Multinationals’ profits drop for lower sales, higher costs

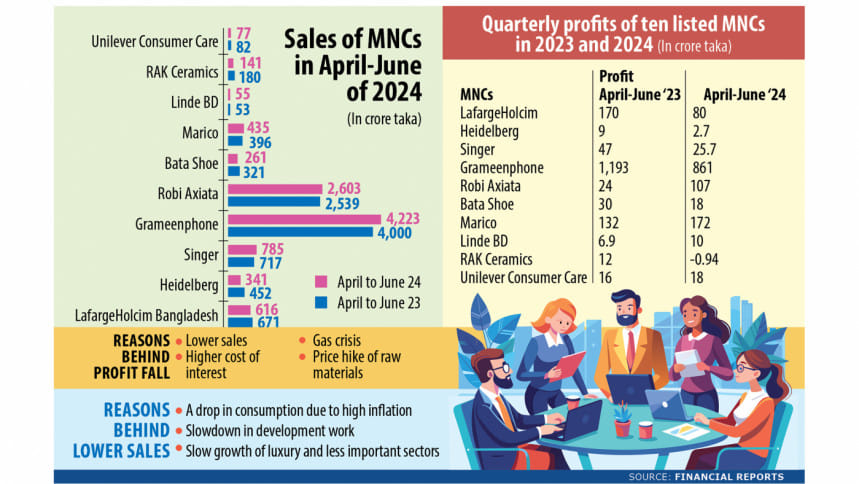

Most listed multinational companies in Bangladesh witnessed lower profits in the April-June quarter this year as sales dropped due to the erosion of people's purchasing power amid runaway inflation.

Among 13 renowned MNCs, 10 have published their financial reports for the three-month period.

Of these, five logged lower profits while one incurred loss despite being in the green during the corresponding period last year.

And other than lower sales, the companies also blamed the rising raw material and funding costs for their reduced earnings.

"The drop in sales is purely an economic issue as inflation rose at a higher pace than people's income," said Shahidul Islam, CEO of VIPB Asset Management.

So, lower profit stemming from fewer sales indicates that people have decreased consumption amid the rising commodity prices, he added.

The country's annual inflation rate surged to a 12-year high of 9.73 percent in fiscal 2023-24, according to data of the Bangladesh Bureau of Statistics.

Islam also pointed out that the government has tightened its development spending while people are apprehensive about starting construction projects amid the current economic climate.

As such, the cement industry is among the worst affected by lower sales, he said.

For example, sales of LafargeHolcim Bangladesh Ltd and Heidelberg Materials Bangladesh PLC dropped by 8 percent and 24 percent respectively.

Their profits plunged at the same time: LafargeHolcim registered a 52 percent decline while Heidelberg saw erosion of 70 percent during the three-month period.

"The economy is facing challenges that are affecting the construction industry, resulting in lower sales growth," said Iqbal Chowdhury, chief executive officer of LafargeHolcim Bangladesh.

Heidelberg mainly blamed lower sales for the company's reduced profit, but also said higher tax payments contributed to the decline.

The situation is similar for other industries as RAK Ceramics incurred losses of Tk 94 lakh in the April-June period despite logging profits of Tk 12 crore during the same time last year. It is the lone MNC to incur losses so far this year.

In its financial report, RAK Ceramics said the primary reason for its losses is that they had to reduce production due to the lack of gas supply.

Besides, the company's sales have decreased 21 percent year-on-year to Tk 141 crore. However, its fixed costs have not proportionately come down.

Finance costs also rose due to higher interest rates and increased bank borrowing, it added.

Likewise, finance costs of four other MNCs increased by 47 percent year-on-year to Tk 268 crore in total during the three-month period.

Bangladesh Bank has allowed banks in the country to determine their interest rates for loans and deposits based on market demand since May. The move came about four years after the central bank introduced a ceiling to keep interest rates within single digit.

Singer Bangladesh saw its profits fall 47 percent year-on-year to Tk 25 crore during the April-June period even though its sales edged up 9 percent at the same time.

Bata Shoe Bangladesh saw its profits fall 40 percent to Tk 18 crore while its sales declined 18 percent to Tk 261 crore. On the other hand, Marico, Linde Bangladesh and Robi Axiata saw a rise in profit and sales.

Marico's profits surged 30 percent to Tk 172 crore as the company reduced its cost of sales. Also, the hike in interest rates helped the company register higher net finance income.

Meanwhile, Linde's profits grew 42 percent to Tk 10 crore while that of Robi Axiata ballooned by 345 percent to Tk 107 crore. The country's second largest mobile network operator also saw its overall revenue increase by 2.5 percent to Tk 2,603 crore during the April-June quarter.

VIPB's Islam, also a former president of the CFA Society, said the telecom sector is in a comparatively better position considering their individual revenue.

However, Grameenphone struggled with higher taxes as its turnover advanced by 5.5 percent to Tk 4,223 crore in the April-June quarter while its profits fell 27 percent to Tk 861 crore.

Unilever Consumer Care's profits rose slightly even though its sales dropped. The company's profits increased 12 percent to Tk 18 crore while its sales fell 6 percent to Tk 77 crore.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments