Power producers saw profits erode in FY23

Bangladesh's economy has been facing tough times of late as sustained high inflation, hike in interest rates and massive devaluation of the local currency continue to plague the country. In this series, we take a look back at how various industries fared amid the crisis in fiscal year 2022-23. Here, in the sixth instalment of the series, we placed listed power generation companies under the scanner.

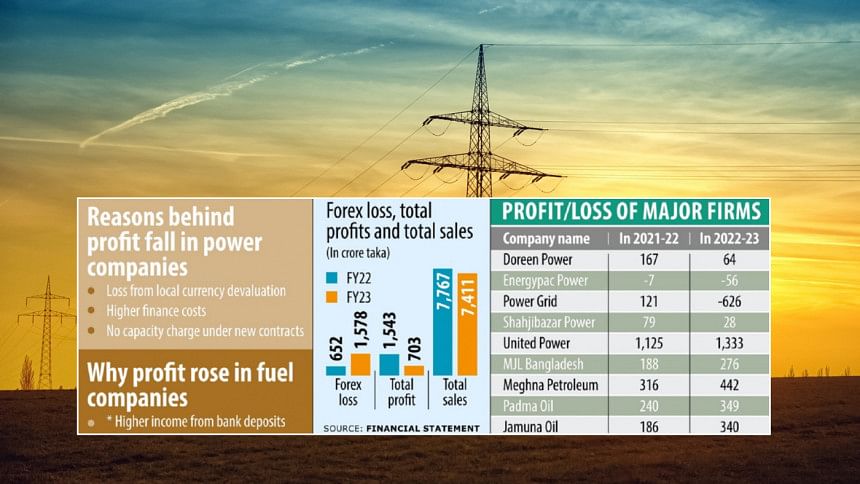

Listed power generation companies saw their profits erode amid devaluation of the local currency and reduction of the capacity charge in fiscal year (FY) 2022-23.

Among the eight listed power producers that have published their financial reports for the previous fiscal year, one sank into deeper losses while two saw fresh losses and three logged lower profit.

Meanwhile, United Power Generation registered 18 percent higher profit of Tk 1,333 crore. However, this is mainly due to the inclusion of profits amounting to Tk 576 crore from its two new subsidiaries.

Otherwise, profits of United Power Generation may have actually dropped.

The profits of power generation companies dropped due to the ripple-effect of currency devaluation and higher interest costs, said Humayun Rashid, managing director and CEO of Energypac Power Generation PLC.

Energypac incurred a loss of Tk 56 crore in FY23 after registering loss of Tk 7 crore the previous year.

The company's turnover had dropped to Tk 800 crore in the previous fiscal while it was Tk 2,033 crore in fiscal 2021-22, according to its financial report.

Rashid informed that the import cost of key raw materials, such as fuel, rose in line with the higher US dollar price.

Besides, as the devaluation of the taka took place sporadically throughout the year, raw material importers had to pay more when settling their import bills that were placed at previous rates.

So, most power companies had to count huge foreign exchange losses. On top of that, the government delayed payments for up to seven or eight months. So, the companies had to count extra interest costs.

The total finance costs of listed power companies rose 20 percent year-on-year to Tk 669 crore in fiscal year 2022-23.

Their combined foreign exchange loss skyrocketed 142 percent to Tk 1,578 crore, according to the companies' financial statements.

Moreover, some of the companies got a shock by getting low capacity charge as the government changed the contract conditions, Rashid said.

For instance, Summit Power made their agreement with Bangladesh Rural Electrification Board on the basis of "no electricity, no payment", meaning without any guaranteed offtake basis for its three power plants.

The same was seen for two units of the Khulna Power Plant.

Power Grid's turnover rose 4 percent to Tk 2,440 crore in FY23, but it registered a loss of Tk 626 crore after notching profit of Tk 121 crore the year prior.

Likewise, Doreen Power's turnover rose 22 percent to Tk 1,842 crore. However, its profits dropped 61 percent to Tk 64 crore.

The company said in its financial report that its performance dropped due to the adverse economic impacts of the Russia-Ukraine war and depreciation of the local currency.

Fahim Ahmed Chowdhury, managing director of Baraka Power, said in its financial reports that the company's profits mainly fell due to a significant increase in foreign exchange losses for various inputs.

Additionally, having unfavourable volatility or currency fluctuations impacted the activities of its associate companies while there was decreased demand from the government.

As such, its profits dropped 68 percent to Tk 15 crore.

Profits of listed power companies dropped amid the recent macroeconomic situation and massive devaluation of the local currency, said Shahidul Islam, CEO of VIPB Asset Management Company.

"Investors who invested in power generating companies knew it very well that these companies have power purchase agreements (PPAs) with the government for specific time periods," he said.

Therefore, investors had no expectations that the PPAs would be extended. So, any argument that the PPAs need to be extended for the sake of capital market investors has no basis, Islam added.

But although power generation companies suffered in the last fiscal year, listed fuel suppliers logged bumper profits.

Except Lub-Rref and Intraco CNG Refueling, all other fuel companies saw higher profits in FY23. Profits of Mobil Jamuna Bangladesh jumped 46 percent year-on-year to Tk 276 crore.

At the same time, Jamuna Oil's profits rose 82 percent to Tk 340 crore, Meghna Petroleum's increased 39 percent to Tk 442 crore and Padma Oil's grew 45 percent to Tk 349 crore.

Financial statements of the companies showed that their profits soared mainly due to higher interest income from bank deposits.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments