State agencies go tough on S Alam Group

In a major development, three state agencies yesterday made a series of moves against the S Alam Group, its chairman Mohammed Saiful Alam, and his family members amid allegations of loan irregularities during the 15-year tenure of the recently ousted Awami League government.

The Bangladesh Bank (BB) dissolved the board of loss-ridden National Bank Ltd (NBL) associated with S Alam Group, and the Bangladesh Securities and Exchange Commission (BSEC) restricted the transfer and sale of shares of six banks with ties to S Alam and his family members.

In a separate development, the Customs, Excise and VAT Commissionerate, Chattogram, a field office of the National Board of Revenue (NBR), formed four teams to audit the VAT compliance status of 18 concerns of the S Alam Group to examine whether it properly deposited taxes to state coffers.

"We want to hold the group accountable. So, we have formed the audit teams. In the past, we did not receive cooperation. Now, we think we will get support from other agencies and ensure proper collection of taxes for the state," said Syed Mushfequr Rahman, commissioner of the VAT Customs, Excise and VAT Commissionerate, Chattogram.

The teams have been instructed to examine all categories of financial transactions and purchase and sales documentation from the past five years, starting in 2019.

The field office of the NBR earlier detected that S Alam Vegetable Oil Ltd and S Alam Super Edible Oil Ltd had unpaid VAT and consequent penalties worth over Tk 7,000 crore. The companies allegedly evaded VAT through various means, including by presenting lower purchase and sales data in VAT returns between 2019 and 2022, according to an audit by the field office.

The two companies "evaded" Tk 3,538 crore in VAT, for which they were fined Tk 3,531 crore, according to an audit report. S Alam has denied these allegations.

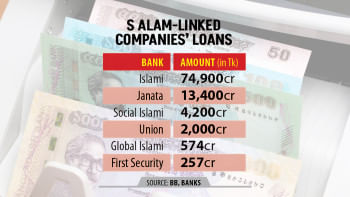

The development took place at a time when six banks linked to S Alam Group are facing restrictions on lending, a bar imposed by the BB on August 19 to prevent the situation of the banks from deteriorating further amid allegations of wrongdoing.

Last week, the NBR asked banks to provide account details of S Alam and his family members.

S Alam and associates lose control over NBL

Yesterday, the BB dissolved NBL's board, which caused S Alam Group and its associates to lose their grip on the private bank.

This marks the third time since December 2023 that the BB has dissolved the board of the NBL, one of the oldest private banks in Bangladesh.

In an order issued by BB Governor Ahsan H Mansur, the banking regulator said it had dissolved the bank's board for the sake of the depositors' money and public interest.

The central bank formed a new seven-member board, including three directors and four independent directors. The bank's board was dissolved for the first time in December last year and again in May this year.

The three new directors are shareholders of the bank, namely BNP Vice-Chairman Abdul Awal Mintoo, Moazzem Hossain from Hosaf Group, and Zakaria Taher.

The four independent directors are Md Zulkar Nain, a former Bangladesh Bank executive director, Mukhlesur Rahman, former managing director of Shimanto Bank PLC, Melita Mehjabeen, a professor of the Institute of Business Administration at the University of Dhaka, and Md Abdus Sattar Sarker, a chartered accountant.

Associates of the S Alam Group came to the board of directors in May, after the Sikder family's grip on the bank loosened as Parveen Haque Sikder lost her directorship.

The S Alam associates who lost their directorship include Md Reazul Karim, former managing director of Premier Bank, who was nominated by Chattogram-based KY Steel. The others are Ahsanul Karim, a senior lawyer of the Supreme Court, who was chosen by Chattogram's Sundarban Consortium Ltd, AKM Tofazzal Haque, a professor at Chittagong University, who was selected by Chattogram's East Coast Holdings Ltd, and Ershad Mahmud, brother of former foreign minister Hasan Mahmud, who was picked by Stitches and Weave Ltd, based in Chattogram.

Sponsor director Moazzam Hossain, founder of Hosaf Group of Companies, which is based in Dhaka, was retained on the board.

The other directors that were dropped include independent directors Prof Md Helal Uddin Nizami of Chittagong University, chartered accountant Ratna Dutta, and ABM Zahurul Huda, a former executive director of the Bangladesh Bank.

Ratna Dutta's husband, Subrata Kumar Bhowmik, is an executive director of the S Alam Group.

Sponsor director Khalilur Rahman, the chairman of Chattogram-based KDS Group, was also dropped from the board.

Barred from selling shares of banks

Based on a request from the central bank, the stock market regulator barred S Alam and his family members from selling any part of their stake in Islami Bank, Social Islami Bank, First Security Islami Bank, Global Islami Bank, Union Bank, and Bangladesh Commerce Bank.

The Bangladesh Securities and Exchange Commission sent a letter instructing the Dhaka Stock Exchange, Chittagong Stock Exchange, and Central Depository Bangladesh to this end.

The letter lists 56 companies owned by 25 relatives of S Alam, all of whom have come under the restriction.

The BSEC asked the intermediaries to follow the order immediately.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments