Relaxed incentive rules send remittance to a four-month high

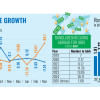

Migrant workers sent home $1.98 billion in October, a four-month high, as banks stepped up efforts to woo more remittance buoyed by a relaxed central bank rule on incentive, a development that is expected to give some relief to a country reeling under the foreign exchange crisis.

The receipts in last month were nearly 30 percent higher than in the same month last year when remittance brought in $1.53 billion and up about 50 percent from a 41-month low of $1.33 billion in September this year, according to the Bangladesh Bank.

The elevated remittance transfer might be the result of a central bank instruction, albeit verbal, that allowed banks to provide as much incentive as they wanted as the BB looked to accelerate the inflow of US dollars.

Overall, families and relatives of the workers received $6.89 billion in the first four months of the current financial year of 2023-24, a decrease of 4.3 percent from $7.20 billion in the identical period from a year ago.

Selim Raihan, executive director of the South Asian Network on Economic Modeling, described the turnaround as encouraging.

"It will be more reassuring if the positive trend continues for at least two consecutive months. We saw such fluctuations in the past but the overall inflows did not increase much at the end of the year since the momentum did not last."

The flow of remittance has increased in recent weeks, said a banker in Chattogram.

The higher inflows could hand some respite to the economy creaking under the strain stemming from a sharp decline in foreign currency reserves.

On October 25, the foreign currency reserves stood at $20.89 billion, enough to meet around four months' import bills. It was about $40.7 billion in August 2021.

Remittances are a vital source of household income in lower-middle-income countries such as Bangladesh. They alleviate poverty, improve nutritional outcomes, and are associated with increased birth weight and higher school enrollment rates for children in disadvantaged households, according to the World Bank.

However, the flow of remittances to Bangladesh has not picked up to the expected level despite a record outbound of workers in 2022 and incentives from the government, largely owing to a higher US dollar rate in informal channels such as hundi.

Even before the coronavirus pandemic, hundi accounted for nearly half of remittances sent to Bangladesh.

In order to attract remittances, the government introduced a 2 percent incentive in 2019, and it was later raised to 2.5 percent.

On October 22, banks said remitters would receive as high as 2.50 percent in an additional incentive from banks apart from the government's existing cash support. But the move did not materalise.

Now, banks can offer as much incentive as they want, said the chief executive officer of a private commercial bank.

"As a result, the remittance flow has gone up."

Mohammad Ali, managing director of Pubali Bank, says banks have intensified their efforts to bring in remittances. Besides, the flexibility in the incentive system has been helpful.

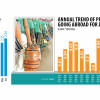

More than 11.35 lakh Bangladeshis left the country for jobs abroad last year, nearly double the 6.17 lakh migrant workers who flew to other countries the previous year.

In the first six months of 2023, about 6.18 lakh workers went to other countries, figures from the Bangladesh Bureau of Manpower, Employment and Training showed.

Migrant workers sent $21.61 billion in 2022-23, which was $21.03 billion a year ago.

Prof Raihan says risk factors are still there. The higher dollar rate in the informal market is one of them.

"The incentive to channel money through the hundi system might be higher than sending them through official platforms."

A Bangladeshi-American living in the US says the higher dollar rate is definitely a factor. Besides, transferring funds through hundi operators is easier than in the formal channels.

In Bangladesh, a one-per cent deviation between the formal and informal exchange rate shifts 3.6 per cent of remittances from the formal to the informal financial sector, the World Bank said in May.

Prof Raihan says if political uncertainty persists, capital flight might increase and the hundi cartels may become more active.

"Then, the incentives might not work."

The CEO of the private bank said hundi operators have to be reined in and the exchange rate has to be floated in a true sense in order to give a sustainable push to remittance flow.

"Otherwise, no makeshift measures will bring long-term benefits."

On October 30, the Bangladesh Foreign Exchange Dealers' Association (Bafeda) and the Association of Bankers, Bangladesh (ABB) decided that banks would have to sell 10 percent of their previous month's remittance earnings in the interbank market, where the rate would be Tk 114 per US dollar.

But some banks are bringing remittance by purchasing dollars from external sources at Tk 116 to Tk 117, said the CEO.

"We can sell the dollars among our clients at a lower than the market rate in order to retain customers. But I can't sell the same dollars at a lower rate to other banks. This is not a charity."

Besides, he said, if the 10 percent rule continues, some banks might not even feel the encouragement to try hard to bring remittances from abroad since they can easily get the funds from the interbank foreign exchange market.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments