Online tax returns can bring $32b extra revenues annually: CPD

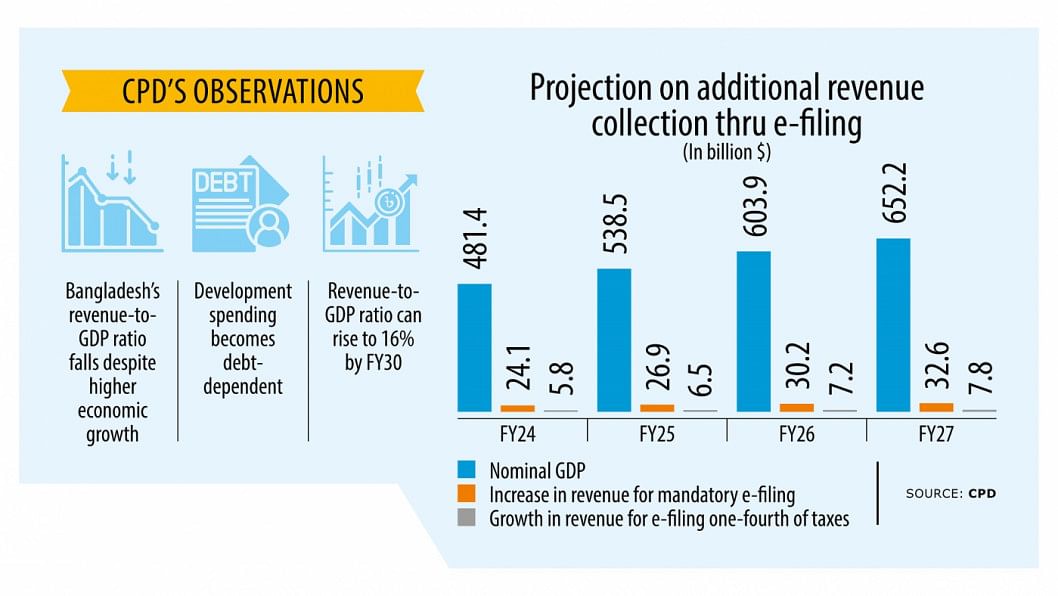

Bangladesh can raise an additional $32.6 billion in revenues annually within the next four years if the electronic filing of tax returns can be ensured, said the Centre for Policy Dialogue (CPD) yesterday.

This is around 5 percent of the nation's gross domestic product (GDP), said the independent think-tank at a dialogue on the digitalisation of the taxation system.

The CPD organised the event in partnership with the European Union (EU) at the Lakeshore Hotel in Dhaka.

"Through the digitalisation of the whole taxation system, Bangladesh can gradually enhance the tax revenue to GDP ratio to 16 percent by fiscal year 2029-30," said Mustafizur Rahman, a distinguished fellow of the CPD.

In other words, $167 billion can be generated in the form of tax revenue by FY2030 through digitalisation, he said while presenting a paper.

Tax revenue generation in Bangladesh remains low in context to its neighbours, which has led policymakers, economists and stakeholders to draw attention to the country's increasing dependence on loans to finance public expenditure.

Bangladesh's revenue-to-GDP ratio declined from 10.99 percent in FY2010 to 8.26 percent in FY2023. The target for FY2024, set at 9.9 percent, is also unlikely to be achieved, said the CPD.

The ratio has also fallen short of the 16 percent targeted in the seventh five-year plan, which ended in 2020.

"Had the target been achieved, the entire revenue budget and annual development programme (ADP) for FY2024 could have been financed with domestic resources," said Rahman, who co-authored the paper with CPD Programme Associate Isabela Rozario Mumu.

The tax to GDP ratio is one of the lowest in Bangladesh. Among South Asian countries, it lags behind all its neighbours in terms of public expenditure to GDP ratio.

The CPD said greater domestic resource mobilisation was important for Bangladesh to meet increasing demand for public sector expenditure, ensure a more equitable income distribution, and cut reliance on domestic and external borrowing.

"It is also necessary to reduce debt servicing obligations on account of interest and principal payments which is eating away an increasing share of revenue earnings," said Prof Rahman.

"The low revenue income has given rise to a situation where the entire development budget is having to be financed by borrowed money, either domestic or external."

Low domestic resource mobilisation means that there is hardly any surplus in the revenue budget, he added.

"Consequently, this entire ADP has to be financed by domestic borrowings and external loans."

The CPD said Bangladesh has witnessed rapid GDP growth and a rise in per capita income over the past couple of decades. However, this has not been reflected in the mobilisation of resources through taxation, including direct taxation.

In Bangladesh, both tax elasticity -- the change in revenue to change in income -- and tax buoyancy -- which reflects efficiency and responsiveness of revenue mobilisation to growth in GDP -- have been low, said Rahman.

Digitalisation can help bridge the gap, detect tax avoidance, remove loopholes, end exemptions, and reduce tax evasion, he said.

The CPD said the National Board of Revenue (NBR) has been able to put in place some basic IT and digital infrastructure.

"However, the experience is that if the entire spectrum of digital-human-institutional architecture does not work in tandem, these will not deliver the expected outcomes in terms of greater domestic resource mobilisation," said Rahman.

The CPD suggested ensuring interoperability of systems.

In order to improve the effectiveness of the value-added tax administration (VAT), additional data from transactions and third-party sources are essential to enhance data analytics for identifying revenue risks.

Debapriya Bhattacharya, a distinguished fellow of the CPD, said those who don't pay taxes and are involved in money laundering are influential, politically, financially and as businesspeople.

"It is not a technical issue -- it's totally an issue of government's political economy."

If the government's political will is not visible, the "helpless NBR" falls into trouble during the collection of taxes, he said.

NBR Chairman Abu Hena Rahmatul Muneem said the NBR's helplessness is exposed when it goes for attaining the higher revenue target.

"The finance division sets a miraculous target. However, we have to achieve it at any cost since the government has framed the expenditure budget on the basis of it. But they don't take into account the NBR's capacity."

"As a result, many innovative ideas are not materialised since we have to run after the target."

Muneem said the revenue target is fixed on the basis of the previous year's goal, not on the basis of actual collections.

Waseqa Ayesha Khan, state minister for finance, said: "Of course, the government has political will. Had there been no political will, we would not have sat here."

Kazi Nabil Ahmed, a lawmaker and chairman of the parliamentary standing committee on the ministry of posts, telecommunications and IT, Syed Khaled Ahsan, senior public sector specialist, at The World Bank, Enrico Lorenzon, team leader for inclusive governance of the delegation of the EU to Bangladesh, Md Alamgir Hossain, a former member of the NBR for tax policy, and Shams Mahmud, a director of the Bangladesh Garment Manufacturers and Exporters Association, also took part in the discussion.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments