No rights issues approved in 2015

Bangladesh Securities and Exchange Commission did not allow any listed company to raise funds through rights offers last year as it followed a go-slow policy in giving approvals.

Insufficient documents for regulatory approval and a downward trend in the secondary market throughout the year were the other factors behind the regulator's stance.

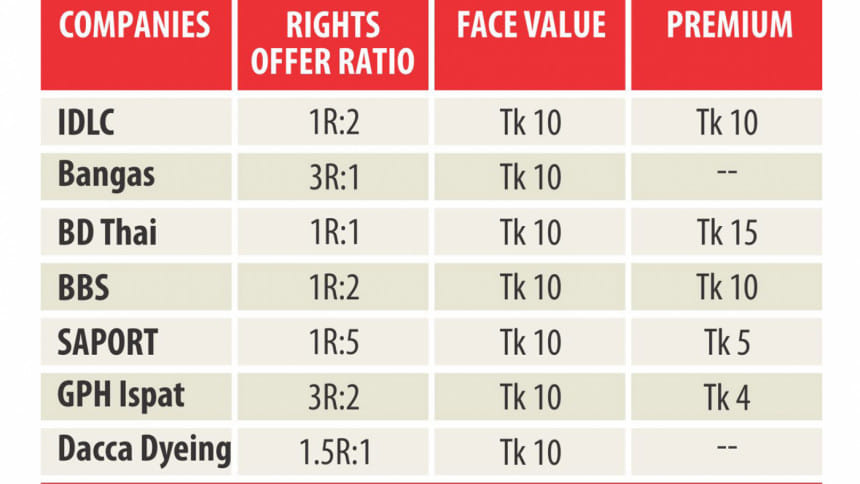

Seven companies submitted their proposals to the BSEC last year, seeking approval for rights issues. Five of them sought premiums in addition to their face value, while the rest two offered the rights shares at face value.

The companies intended to issue rights shares to either strengthen their capital structure or use funds for business expansion and loan repayment.

A rights offer refers to the issue of additional shares by a listed company to raise capital from existing shareholders.

With a rights issue, existing shareholders get the privilege to buy a specified number of new shares from the firm at a particular price within a specified time.

A rights issue is in contrast to an initial public offering, where shares are offered to the general public through a stock exchange.

“The regulator was conservative in allowing listed companies to raise funds through rights shares, as a downward trend prevailed in the secondary market throughout last year,” said a BSEC official.

The DSEX, the key price index of the premier bourse, fell 4.84 percent to close the year at 4,629.64 points. Average daily trade also came down to Tk 422 crore in 2015, registering a 15.43 percent fall compared to the previous year.

Besides, the official said the companies did not submit all the required documents and the regulator had to ask the companies to submit the relevant documents.

“The process took time,” the official said, adding that all the rights offers are now in the final stage and the regulator may give the green light to them this year.

Of the seven companies that sought approval last year, three were from the engineering sector and one each from financial, food and allied, textiles and services sectors.

In 2014, nine listed companies raised about Tk 2,000 crore through 77.5 crore rights shares, according to data from Dhaka Stock Exchange.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments