Female participation through agent banking rising

Female participation in financial activities through agent banking is growing as women now have 1.52 percent higher number of deposit accounts compared to men in Bangladesh.

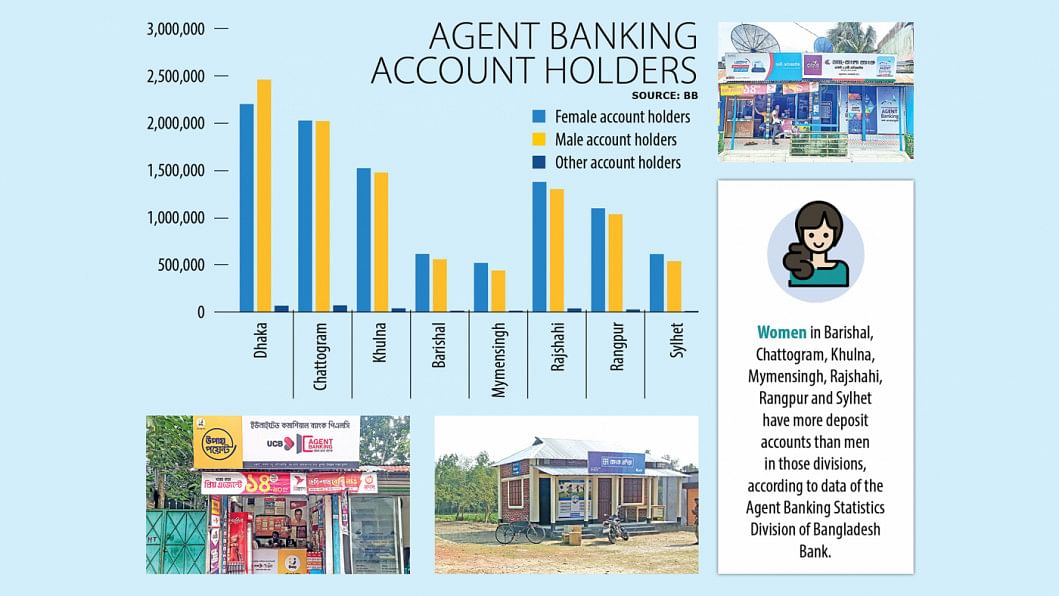

In Dhaka, men hold 52 percent of the deposit accounts while women 46.55 percent, but the scenario is opposite for places outside Dhaka.

Women in Barishal, Chattogram, Khulna, Mymensingh, Rajshahi, Rangpur and Sylhet have more deposit accounts than men in those divisions, according to data of the Agent Banking Statistics Division of Bangladesh Bank.

As of July this year, the number of female deposit accountholders stood at 9,995,969, which is 1.52 percent higher than that of the number of accounts held by men, data from the Bangladesh Bank showed.

Total male and other deposit accounts were 9,846,128 and 302,436, respectively.

In Dhaka, the proportion of male deposit accountholders is 52 percent in Dhaka division, 5.45 percent higher than that of female accountholders.

The capital city has 2,461,993 male deposit accountholders and 2,204,568 female accountholders.

The central bank data focuses that agent banking is providing financial services to rural and underprivileged people to compensate for the shortage of traditional banking facilities.

Until July, the total number of agents and outlets were 15,574 and 21,399 respectively.

Of the total agents, the number of rural agents was 13,156, which is 5.4 times higher than the 2,418 urban agents.

The number rural outlets were 18,401, which is 6.1 times higher than the number of urban agents, which represents rural areas are quite covered by banking facilities through agent banking, the Bangladesh Bank said.

The Bangladesh Bank data showed that Dhaka division has the maximum number of outlets, which is 5,307 or 25 percent of the total, and Mymensingh has the minimum number of outlets, which is 1,228 or 6 percent of the total.

Ziaul Hasan Molla, deputy managing director and head of agent banking at Bank Asia, said his bank introduced agent banking as a pilot project in 2013 with an objective to serve the unbanked population.

This is why, agent banking has spread in the places where there were no formal bank or branch of a bank, he said.

He said majority of the 5,400 agent banking outlets are located in rural areas and 65 percent of its 60 lakh agent bank accountholders are women.

"A main reason behind this scenario is that we distribute the allowances given by the government under the social safety net directly through agent banking accounts," he added.

In bank-wise percentage of agents and outlets, private commercial banks have the maximum number of agents, which is 10,936 or 70 percent of the total agents.

Islamic banks have 3,852 agents, which is 25 percent of the total.

In contrast, the state-owned banks have 786 agents, which is 5 percent of the total.

Similarly, private commercial banks have the largest number of outlets, which is 16,528 or 77 percent of the total number of outlets.

On the other hand, the state-owned banks have 786 outlets or 4 percent of total agents, the BB data showed.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments