Mighty dollar squeezes int’l purchases thru credit cards

The foreign exchange crisis in Bangladesh has dealt a blow to credit card users as the sharp appreciation of the US dollar against the taka has narrowed their scope for foreign purchases through cards.

Industry insiders say the amount of USD that can be spent using credit cards has decreased due mainly to the depreciation of the local currency against the American greenback.

Almost all major currencies have gained significantly against the taka in the last one and a half years amid the significant depletion of the foreign currency reserve.

For instance, the dollar traded at Tk 110 on Sunday, up from Tk 106.60 on the same day last year and Tk 85.20 in 2021.

A client who uses a credit card issued by Eastern Bank Ltd said the availability of dollars against his credit card has declined recently.

The private commercial lender communicated this to him earlier this month, saying the decreased amount is due to the higher taka-USD conversion rate. However, the total assigned limit will remain unchanged, it said.

The notice warned the card-holder that if the USD outstanding exceeds the new limit, a fee might be imposed automatically.

A credit card user of Mutual Trust Bank says he has already crossed his credit card transaction limit due to the higher conversion rate.

The two are among a huge number of credit card-holders who go abroad regularly and purchase products in US dollars and have been impacted by the weak taka.

EBL has already requested the central bank to raise the credit card loan limit.

In 2017, the Bangladesh Bank doubled the limit to Tk 10 lakh.

Banks are authorised to provide an additional credit facility of Tk 10 lakh, but it can't exceed Tk 25 lakh. The excess credit will have to be backed by liquid securities such as fixed deposits or foreign currency accounts.

EBL, one of the leading players in the credit card segment, has around two lakh card-holders and its outstanding loans against the cards stand at Tk 750 crore.

"Credit cards are generally issued with a taka limit and clients can use foreign currencies within the same ceiling," said Ahsan Ullah Chowdhury, head of digital financial services at EBL.

He says Bangladeshi nationals are allowed to spend a maximum of $12,000 outside of the country through credit cards or in cash. But card-holders are now able to use a lower amount of US dollars because of the higher exchange rate.

EBL's credit card business in the international market has fallen due to the higher currency conversion rate and airfares, he said.

However, credit card use domestically has increased owing to an erosion of the purchasing power of consumers in recent months amid higher inflation, bankers say.

Inflation advanced 23 basis points in August to 9.92 percent propelled by food inflation, which hit a 12-year high, data from the Bangladesh Bureau of Statistics showed.

Consumer prices have remained at an elevated level for more than a year.

Ahsan said purchasing products or paying bills using credit cards gives some breathing space to people at a time of economic crises.

"So, this is high time to increase the credit card loan limit since the existing ceiling is not enough for clients considering higher inflation and the USD rate."

Md Abu Bokar Siddik, head of the card division at Mutual Trust Bank, also said customers can now use a lower amount of US dollars than in the past.

The private commercial lender has 1.17 lakh cards in the market, which places it among the top five players in the segment.

Despite the higher exchange rate, the number of credit card-holders and the amount of transactions is growing.

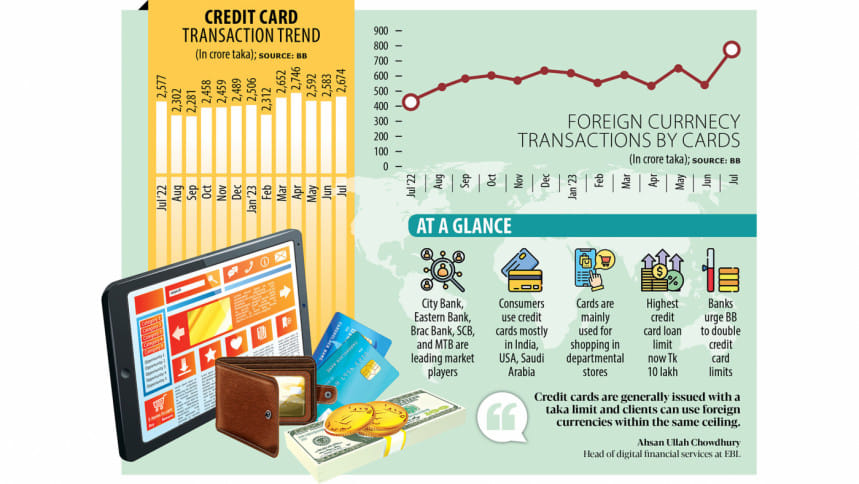

In July, the number of credit cards stood at 2.27 lakh, up from 2.01 lakh a year ago, BB data showed.

Transactions involved Tk 2,674 crore in July, an increase from Tk 2,577 crore a year ago.

Foreign currency transactions stood at Tk 769 crore in July, which was Tk 440 crore in the identical month of 2022.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, attributed the recent spike in card transactions and users to the lower USD rate offered by credit cards than in the kerb market.

"The USD costs Tk 118 in the unofficial market whereas it is much lower in the credit card. That's why people are using credit cards while visiting abroad amid the volatility in the forex market."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments