WB, IMF loans to help Bangladesh rebuild reserves

On the back of the credits from the World Bank and the International Monetary Fund, Bangladesh may meet for the first time the condition on net foreign exchange reserves attached to the $4.7 billion loan from the IMF and secure the next instalment.

Yesterday, the board of the WB approved budget support worth $500 million. The fund will be disbursed by this month, said finance ministry officials.

The IMF will discuss releasing $1.15 billion in the third tranche of its multi-year credit to Bangladesh during its board meeting tomorrow.

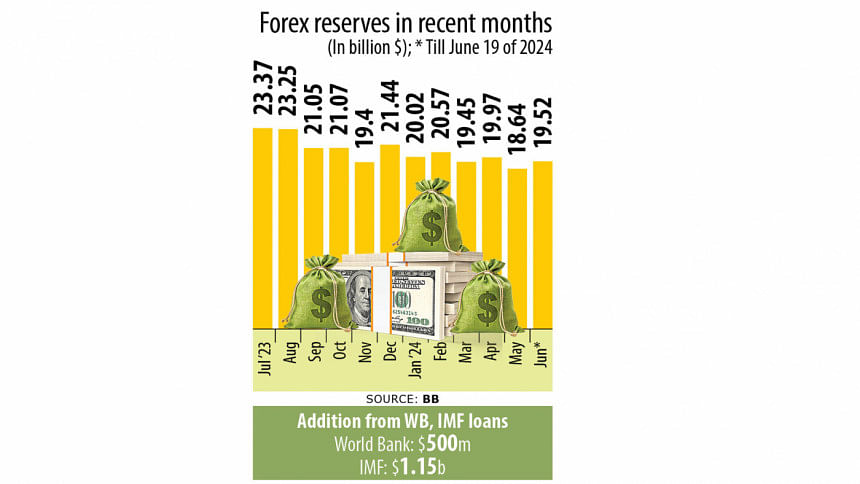

The budget support and the loan will add $1.65 billion to the forex reserves of the South Asian nation, handing it a much-needed boost as it has been struggling to overcome the US dollar supply crunch for the past two years.

Owing to the sharp fall in the reserves level since its peak in August 2021, Bangladesh could not fulfil the target on net international reserve (NIR) as per the conditions of the IMF since the loan programme started in January last year. Still, the global lender disbursed the first two instalments and is going to do the same this week.

To secure the fourth instalment, Bangladesh would have to maintain an NIR of $14.69 billion by June 30. Since the reserves are not picking up as expected, the IMF has revised down the goal from the $20.11 billion set for the end of the current financial year.

NIR figures are not published regularly. Currently, the central bank releases data on the reserves as per its traditional accounting method as well as in line with the balance of payments and investment position manual (BPM6) of the IMF.

The NIR is defined as reserves assets minus reserve liabilities. Reserves liabilities are all foreign exchange liabilities. As per BPM6, gross forex reserves include gold, cash US dollar, bonds and treasury bills, reserve position in the IMF, and special drawing rights holdings.

Usually, the NIR is $5 billion to $6 billion lower than the amount reported under the manual.

In order to hit the NIR goal, Bangladesh will have to keep gross forex reserves above $20 billion as per the BPM6. The reserves stood at $19.53 billion on Wednesday, central bank data showed.

In Bangladesh, the reserves have been declining sharply since the beginning of the Russia-Ukraine war as the conflict sent the prices of commodities higher, hurting import-dependent nations such as Bangladesh.

Mismanagement in the forex market, frequent policy changes, and the gap between the official and the unofficial exchange rate are also to blame.

The dwindling reserves forced the Bangladesh Bank to make the exchange rate almost market-based on May 8 when it introduced the crawling peg mid-rate, allowing banks to trade US dollars at around Tk 117.

WB approves $900 million

The World Bank board gave its consent to two projects and extended $500 million in budget support and $400 million in project loans.

"Decisive reforms will help Bangladesh sustain growth and strengthen resilience to climate change and other shocks," said Abdoulaye Seck, WB country director for Bangladesh and Bhutan, in a press release.

He said the new financing operations will help Bangladesh in two critical areas – the financial sector and urban management — to achieve its vision of upper-middle-income status.

The Second Recovery and Resilience Development Policy Credit involving $500 million, the last in a series of two credits, supports fiscal and financial sector reforms to accelerate sustainable growth and build resilience to future shocks, including climate change.

The programme is to facilitate the transition from trade taxes to consumption and income taxes in order to help Bangladesh strengthen its competitiveness and prepare for LDC (least-developed country) graduation.

The WB said it would help institutionalise the public procurement authority responsible for the electronic government procurement (e-GP) and cut down the average e-GP procurement lead time from 70 days to 55 days.

The programme supports stronger banking sector oversight and improved management of national savings certificates and is expected to improve the efficiency and targeting of cash-based social protection schemes and scale up public and private climate adaptation and mitigation investments.

"A well-functioning financial sector is critical for Bangladesh to increase investment and improve access to finance for those left out of formal banking systems," said Bernard Haven, senior economist and task-team leader for the programme of the WB.

"The government has adopted strong macroeconomic reforms to address external imbalances and a new legislative framework to strengthen the financial sector."

The $400 million has been extended under the Resilient Urban and Territorial Development Project.

The project will help improve climate-resilient and gender-responsive urban infrastructure and urban management capacities in seven city clusters along the economic corridor covering more than 950 kilometres of the highway from Cox's Bazar in the south to Panchagarh in the north.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments