DSE’s turnover continues to tumble

Stock trading in Bangladesh has slowed in recent months as most investors are not placing fresh bets considering the market's bleak outlook amid ongoing economic uncertainties.

As such, daily turnover of the Dhaka Stock Exchange (DSE) plunged by 5.02 percent to Tk 279 crore yesterday, marking its steepest decline since the political changeover on August 5.

Representing the collective value of traded shares, turnover had last reached such levels when it was recorded at Tk 207 crore a day before the Awami League government was ousted by a mass uprising.

Besides, the turnover on Sunday was 12.47 percent lower than that recorded on the last trading day of the previous week, indicating that recent regulatory measures could be eroding investor confidence.

The textile sector dominated market activities, contributing about 16 percent to the day's total turnover.

Block trades, meaning high-volume securities transactions executed outside the open market, contributed another 3.4 percent.

Dragon Sweater and Spinning was the most traded stock, registering turnover of Tk 11.5 crore.

Industry people and market analysts said investors are reluctant to pour fresh funds as efforts to curb stock manipulation seem to have dampened their moods.

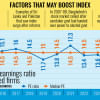

The DSEX, the broad index of the country's premier bourse, edged down by 0.29 percent from the previous day to close at 5,166 points yesterday.

The DSES, an index representing the performance of Shariah-compliant companies, fared similarly, losing 0.23 percent from the day before to hit 1,154 points.

Likewise, the DS30 index, comprised of blue-chip companies, shed 0.24 percent of its previous value to reach 1,904 points, marking its third day of decline.

Of the 395 scrips that changed hands, the prices of 126 rose while 179 closed lower and rest did not see any fluctuation.

Sector-wise, services and real estate, jute, and telecom were the top three sectors that closed in positive territory. Meanwhile, paper and printing, information technology (IT), and food and allied were the top three sectors to close in negative territory, as per the day's market update of UCB Stock Brokerage.

In a separate market update, BRAC EPL Stock Brokerage said most large-cap sectors posted negative performances.

The food and allied sector experienced the highest loss of 0.50 percent followed by the banking sector (0.41 percent), pharmaceuticals (0.21 percent), fuel and power (0.19 percent), non-bank financial institutions (0.16 percent), and engineering (0.06 percent).

However, the telecommunication sector is the only sector that recorded a gain of 0.18 percent.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments