Window for easy loans narrowing

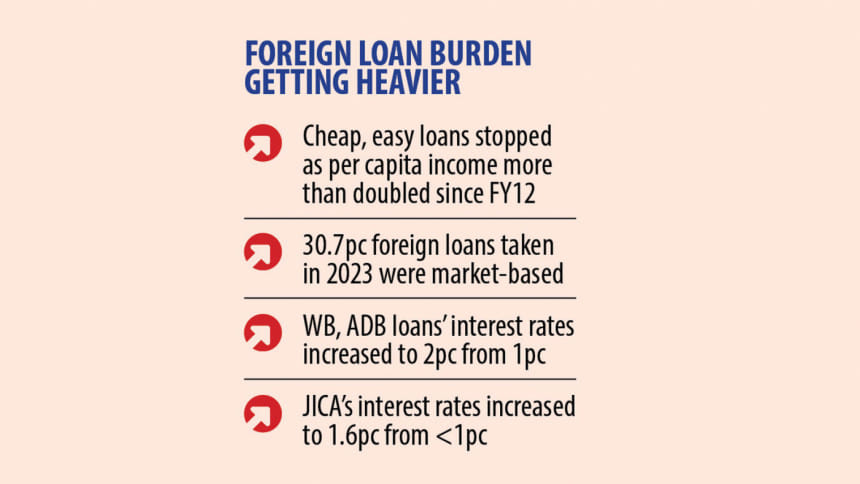

Bangladesh's access to cheap loans is closing in with its rising per capita income, making foreign borrowing costlier.

The country now has to go for borrowing at the costlier market-based rates to keep up development spending, according to a report of the Economic Relations Division.

The interest rate risk is high when the debt portfolio is dominated by market-based rates as the size of interest payment is based on the vagaries of the global economy.

For instance, Bangladesh's cost of foreign loans has been on the rise in recent times as the interest rates have shot up globally.

In 2023, the government borrowed about $2.6 billion at the market-based rate, which accounted for 30.7 percent of the total committed loans. In 2022, it was $3.42 billion, which was 43.9 percent of the total.

Take the case of the World Bank, one of the major lenders of Bangladesh. Until 2018, its loans carried no interest; all the government had to bear was a 0.75 percent service charge, which was sometimes waived.

When the country's status was upgraded to a lower middle-income country in October 2018 from a low-income nation, the WB fixed a 2 percent interest rate and the repayment period was adjusted downwards to 25 years from 30 years previously. The grace period was halved from 10 years.

The reason for the tougher loan terms is Bangladesh is now a "GAP" country, meaning the country is currently at a stage where it can borrow at a market-based interest rate if it wants.

It is the same in the case of the Asian Development Bank, another major development partner, which allocated loans at a fixed and low-interest rate previously. Before 2000, the interest rate was only 1 percent, which jumped to 2 percent in 2013.

From January 2022 to July 2023, the government signed loan deals worth $4.4 billion with the ADB, with 54.5 percent of the amount taken at market-based interest rates.

Bangladesh started borrowing from the Asian Infrastructure Investment Bank since its inception in 2016 and the Beijing-based lender ramped up lending during the pandemic to help the economy recover from the shock by the way of extending budgetary support.

As of June 2023, the government secured $3.4 billion from the bank and the interest rate on the loans is market-based.

A portion of the market-based loans from the ADB and AIIB are budget support taken during the pandemic.

Russia lent about $11.9 billion for the country's biggest infrastructure project: the Rooppur nuclear power plant. The interest rate is Libor plus 1.75 percent.

The London Interbank Offered Rate (Libor) was a benchmark interest rate before it was phased out in June last year and replaced by the Secured Overnight Financing Rate (SOFR).

The SOFR stands at more than 5 percent currently whereas it was less than 1 percent before the latest surge in the cost of funds.

Moscow has already disbursed about $6.5 billion.

Some additional charges take the borrowing rate to 8 to 9 percent, finance ministry officials said.

Japan, the largest development partner of Bangladesh among the bilateral donors, gave out loans at less than 1 percent before it changed its official development assistance policy to increase the interest rate for low-middle-income countries in October 2023.

As a result, the new deals with Japan were signed at a 1.6 percent interest rate.

The upward revision of the interest rate also came as development partners have taken into account the country's growing repayment capacity manifested from the growing per capita income.

In the last fiscal year, the per capita income rose to $2,765 from $1,130 in fiscal 2011-12.

As of January, the total outstanding external loans of the government were $66.8 billion, with about 61 percent of the sum disbursed in the last three fiscal years.

Usually, the loan repayment starts after a loan matures, but the interest payments begin immediately after the release of the funds. Since the loan portfolio has ballooned, the debt servicing has widened simultaneously.

Foreign loan repayments rose 32.4 percent in fiscal 2022-23 while interest payments surged 88.8 percent.

The trend has continued into the current fiscal year: loan payments climbed 44.5 percent and interest servicing rocketed 108.2 percent in the first seven months.

Annual loan repayment was less than $2 billion before fiscal 2021-22. In fiscal 2022-23, it rose to $2.67 billion.

As per the finance ministry projection, $3.57 billion will be required this fiscal year to service debts and $4.5 billion in the next fiscal year.

If the interest rate and loan utilisation keep increasing, repayment will cross $5 billion by that time, said a finance ministry official.

The escalating interest spending will put pressure on the budget.

"We pay Tk 1 as an interest payment for every Tk 4 expenditure from our budget. Therefore, if we can't increase the revenue mobilisation, our budget will be under pressure," said Zahid Hussain, a former lead economist of the World Bank's Dhaka office.

In recent times, the government has taken various steps to raise taxes.

Still, at less than 9 percent, Bangladesh has one of the lowest tax-to-GDP ratios in the world.

To keep the risks stemming from rising debt servicing under check, the government now has two options: one is to collect more revenue or to take on more loans.

"The government should take the decision now. Besides, it should reduce its expenditure. We need to make our state-owned enterprises profitable, cut illogical subsidies and allocate more foreign loans to development projects on a priority basis," Hussain said.

Complicating matters for the government is the unprecedented appreciation of the dollar. The greenback has gained by as much as 30 percent against the taka in the past two years.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments