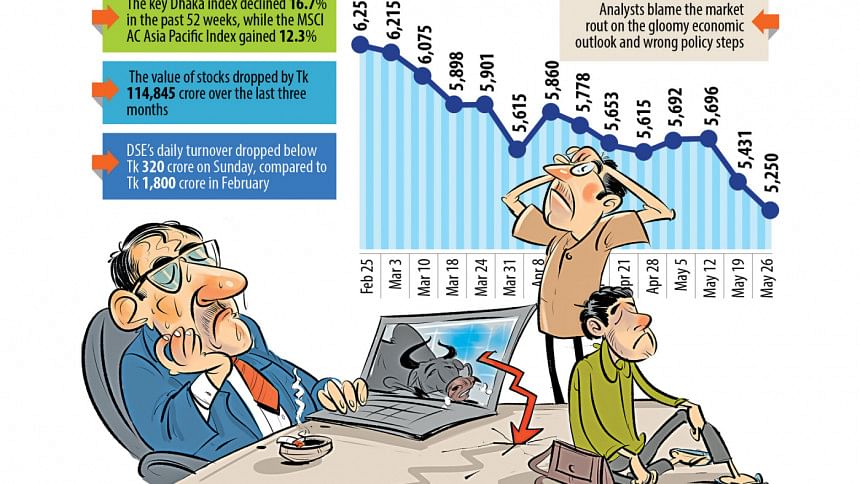

Stocks shed 1,000 points in 3 months

The key index of the Dhaka Stock Exchange plunged by 1,000 points in a span of three months as investors keep selling their holdings, fearing further deterioration of economic indicators.

The DSEX, the benchmark index of the DSE, has fallen by 1,022 points, or 16 percent, to 5,250 since February 27.

During the period, market capitalisation or share value of the listed companies dropped by Tk 114,845 crore or 15 percent.

"The index is falling mainly due to deterioration of various economic indicators. Investors are in panic, so they keep selling shares."

The index has been falling sharply since February when Bangladesh Securities and Exchange Commission (BSEC) withdrew the floor price that was launched in mid-2022.

The system was introduced to stem the market fall amid economic turmoil that resulted from the Ukraine-Russia war. The unusual mechanism failed to prevent the index from falling.

Talking to The Daily Star, Faruq Ahmad Siddiqi, a former chairman of the BSEC, said the index is falling mainly due to deterioration of various economic indicators. Investors are in panic, so they keep selling shares.

When economic indicators don't do well, it impacts the performance of the listed companies, leading to a drop in their share prices.

On the other hand, the interest rate for treasury bills and bonds rose to more than 12 percent. It is only logical that institutional investors will transfer their funds to the bond market, he pointed out.

As the government missed the revenue collection target, it had to borrow heavily from banks, creating a liquidity pressure in the banking sector. And it ultimately raised the interest rate against deposits, Siddiqi clarified.

Moreover, investors are now worried over some possible measures, including reimposition of capital gains tax, in the next budget.

Foreign investment is also declining as the local currency massively lost its value against the dollar.

Besides, the central bank allowed foreign deposits through offshore banking. A foreign investor can now get interest rate of more than 8 percent without having to worry about currency devaluation.

They can enjoy tax-free profit of up to 8.40 percent on fixed deposits in the US dollar or the euro for terms ranging from three months to five years, according to the Offshore Banking Act 2024 that took effect in March.

Siddiqi said, "If they can get such a high interest by investing in safe instruments, why would they take the risk of investing in the stock market?"

Foreign investors started selling shares on a large scale after the floor price was withdrawn in January this year.

Shekh Mohammad Rashedul Hasan, managing director and CEO of UCB Asset Management, said the investors are worried. They are selling shares, fearing that the economic situation may worsen further.

"I think the investors are overreacting now. The central bank has already taken some major steps to mend the mistakes ..."

Early this month, the BB allowed a market-based interest rate and also introduced a crawling peg exchange rate. It also raised the policy rate to tame inflation.

Rashedul said the investors overlooked the major BB steps that may help improve the macroeconomic indicators. They should not sell the shares of blue-chip companies just because the earnings fell in one or two quarters.

These companies, which have been operating for decades, are absorbing the macro-economic heat, especially high inflation. They will bounce back soon, he pointed out.

Inflation was above 9 percent since March 2023, according to Bangladesh Bureau of Statistics.

The asset manager further said some flawed policies were adopted and the stock market already paid a price for that.

As examples, he referred to the introduction of floor price, and the policy of keeping the local currency overvalued against the dollar for years.

If large corporates now come forward and buy shares, the stock market can bounce back, he added.

Muhammad Nazrul Islam, secretary general of Bangladesh Merchant Bankers Association, said investors are selling shares as several economic indicators, including remittance and export earnings, are not performing well.

The foreign currency reserves, which rose to an all-time high of $41 billion in August 2021, has more than halved to $18.60 billion. The taka has lost its value by 35 percent.

Moreover, forced sale of shares contributed to the erosion of the index, he said.

When investors buy shares on loans and the share prices fall, merchant bankers and stock brokers sell shares to save the mortgage-free loans. It's known as forced sale.

Nazrul said people should not invest in the stock market by taking loans.

Stock investors continue to leave the market due to the rapid fall in the index.

The number of Beneficiary Owners accounts dropped by more than 4 percent to 17.90 lakh last week compared to the same period last year, shows data from Central Depository Bangladesh Ltd.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments