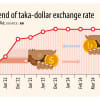

Taka fell 13.3% vs dollar in 2022: BB

Bangladesh's currency taka depreciated by 13.3 percent against the US dollar in 2022, said Financial Stability Report 2022 of Bangladesh Bank.

The interbank exchange rate stood at Tk 85.80 per US dollar on January 2 last year whereas Tk 105.40 on December 1. Yesterday it was Tk 109.50.

In spite of the taka's depreciation, Bangladesh Bank had pumped $13.50 billion from its reserves to cool down the foreign exchange market.

The volatility in the foreign exchange market arose in the pandemic's aftermath and the situation worsened at the start of the Russia-Ukraine war in February last year.

Most global currencies depreciated notably against the US dollar due to supply chain disruptions in the global market.

Released yesterday, the report said currencies of major import partners, including Chinese yuan, Indian rupee, Japanese yen and Indonesian rupiah, witnessed substantial depreciations last year.

The Pakistani rupee depreciated the highest, by 22 percent. The Japanese yen followed suit with 14 percent, as per the report.

The value of the euro and UK pound sterling, two major export earning currencies, also plummeted substantially, making exports to those regions less appealing.

The euro depreciated by 6 percent and the UK pound sterling depreciated by 10 percent against the US dollar last year, the report showed.

Currencies such as the Russian ruble and the Singaporean dollar recorded a modest increase in 2022, by 2 percent and 1 percent respectively.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments