What makes Bangladesh's economy more troubled to progress?

If there is any element of truth in the saying, "Morning shows the day," the interim government has failed to show a bright morning in terms of stabilising the economy. The two economic vices—inflation and unemployment—were at the root of the student-led mass uprising in July-August 2024, yet both reign supreme even after five months of the interim government's inception. And there is no certainty that the economic aspects won't deteriorate further, suggesting that the government should now think seriously about holding an inclusive election at its earliest capacity.

That was not the deal when the interim government took office on August 8 last year. Massive corruption and an authoritarian rule masquerading the façade of democracy contributed to the drastic ouster of the Awami League regime. In that backdrop, almost all political parties and the public demanded the sequencing of reforms first before holding an election. As time passed by, many, if not all, influential political parties are demanding the election first before delivering reform in the economy. The question of how far a non-elected government can go for time-consuming reforms within its limited capacity has become the talk of the town in recent days. And that very political landscape has made the economy more troubled than ever before.

The economy is not heading in the right direction because of two things: i) inherited mismanagement from the previous regime; and ii) conflicting priorities and intrinsic bumpiness of the interim government. The government seems to be engaged in unnecessary political debates by indulging untimely sociopolitical issues related to the constitution and history. This is unwarranted, particularly when the priority should be to curb inflation and to reduce unemployment.

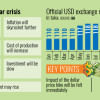

Although the Bangladesh Bank governor expects the inflation rate to drop to around seven percent by June this year, the rising price of the US dollar doesn't lend credence to it. The indomitable practice of localised extortions and organised syndication are sending the prices of necessary commodities beyond the reach of the extreme poor and lower-middle class that occupy a lion's share of the population.

A minimum level of macroeconomic stability will be hard to achieve if the interim government keeps its attention on political confusion, noneconomic diplomacy, racial discontent, and a huge vagueness about its own strategic intent. Simply a market-based exchange rate or interest rate doesn't create macro stability when the rulers have a nebulous roadmap to follow. Printing Tk 22,500 crore to resuscitate the drowned banks seems necessary at the time, but it will refuel inflation despite the parallel mop-up attempts, which are inadequate.

As the Bangladesh Bank data on LC settlements suggest, imports of consumer goods fell by 13.4 percent during the July-November period of 2024 over its corresponding period of 2023, suggesting a further pressure on inflation due to the supply shortage. At the same time, a decline in imports for capital machinery by 21.9 percent will invariably hurt the country's productive capacity and growth potential. A decrease in the imports of intermediate goods by 15.4 percent over the same period will dampen industrial production, which already suffers from labour unrest, layoffs, and sporadic closures.

These factors will largely contribute to the weakening of GDP that is expected to see four percent growth this fiscal year, as per the World Bank forecast. Bangladesh heads to an untimely stagflation, which has tormented many economies in the 1970s in the wake of the oil shocks. A Phillips curve, which exhibits a typical trade-off between unemployment and inflation, disappears during stagflation when both stagnancy and inflation force the toiling mass to walk through a tightrope. Stagflation makes the economy nosedive and induces youth frustration to erupt, the primary symptoms of which are looming. The student force seems to remain hugely unsettled in the education sector, damaging the quality of human capital for the future.

Despite these negative signals, one piece of good news is that remittances in December 2024 made a record inflow of $2.64 billion. There are three reasons behind it: i) a fair value for the dollar that reached up to Tk 126 per dollar; ii) continuation of the 2.5 percent incentive in addition to the fair dollar price made the hundi channel less attractive; and iii) Bangladeshis tend to send more money during the dry season, which is good for marriages, festivities, construction of buildings, and purchases of durable commodities. However, this trend may fall again when the central bank switches back to capping the dollar price at Tk 123.

Remittances alone aren't enough to ensure a good growth in foreign exchange reserves. A fall in imports will impede growth in exports. Although forex reserves slightly edged up to around $21.4 billion on the last day of 2024, its growth will be eroded if foreign direct investments (FDIs) don't pick up. FDIs in FY2024 declined by 8.8 percent, and the trend has even worsened during the interim regime. FDIs in the July-October period of FY2025 saw a collapse by 19.8 percent, suggesting that the foreign capitalists are not considering Bangladesh right now as a hotspot for investment. FDIs don't flow in unless domestic private investment shows an uptick, and here lies a problem with the interim government's capability for creating a credible business environment.

If the government is passionate about reforms, why did it deliver the contract of ground-handling of the third terminal of Dhaka airport to a branded inefficient company, Biman, whose stories of corruption are rampant? Why would it keep the Financial Institutions Division (FID), which made default loans worse? Why would it jump into non-productive expenses for buying weapons from China and Pakistan right now? This decision can wait for an elected government. There are other priorities which the interim government has not only failed to address, but it has also confused the economy, which is facing terrible headwinds, with its poor managerial leadership.

Dr Birupaksha Paul is professor of economics at the State University of New York at Cortland in the US. His recent book is 'Sangkatkaler Orthoniti.'

Views expressed in this article are the author's own.

Follow The Daily Star Opinion on Facebook for the latest opinions, commentaries and analyses by experts and professionals. To contribute your article or letter to The Daily Star Opinion, see our guidelines for submission.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments