Urea output plummets on feeble gas supply

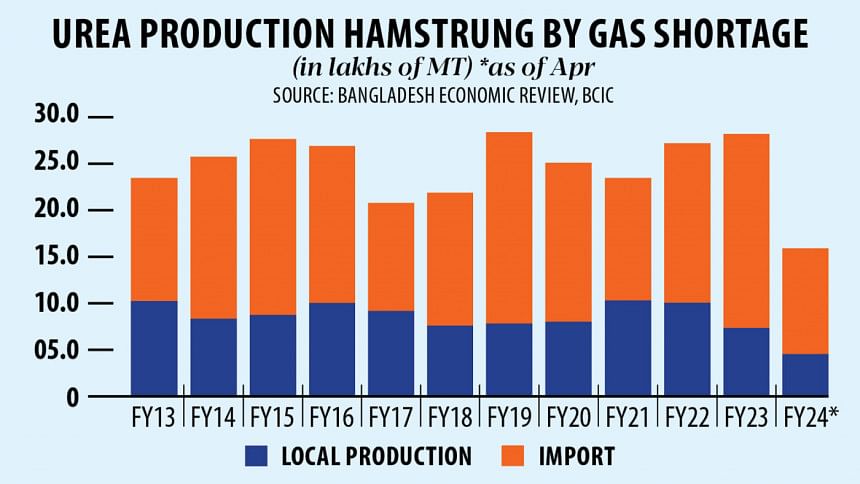

Bangladesh is mostly relying on imports for urea as gas shortage has brought local fertiliser production to a near halt, in a development that will cost the country dearly in terms of foreign currency reserves and food inflation.

The country's six urea factories need 329 million cubic feet of gas a day (mmcfd), according to Petrobangla. Since February, Petrobangla has been providing only 107 mmcfd to the fertiliser sector. Subsequently, four of the six factories have halted production.

Only Ghorashal Polash Fertiliser (GPFPLC) and Karnaphuli Fertiliser (Kafco) are getting their required gas and are in operation. Of the two, the government has to purchase fertiliser at the prevailing rate in the global market from Kafco, a joint venture between the government and private investors from Bangladesh, Japan, Denmark and the Netherlands.

It means the government is getting urea from only GPFPLC out of five state-owned producers at a lower cost.

Currently, there is no fertiliser crisis, according to Md Saidur Rahman, chairman of Bangladesh Chemical Industries Corporation (BCIC).

"If we don't get gas from one or two more factories in the near future, there might be a problem," he said, adding that if the energy division were able to supply adequate gas, the factories would have been running in full swing.

The Aman season, which accounts for about 40 percent of Bangladesh's rice production, begins in July-August and ends in November-December. If the gas crisis continues, fertiliser supply may be hampered in the upcoming Aman season, which can go on to fuel food inflation.

In the absence of local urea production, the government is relying more and more on costly imports.

This gives rise to two problems: exhaustion of limited dollar stockpile and ensuring a strict shipment schedule of fertilisers, said Jahangir Alam, an agriculture economist.

As of June 30, foreign currency reserves stood at $21.8 billion, enough to meet about three-and-a-half months' import bills, according to data from the Bangladesh Bank.

"If we rely completely on imports during the farming season, there might be hold-ups in getting steady supply of fertilisers. Rather, it will be beneficial for all if we increase gas supply to the fertiliser plants," Alam added.

Gas supply to the fertiliser plants was reduced to make way for increased supply to the gas-fired power plants for higher electricity generation during the summer months, said a top official of Petrobangla on the condition of anonymity to speak candidly on the matter.

"The gas crisis has been going on for a long time, so the supply has to be rationed," he added.

Between July last year and April this year, Jamuna Fertiliser could meet just 42 percent of its production target for want of gas, while Shahjalal Fertiliser managed 57 percent, according to the latest report of BCIC.

Chittagong Urea Fertiliser met 74 percent of its production target and Ashuganj Fertiliser and Chemical Company 69 percent, the report said.

The four factories are shut now, which means they fell short of their production target for fiscal 2023-24 by a wider margin, according to BCIC officials.

Besides the urea, Bangladesh consumes DAP and TSP fertilisers, both of which are mostly imported.

The lone DAP factory achieved only 36.6 percent of its production target and the TSP factory achieved about 66 percent in April.

Last fiscal year, as much as $5 billion was spent on fertiliser imports, according to data from BCIC. In fiscal 2020-21, fertiliser imports stood at $1.4 billion. In the previous years, imports were even lower.

About 15 years ago, BCIC was producing 70 percent of the fertiliser required, according to Alam, also a director of Dhaka School of Economics. Now, local production accounts for 25 to 30 percent of the demand.

"BCIC became import dependent instead of focusing on scaling up local production, which was the main duty of the organisation. We have the advantage and ability to produce nearly 100 percent of required urea locally, but due to gas shortage, the import dependency has been increasing," Alam added.

If the government purchased fertiliser from local producers, the cost for per metric tonne of urea would be about Tk 25,000, according to BCIC officials. It costs more than Tk 45,000 to bring the same volume of urea from abroad. For urea purchases from Kafco, the rate is about Tk 40,000.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments