand, cost of sales increased due to system loss," it added.

The Power Grid Company of Bangladesh, a state-run listed power transmission company, incurred a loss of Tk 331 crore whereas it had logged a profit of Tk 279 crore in the same period of the previous year.

The company sank into losses mainly due to the depreciation of the value of the take against the US dollar and the increase in financing costs. Its foreign exchange losses stood at Tk 911 crore whereas it was Tk 74 crore in the previous year.

"Though the company's revenue rose in the period, it was not in line with the higher expenses, that especially came from the foreign exchange loss," the company said in its financial reports.

Among the oil supplying state-run companies, Jamuna Oil Company Ltd recorded a 99 per cent surge in earnings.

Padma Oil Company Limited and Meghna Petroleum Limited, the largest and second largest oil marketers on behalf of the government, posted a 33 per cent and 31 per cent growth in profits respectively.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments