Digital banks aim to create space for all

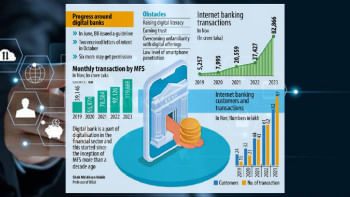

It took decades for Bangladesh to bring around 10 percent of the adult population under the banking system before the mobile financial service (MFS) accelerated the pace in the past decade.

MFS providers have taken financial services through mobile phones to almost 30 percent of the population. Still, the country will have to go a long way before a significant portion of the populace comes under the banking system.

But Habibullah N Karim, a noted entrepreneur in the information technology sector, thinks that this is about to change – thanks to digital banks.

"Because of MFS operators, you can see the difference. Fintech can expedite the adoption of financial services. The digital bank is another step up," he said.

Karim is pinning his hopes on digital banks that the central bank is looking at to drive the next phase of financial inclusion.

Karim is the chairman of Kori Digital Bank which alongside Nagad Digital Bank secured approval last October from the central bank to roll out digital banks, becoming the first two entities in Bangladesh to get the scope to set up fully online banking operations. Karim is the founder and CEO of Technohaven Co Ltd.

Kori Digital Bank's sponsors include telecom, banking and IT professionals as well as conglomerates ACI, Ispahani, Mohammadi Group, Paragon, Square and Transcom.

During an interview with The Daily Star recently, he said digital banking started its journey globally about 15 years ago. Some call it neo-banks. China and India have coined a new term called payment banks.

They have emerged in response to the limitations confronting conventional banking owing to its rigid structures and stratified rules and practices.

And that happened for a reason over the years, Karim said.

"Banks have the fiduciary responsibility to protect people's money. So, in order to safeguard the money from misuse, mismanagement, or corruption, they have added layers of supervision and regulatory compliance. That has made banking extremely stiff."

Similarly, MFS providers, which have almost covered the entire population, have their own limitations: usually, they can only facilitate sending or receiving money but they can't give out loans or accept deposits.

"If you are confined to SMS-based transactions, it is extremely difficult to make payments," Karim said.

"However, MFS operators have shown what can be done if technologies are employed to bring people into banking."

He said inclusivity has been a clarion call for the government and the Bangladesh Bank over the last 10 years. So, one of the goals that the current governor has is that he wants to see 70 percent of all transactions in the public and private sectors and at the individual level be cashless by 2027.

"This is a stupendous target. It's an ambitious target no doubt, compared to less than 20 percent today."

"To achieve that, you need to bring the whole adult population into the banking ecosystem. That obviously can't be done through brick-and-mortar banks."

Altogether, there are more than 10,000 bank branches in the country, but for a country of 17 crore people, 10,000 points of contact are not enough.

"How do you reach everybody? Technology is the solution," Karim says.

Karim, a co-founder of the Bangladesh Association of Software and Information Services (BASIS) and a two-time president of the trade body, said reaching out to people in remote, rural areas is not that difficult.

As all MFS providers have done in recent years, all digital banks will reach out to them through social media and traditional communication mediums like television, radio, and print media.

"The difficult part is getting them to feel comfortable to come to the platform online and open an account or apply for a loan."

Trust is absolutely crucial, he said.

"Since everything is done digitally, cybersecurity is paramount. Everything we do has to pass the test of cybersecurity first."

Not only financial transaction data, but also personal information must remain safe, secure, and confidential.

"Not only that, we have to comply with the digital security laws, the ICT Act, and the financial and banking laws."

He says when the server is down, customers sometimes have to wait for hours when they go to a bank to cash a check.

"You are not going to face that with our platform. This is what is known as a continuous availability system. No matter what happens, the system will always be available."

"I can ensure that we are coming up with a platform in such a way that it will never stop working even for a second even if we have to carry out some maintenance and upgradation. That's another technology we're going to provide -- something that is not available in Bangladesh yet."

Karim was the convener of the Working Group of the National ICT Policy Review Committee that authored Bangladesh's ICT Policy 2009. He is also the coordinator of the Blockchain Olympiad Bangladesh.

He said despite the spread of the MFS industry, more than 90 percent of all transactions are cash-in and cash-out.

"But that is not the model we are offering to people. We want to make it easy for people to transact and try day-to-day transactions of any kind. We are going to make it so easy for them that they are going to say why on Earth we ever used cash."

Digital banks are not allowed to have agents, own ATMs, or physical contact points. It can have call centres, however.

As a result, it may seem very difficult for people to get on board and put in money, according to Karim.

"For us, it's the other way around. The reason the central bank has disallowed all these things for us is because we are allowed to use every single channel. We are allowed to use all MFS points, agent points, bank branches, ATMs, cards, debit cards, credit cards, prepaid cards, and other digital wallets."

"From anywhere, you can add money to your digital account. We will have integration. The Bangladesh Bank itself is helping with the integration with the national payments switch to give us access to most of the services automatically."

Digital banks will have integration with banks and managed service providers (MSPs), which provide fully outsourced network, application, and system services across a network to clients.

"As a result, once customers add money, we are very confident that they will keep that money in that digital account because they will be able to do things digitally – easily and quickly. They will never go back to paying in cash."

Karim says MFS has some built-in distribution costs.

"So, when they charge you 1.5 percent or 2 percent, they retain a small part of that, and most of that money is paid out to distribution partners."

"But when we pay from one digital account to another digital account, the cost will be minimal. So, we will be able to charge a lower fee. The fees can be so low that the fish seller in a wet market eventually will not mind absorbing that cost."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments