Tools where pension funds can be invested

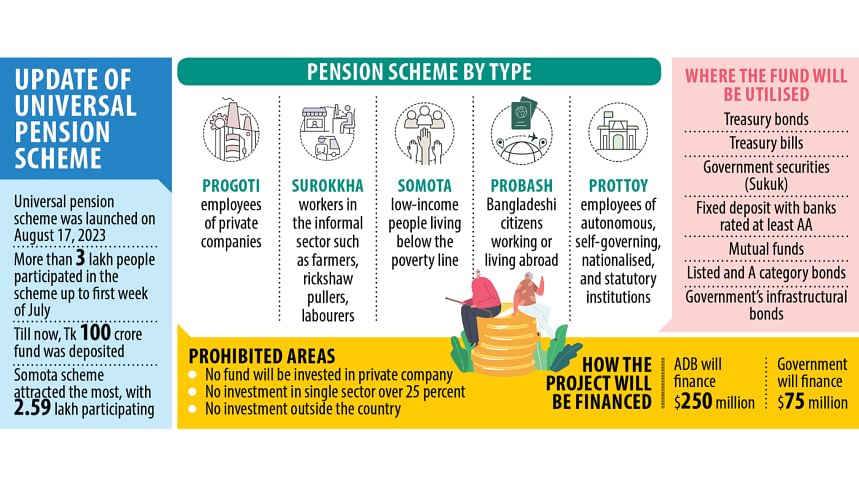

The government has published rules stating where and how pension funds will be invested so that the National Pension Authority (NPA) can produce better returns at lower risks, a move that will ease its repayment burden.

According to the regulations, the funds will be invested in treasury bonds and bills alongside other government securities such as sukuks and mutual funds approved by the Bangladesh Securities and Exchange Commission (BSEC), and fixed deposits with banks rated at least AA.

The gazette was published yesterday.

Funds could also be invested in listed A-category bonds and in securities issued by the government or any government authority for infrastructural development.

The funds can't be invested in firms owned by the private sector. Neither is there any scope to invest outside the country, directly or indirectly, the regulations said.

In any sector, the investment size must be less than 25 percent of the total fund. The ceiling is not applicable to investments in government securities.

A fund management committee will be formed. It will be chaired by a member of the National Pension Authority (NPA).

For the investment policy committee, another member of the authority, alongside two representatives, from the finance division holding the position of at least joint secretary will be included.

The chairman of the finance department of the University of Dhaka or a professor that he/she selects from the department, a representative from the BSEC holding at least the rank of a director, and a representative from the Bangladesh Bank, will also be in the team.

The pension authority's general manager of fund management will also be a member secretary of the committee.

The committee can co-opt any person if needed. To obtain special analysis from individuals, it can invite those who can present their analysis only. They will not have any voting powers.

The committee will recommend investing in securities after analysing their potential and risks. It will advise the fund manager to invest in low-risk, profit-making sectors. It also will make suggestions aimed at developing the business, fund and investment size of any security.

The government plans to initiate a project to expand and strengthen the universal pension scheme at an assumed cost of Tk 4,000 crore, or $325 million.

Of the sum, $250 million will be funded by the Asian Development Bank and the rest will come from the government.

The project will establish the institutional structure of the pension authority, build necessary infrastructure, and train officials. The implementation will start in November this year and will end in June 2028.

Thanks to the new scheme, the government is shifting from the unfunded pension system for public service-holders to a funded system in order to reduce the burden of rising costs for pensions. In unfunded pension plans, retirement benefits are usually paid directly from employer contributions.

The government spending on pensions and gratuities was Tk 4,395 crore in the fiscal year 2009-10, or 4.3 percent of the budget. For 2024-25, the allocation stands at Tk 36,902 crore, which is 4.63 percent of the total budget, according to the finance ministry.

The universal pension scheme saw a low response from people so it is trying to expand its offices.

In Bangladesh, the importance of the universal pension scheme in ensuring the social safety of people after they go past the retirement age is huge since only public sector employees are entitled to such benefits.

To make it sustainable, some steps need to be taken. So, the project is necessary, the ministry said in a project document that was sent to the Planning Commission.

"When the project is rolled out, the IT infrastructure will improve," said Md Golam Mostofa, a member of the National Pension Authority. "The authority will also realise where it needs to improve infrastructure."

The ADB has verbally informed the ministry that it will finance the project.

The main target of the project is to bring elderly people under a sustainable and organised social safety system and expand the pension scheme.

In order to ensure the ADB's funding and formation of the final development project proposal, a feasibility study through the development partner needs to be completed.

Therefore, the primary development project proposal has been sent to the Economic Relations Division, said a finance ministry official, adding that it is looking for a consultant to run the study.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments