New monetary policy fails to live up to expectations

The new monetary policy will not be enough to help Bangladesh rein in higher inflation as the central bank has come up with inadequate measures against huge expectations, economists and experts said yesterday.

They also said the monetary policy alone can't help contain higher consumer prices, and supportive fiscal policy and proper market management are vital.

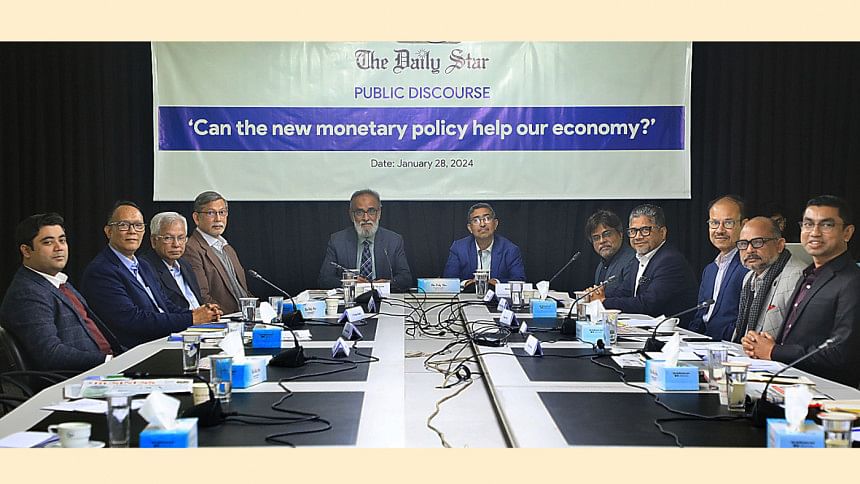

They made the comments at a public discourse on "Can the new monetary policy help our economy?" organised by The Daily Star at its office in Dhaka.

"The central bank wants to achieve too much from the monetary policy which is a problem," said MA Taslim, a professor of economics at the Independent University, Bangladesh.

"The central bank is taking the sledgehammer approach, saying you have to accept this interest rate and you have to trade at this rate even though you don't want to. When you do this sort of thing, the outcome is not as good as it could have been, if markets are relatively free."

He said the major policy stance of the Bangladesh Bank is to manage inflationary pressure and stabilise the exchange rate.

"But all it is doing is fixing it, forcing people to sell at that rate."

The exchange rate was never fully flexible and the crawling peg, which the central bank plans to introduce, is probably not going to solve the problem.

"It never solved any problem. By definition, crawling means you're not in equilibrium. By the time you approach the equilibrium, the equilibrium will shift," said Prof Taslim.

Ashikur Rahman, a senior economist at the Policy Research Institute, said the new MPS offers a lukewarm response to the current inflationary pressure by increasing the policy rate to 8 percent, which is lower than the inflation rate of 9.4 percent.

"If we see how central banks responded in India or the US, we observe that the interest rate hike has been much more aggressive as they have settled for policy rates above their respective inflation rate. Unfortunately, such bold measures are not visible in the new MPS."

He said the governance crisis in the banking sector has become a binding constraint for effective management of inflation as the BB is printing money to rescue troubled Islamic banks.

"Without correcting this core governance deficit in the banking sector, we can't tame the current inflationary pressure. Unfortunately, the MPS does not recognise this issue seriously."

Rahman praised the central bank for its decision to come out of the lending rate cap and embrace an interest rate targeting framework.

"It would have been even better if the Bangladesh Bank went for an inflation rate targeting framework as observed in the advanced economies."

The decision to start a transition to a market-based exchange rate is also a step in the right direction, he said.

The PRI economist asked the BB to abandon its lukewarm response and go for a policy rate that is at least as high as the inflation rate and carefully observe whether it halts reserve depletion and reduces the inflationary pressure.

"If it does not, then it must go even further."

While presenting his keynote paper, Mamun Rashid, managing partner of PwC Bangladesh, said the central bank declared the monetary policy by letting the interest and exchange rates go up and the market play a role.

"But in developing economies, the monetary policy alone can't help contain inflation. The market management is vital. But we have failed in this area."

Rashed Al Mahmud Titumir, a professor of economics at the Department of Development Studies at the University of Dhaka, said the central bank is working around the interest rate but it will not help bring inflation down.

"The authorities need to identify the reasons behind the higher inflation. Why don't retail prices of commodities decline even after their fall in the wholesale market?"

He said erratic supply and the devaluation of the taka have been behind the runaway inflation.

Titumir, citing a 33 percent jump in imports in the fiscal year 2021-22, said, "Has the central bank taken the initiative to know the reasons behind this phenomenal rise?"

Similarly, he questioned the discrepancy in data on export earnings maintained by the Bangladesh Bank and the Export Promotion Bureau. "Where has the money gone?"

AK Enamul Haque, a professor of economics at the East-West University, said supply chain disruptions, corruption and poor governance are also responsible for the unprecedented inflation.

"So, interest rates alone will not be enough to control it."

Bangladesh's foreign currency reserves have halved to about $20 billion in just two years. And Prof Haque said the reserves would not increase in a traditional manner.

"Market and product diversification is needed to give a much-needed boost to exports and thus reserves."

The level of the reserves can also increase through foreign direct investments, he said. "However, investors will not invest if there is uncertainty."

Masud Khan, chairman of Unilever Consumer Care Ltd, said in Bangladesh, higher inflation has been caused by mainly two factors: cost-push and monetary expansion.

"Can the cost-push factor be addressed by higher interest rates or will the situation deteriorate?"

He said the food inflation has been caused by the dollar appreciation of imported items. For local items, the higher prices of diesel, transportation and higher wages have led to a cost push.

Also, the lower production due to inclement weather, artificial scarcity, and disruptions in the supply chain have contributed to the price increase, he said.

He said that already the investment climate is gloomy with hardly any funds coming from local and external investors.

"The increased interest cost will aggravate the situation which could dampen future economic growth."

Khan said the spike in interest may be a death knell for the struggling but promising SME sector. "The SME sector needs to thrive in order to ensure sustainable growth."

Mohammad Muslim Chowdhury, a former comptroller and auditor general, said the monetary policy is just an instrument and it would not alone help the economy.

He thinks focusing only on fighting inflation by keeping GDP growth stagnant is not a wise policy measure.

TIM Nurul Kabir, executive director of the Foreign Investors' Chamber of Commerce & Industry, said the government should formulate strategies to attract substantial amounts of FDIs to ease the current shortage of forex.

"The drastic depreciation of the domestic currency against the US dollar has created a severe deficit in business confidence among foreign investors who find repatriating dividends and profits difficult due to the liquidity problem in the foreign exchange market."

Mohammad Ali Khokon, president of the Bangladesh Textile Mills Association, said the volatile exchange rate, nearly 40 percent rise in the prices of capital machinery, and increasing bank interest rate have discouraged new investments in the primary textile sector.

"As a result, the export of some goods like home textiles is going down."

For instance, the export of home textiles declined to $600 million last fiscal year from a record $1.6 billion.

He said although the official rate of the US dollar quoted during the opening of letters of credit is Tk 110, importers are buying the currency from banks at Tk 123 per dollar.

The BTMA chief termed the willful non-performing loans as plundered loans.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments