$600m loans from EDF turn sour

Loans amounting to nearly $600 million, or Tk 7,000 crore, disbursed from the Export Development Fund (EDF), which was formed based on the country's foreign exchange reserves, have been defaulted, according to a Bangladesh Bank (BB) document.

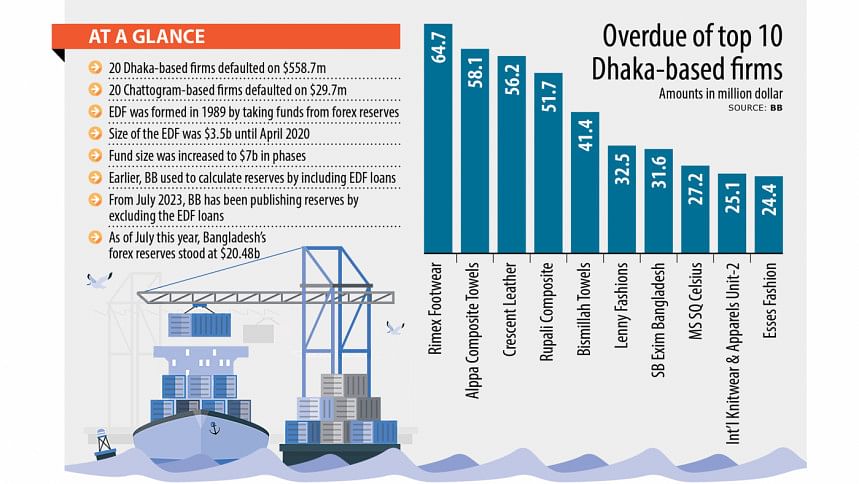

Firms based in Dhaka defaulted on most of the amount, accounting for $558.7 million.

Besides, Chattogram-based companies did not return $29.7 million, the BB data showed.

Among Dhaka's top 20 entities that defaulted on these loans are Crescent Group's Rimex Footwear with $64.7 million and its other concern Crescent Leather Products with $58.1 million, and Rupali Composite Leatherwear with $51.7 million.

Bismillah Group's Alppa Composite Towels Ltd defaulted on $58.1 million and Bismillah Towels Ltd $41.4 million, and Hindulwali Textile $14.5 million, according to the data of the central bank.

The top 20 Dhaka-based companies with overdue loans from the EDF owe between $8.8 million and $64.7 million, according to central bank data.

And due to weak control, the BB could not create any pressure to realise the loans even though the foreign exchange reserves have been falling, deepening pressure on the country's external account.

Bangladesh Bank Executive Director and Spokesperson Md Mezbaul Haque could not be reached for comment.

Among other firms that defaulted in repaying loans, Lenny Fashions did not repay $32.5 million and SB Exim Bangladesh defaulted on $31.7 million.

MS SQ Celsius Ltd defaulted on repayment of $27.3 million and International Knitwear and Apparel had overdue loans of $25.2 million.

Esses Fashions, a concern of Beximco, had overdue loans of $24.4 million taken from the EDF formed by the central bank in 1989 to provide low-interest loans to exporters and import raw materials.

After the coronavirus pandemic, the size of the EDF was $3.5 billion until April 2020.

Later, it was hiked to $7 billion in phases.

Earlier, the BB used to disclose the amount of reserves adding the amount of loans disbursed from the EDF.

However, from July 2023, it published information regarding the reserves as per a calculation method of the International Monetary Fund (IMF).

At the end of July this year, Bangladesh's forex reserves stood at $20.48 billion, down from $23.30 billion a year ago, showed the BB data.

The remaining top 20 Dhaka-based companies with overdue loans ranging between $9 million and $24 million include Bextex Garment, a concern of Beximco.

Another is Crescent Group, which also operates various industries including leather, textiles and real estate. The company has been embroiled in significant corruption allegations brought on by the Bangladesh Financial Intelligence Unit and the Anti-Corruption Commission in the past.

It is also accused of laundering large sums of money through fraudulent export-import transactions. There is an allegation of the group's involvement in securing loans from multiple banks using fake documents and inflated export bills, and these funds were allegedly siphoned off to offshore accounts.

Likewise, Bismillah Group, owner of Bismillah Towels Ltd, has become infamous for its involvement in corruption and money laundering scandals in the country.

On September 11, 2028, nine top executives of Bismillah Group, including Managing Director Khaza Solaiman Anwar Chowdhury and Chairperson Nowrin Hasib, were sentenced to 10 years of rigorous imprisonment in a case filed over laundering Tk 15.33 crore.

The Daily Star tried to contact multiple numbers posted on the websites and social media platforms of Crescent Group, Rimex Footwear, Crescent Leather Products, and Bismillah Group for comment.

However, they could not be reached by the time this report was filed.

Contacted, Md Abu Shafiullah, managing director of Esses Fashions and Bextex Garments Ltd, did not want to comment.

"Our finance officials can talk on the issue," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments