Bangladesh plans more licences for digital banks in push to go cashless

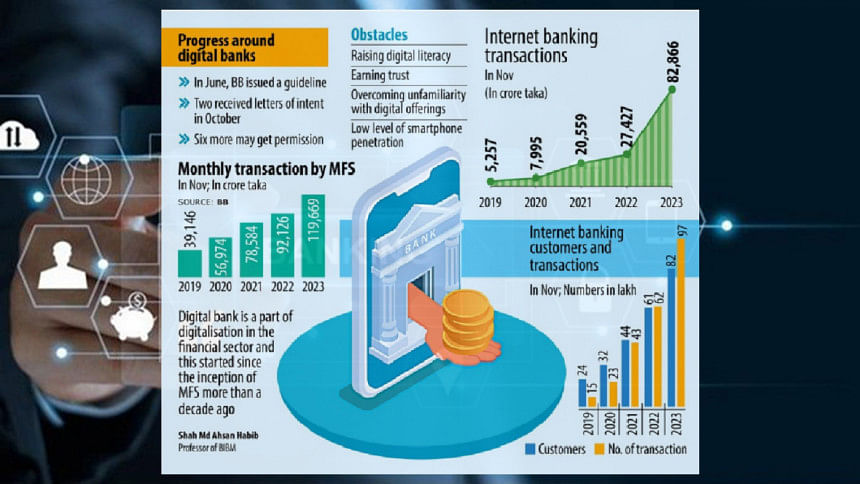

The Bangladesh Bank plans to offer more permissions for digital banks, building on the progress made by mobile financial services and internet banking in recent decades, in order to pave the way for full-fledged financial services based on a 100 percent branchless banking system.

Digital banks, also known as neo-banks, are popular globally as well as in neighbouring countries whereas it is a new concept in Bangladesh.

But the stage seems ready for the country to take the next leap forward following massive gains in the areas of mobile phone subscriber base, MFS, agent banking, and internet banking, and the growing number of digital-first customers.

In June, the BB issued a comprehensive guideline for setting up digital banks and received a huge response.

Fifty-two applications from around 500 companies, including banks, non-bank financial institutions, MFS providers, mobile phone operators, IT firms, start-ups, pharmaceuticals and cement manufacturers, sought consent.

Of them, Nagad Digital Bank and Kori Digital Bank got the letters of intent (LoIs) in October.

The BB has also decided to allow three bank-led applicants. As a result, Bank Asia-led Digital, BRAC Bank-led bKash Digital Bank, and Digi10, a consortium of 10 private banks, can launch digital banks as the applicants have already had full-fledged banking licences.

The regulator also plans to issue LoIs to three more candidates: Smart Digital Bank, Japan Bangla Digital Bank, and North East Digital Bank.

Speaking to The Daily Star recently, Habibullah N Karim, chairman of Kori Digital Bank, says Bangladesh's efforts aimed at bringing more people under the financial system would receive a much-needed boost thanks to digital banks.

"Fintech can expedite the adoption of financial services. The digital bank is another step up."

Nagad says digital banks are expected to accelerate cashless transactions and digital transformation and make the government's financial inclusion agenda complete.

Tanvir A Mishuk, managing director of Nagad, said Nagad would reach the grassroots level where traditional financial institutions have not expanded their branches.

As of September, the country's 61 banks had 11,200 plus branches and more than half were in urban areas, according to Bangladesh Bank data.

"This gap will provide the opportunity to digital banks like Nagad to reach millions of unbanked people," Mishuk said, adding that informal transactions account for 52 percent of the economy.

With digital banks, Bangladesh is set to jump on the global bandwagon of digital banking.

Globally, the digital bank market is growing rapidly.

According to a 2021 analysis of mobile bank N26 and information technology firm Accenture, millions of customers have switched to digital banking for its ease and convenience—a trend accelerated by the Covid-19 pandemic.

One in four customers is already using a digital-only bank. Across the 28 countries surveyed, the number of consumers with a digital bank account represented 23 percent of the population—an estimated 450 million customers.

Globally, digital banks offer a wide range of financial products and services, including savings and checking accounts, credit cards, personal loans, and investment products. They offer a more convenient, accessible, and user-friendly banking experience by leveraging technology such as mobile apps and artificial intelligence.

The projected net interest income worldwide in the digital banks market is set to reach $822 billion in 2024, according to statista.com, a global data and business intelligence platform.

The income will post an annual growth rate of 10.34 percent between 2024 and 2028, leading to a market volume of $1.22 trillion by 2028.

Worldwide, digital banks are making impressive gains because of the low-cost structure compared to traditional banks since the former don't have brick-and-mortar branches, keeping expenses lower and allowing them to charge reduced rates services and products.

Another benefit is digital banks can provide financial services round the clock and quickly and in line with the lifestyle of the tech-savvy new generation, which does not want to visit bank branches.

For example, Gen Z (born between 1997 and 2012) is far less likely to have a traditional bank account than Millennials (25-39 years old) or Baby Boomers (born between 1955 and 1964), according to MX, one of the fastest growing fintech innovators.

Industry insiders say that in Bangladesh, clients, especially the new generation, want to avoid visiting bank branches physically and this tendency has increased due to the pandemic.

Shah Md Ahsan Habib, professor of the Bangladesh Institute of Bank Management, said digital bank is a part of digitalisation in the financial sector and this started since the inception of MFS in the country more than a decade ago.

"There is a need for digital banks now because MFS providers can't lend and accept deposits."

He says there is a huge potential for digital banks in Bangladesh.

AKM Fahim Mashroor, a former president of the Bangladesh Association of Software and Information Services (BASIS), said if digital banks gain traction, small and medium entrepreneurs will be able to access loans at a lower interest rate than the 20 to 26 percent interest rate charged by microfinance institutions.

Arfan Ali, who pioneered agent banking while working as managing director of Bank Asia, said the future of digital banking is bright because the new generation is interested in availing financial services digitally.

"However, it will take time for digital banks to become profitable. There is also a need for huge investment in technology."

Challenges for digital banks

The N26-Accenture analysis says digital banking is taking off, and will only become more prevalent in the years to come.

"Obstacles remain, including earning trust and overcoming unfamiliarity with digital offerings. And yet the drivers—simplicity, convenience, value, and safety—have seen conversions grow sharply."

Fahim Mashroor said the penetration of internet and smart phones is still low in Bangladesh.

BIBM's Habib said ensuring cybersecurity, developing IT infrastructure and increasing digital literacy are key to successful digital bank ventures.

A low level of digital literacy is posing another challenge, he said.

"A growing number of people use mobile phones but most of them are not digitally literate."

At a meeting in June, the BASIS said the country needs to make key preparations such as personal identity authentication, real-time interoperable payments, and a comprehensive credit bureau with data of all lending institutions for the successful implementation of digital banks.

"This is an untested arena for Bangladesh. and it remains to be seen what products and services the digital banks will come up with that are not covered by existing banks," said Zahid Hussain, an economist.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments