Deposits in Islamic banks rise but liquidity challenge persists

Deposits in the Islamic banking sector of Bangladesh rose 8.16 percent last year but the liquidity challenge that it has been facing for months remained persistent.

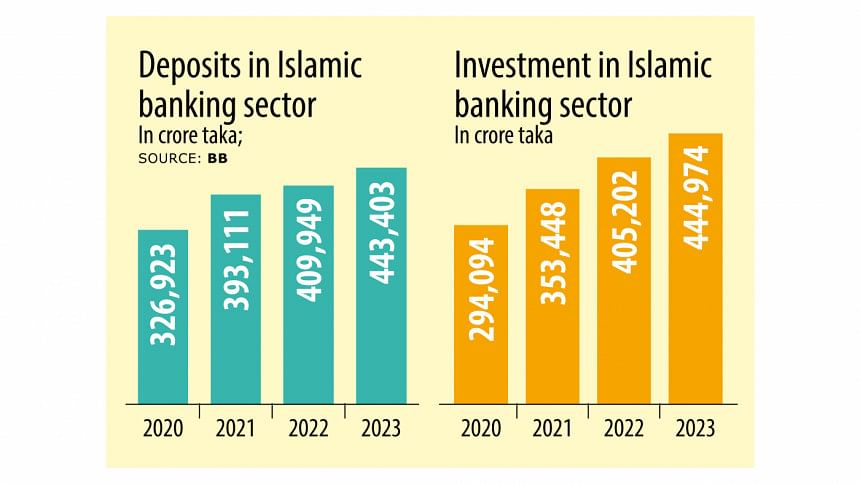

Deposits in the Islamic banking sector stood at Tk 443,403 crore at the end of December 2023, up from Tk 409,949 crore a year ago, as per the Bangladesh Bank's quarterly report on Islamic banking.

On the other hand, liquidity in the Islamic banking sector stood at Tk 11,107 crore, down from Tk 12,871 crore a year ago.

Industry insiders said that four to five Islamic banks were still facing liquidity shortages, which was adversely affecting the overall Islamic banking sector. They said that those banks were continuously taking liquidity support from the central bank as a result.

A senior official of the central bank told The Daily Star that Islamic banks in Bangladesh were sitting on huge amounts of excess liquidity two to three years ago.

Now, the sector is going through challenges due to massive loan irregularities at the five banks, he added.

However, he said it was a good sign that deposits in this sector had increased slightly.

The BB report also showed that investment in the Islamic banking sector increased 9.81 percent last year.

There are 10 full-fledged Islamic banks in the country and the number of branches of Islamic banks, including Islamic branches of conventional commercial banks, stood at 1,700 at the end of last year.

Deposits at the 10 full-fledged Islamic banks stood at Tk 403,850 crore, while it was Tk 20,433 crore at windows of conventional banks and Tk 19,121 crore at branches of conventional banks till December last year.

The situation of Islamic banks improved slightly due to the good liquidity position of Islamic branches and windows of conventional banks, industry insiders said.

Remittance earnings through Islamic banks stood at Tk 35,348 crore till last year, up from Tk 25,691 crore a year ago.

At the end of December 2023, Islamic banks accounted for 25.35 percent of total deposits in the banking industry and 28.92 percent of total investments in the sector. Those figures stood at 26.61 percent and 28 percent respectively at the end of September 2023.

At the end of December 2023, there were 10 full-fledged Islamic banks in Bangladesh operating with 1,670 branches.

In addition to this, 30 Islamic banking branches of 15 conventional commercial banks and 624 Islamic banking windows of 16 conventional commercial banks are also providing Islamic financial services in Bangladesh.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments