Small garment units in a tight spot

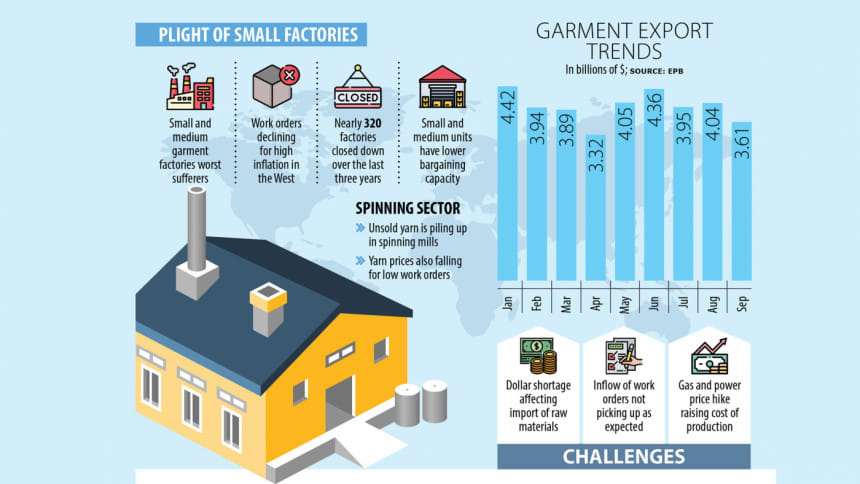

Small and medium-sized garment factories in Bangladesh are finding it increasingly difficult to keep their heads above water amid the rising cost of production and a fall in work orders from international clothing retailers and brands.

A key cog of the apparel supply chain, SMEs are particularly vulnerable under the current volatile situation since their financial position is not that strong like their larger peers and the persistently low level of orders may force them out of business.

The crisis for them is not new but what is worrisome is that it is worsening day by day since the external and internal factors responsible for their lingering peril are not going away.

Following the outbreak of the Russia-Ukraine war, the inflow of work orders to Bangladesh started declining as the global economy, which was still facing the impacts of the coronavirus pandemic, has been witnessing one of the toughest times in recent memories because of record inflation in the western world and higher global commodity prices.

SMEs are particularly vulnerable under the current volatile situation since their financial position is not strong like their larger peers.

The twin crises have hit the consumers in the US and the European Union, the two main export destinations for the second-largest apparel supplier in the globe.

SME suppliers have also been the worst victim of the low prices being offered by global buyers since they will not survive if they accept the reduced rates.

Larger units can afford to agree to cater the demand on the back of their strong financial health even when the rates are lower than the production cost.

Md Ehterab Hossain, managing director of Base Fashion, says his factory usually remains flooded with orders between October and December.

"The order equals to about 70 percent of capacity this year."

The factory exports T-shirts, polo shirts and running clothes mainly to Germany and Spain and employs 1,200 workers.

Currently, the factory is booked up to December whereas it sat on piles of orders up to March and April in the past.

Hossain's plight did not end there: his buyers are also delaying placing fresh orders because of the volatile economic situation globally and the drop in retail sales.

In Bangladesh, the cost of production has increased nearly 20 percent over the last one year mainly because of a 100 percent hike in gas and petroleum prices in the domestic markets since the prices of yarn and transport costs have gone up, manufacturers say.

However, international buyers have not increased the prices of the garment items they source from the country, which shipped nearly $47 billion worth of products in the financial year that ended on June 30.

Ahmed F Rahman, chairman of Kappa Fashion Wears Ltd, says the capacity of the factory can't be utilised fully owing to the decline in export orders.

He added although the cost of doing business has increased for him by nearly 15 percent over the last one year, the prices of the garment items did not increase.

"It is very difficult time for us. The business had picked up after the impacts of Covid-19 eased, but the situation has turned worse again."

M Shahadat Hossain Sohel, managing director of Towel Tex Limited, which has employed 500 workers, says after the deduction of the cost of production, much is not left in terms of profits.

"It is better to leave the business. However, we can't do so now since a lot of money has been invested."

AK Azad, chairman and chief executive officer of Ha-Meem Group, one of the largest garment units in Bangladesh, says all SMEs are in big trouble as the inflow of work orders declined due to the volatile economic situation.

The order is relying on the prospective sales linked to Christmas, Thanksgiving Day and New Year in the US and the EU, he said. The three festivals account for a major portion of the sales of garment items manufactured in Bangladesh.

The former president of the Federation of Bangladesh Chambers of Commerce and Industry also said the spike in gas and power prices is affecting the cost of production at a time when orders have fallen.

"Nearly 320 small and medium garment-sized factories have closed owing to poor inflow of orders since the beginning of Covid-19," said Md Shahidullah Azim, vice-president of the Bangladesh Garment Manufacturers and Exporters Association, a platform of apparel makers.

He particularly mentioned the case of Dird Group's lay-off recently.

"Dird Group is a good factory and it had been running very well for the last many years. But recently it laid off workers because of the lower orders."

Like Dird Group, many other factories are suffering from the reduced work orders, an ominous sign for an industry that has created jobs for millions of workers, mainly poor.

Azim also blamed the bankruptcy of many retailers and brands in the US and the EU for the trouble at home.

For instance, UK's Debenhams had been a good sourcing company for Bangladesh. It went bankrupt in 2020 and many local suppliers are yet to receive the payments, he said.

The utility price hike is another major cause of concern for garment exporters and many of them are not even capable of opening letters of credit owing to a lack of US dollars at banks.

"As a result, apparel shipments to the US and the EU have declined in recent months," Azim said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments