Bailout for big loan defaulters

Bangladesh Bank and a government committee have come up with a generous scheme to allow easy rescheduling of defaulted loans, which experts say will hurt the banking sector and the economy at large.

Once implemented, the scheme will also enable loan defaulters to obtain many other financial benefits.

Four years ago, a similar bailout offer was made to companies that had defaulted on large loans, allowing them to reschedule and repay loans on significantly relaxed terms.

But the special bailout scheme couldn't yield desired results as most of the large loan defaulters, who availed themselves of the scheme, did not make any serious effort to pay back their huge loans.

According to the new proposal, loan defaulters will get 13 to 15 years, with a grace period of up to two years, to pay back their loans.

All they will need to do is make a down payment of maximum 2 percent of their outstanding loans, instead of the current requirement of 10 to 15 percent, for regularising their loans. In some cases, they won't have to pay.

In case of the defaulters, who got loans from the BASIC Bank through irregularities between 2010 and 2014 when Sheikh Abdul Hye Bacchu was its chairman, will be allowed to regularise their loans by making a down payment of 2 percent of their outstanding loans.

The proposal is now pending with the finance ministry for a go-ahead.

Economists and banking experts fear that if implemented, the scheme would throw the banks into more financial troubles.

The proposal was readied by a committee led by Agrani Bank Chairman Zaid Bakht.

In January this year, it was sent to the BB which included more lenient terms in it.

The finance ministry formed the committee in June last year to prepare a bailout package for loan defaulters in three sectors -- trading, shipbuilding and steel -- to help them revive their businesses.

The committee submitted its report to the ministry which sent it to the BB last month, seeking its opinion on the proposed package.

In its opinion, the central bank recommended offering the package to all sectors, not only the three.

Though the committee proposed excluding from the scheme the borrowers, who had availed themselves of large loan restructuring schemes in the past, the BB recommended including them in it.

The central bank said most of the borrowers who took advantage of the scheme did not pay back loans as per the restructuring conditions. As a result, non-performing loans in the banking sector was on the rise.

Asked, Zaid said the policy was prepared to give a “breathing space” to the loan defaulters.

Experts questioned whether the BB had thought deeply about the implications of such a policy on the health of the banks.

For example, the proposal says loan defaulters who were “adversely affected by internal and external economic factors” will be entitled to have their loans rescheduled.

Economists and bankers pointed out that the label was so generic that all defaulted loans will fall under such vague and all-encompassing categories.

Any business is exposed to internal and external factors and hence this eligibility condition is simply absurd. Any defaulter could seek rescheduling under this policy and this could create havoc on the banks' financial discipline, they mentioned.

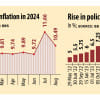

As of December last year, the amount of defaulted loans in the banking sector stood at Tk 93,911 crore -- 10.30 percent of the total outstanding loans, and there are over 2.66 lakh loan defaulters, according to BB data.

Khondkar Ibrahim Khaled, former deputy governor of Bangladesh Bank, said, “The policy will destroy the banks.”

Banking records show that if a loan remains unrecovered for a long time, the chance of recovery is low. This experience has been ignored by the policy, which could bring disaster to the banking sector, he told The Daily Star.

Some influential politicians, who are large loan defaulters, are probably involved in the formulation of such a policy, Khaled mentioned.

The policy will have a serious “side effect” on the money market. When loans are not recovered for a long time, lending rates go up and hurt businesses, he added.

Fahmida Khatun, executive director of the Centre for Policy Dialogue (CPD), said, “This is an artificial solution just to reduce defaulted loans.”

The policy would not bring any good to the sector because the previous bailout package failed to regularise the defaulted loans, she said.

Long-term loan rescheduling would hurt financing of the productive sectors, Fahmida noted.

The government is encouraging defaulters instead of taking strict action against them, said Salehuddin Ahmed, a former BB governor.

Long-term repayment schedule would put pressure on liquidity of banks, he added.

CONDITIONS OF PACKAGE

The interest rate will be 7 percent under the simple interest formula. But the defaulters with the BASIC Bank will enjoy a reduced interest rate as they have to pay only 2 percent interest along with costs of funds. Currently, the banks use compound interest formula for all loans.

The defaulters have to pay instalments quarterly and failure to pay two consecutive instalments would result in cancellation of the rescheduling.

PAST EXPERIENCE

In January 2015, the central bank offered a special package for borrowers who had bank loans of at least Tk 500 crore each. It relaxed the loan rescheduling policy for the borrowers, who were required to make a down payment of just 1-2 percent, instead of usual 10-15 percent.

The BB made the move after several companies asked for the package, saying they had been affected by political unrest between 2013 and 2015.

Eleven large borrowers availed themselves of the scheme and had their loans of Tk 15,000 crore restructured.

Of those, only one complied with the conditions laid down in the policy.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments