Loans to become overdue 3 months after repayment date

In a bid to conform to international best practices in the classification of default loans, Bangladesh Bank (BB) yesterday tightened the definition of overdue term loans.

In a circular, the central bank said that lenders will treat a loan as overdue if a borrower does not make an instalment payment within three months after the due date of repayment.

Under existing rules, if a borrower fails to repay an instalment on time, the loan is considered overdue six months after the repayment date.

The BB said this will come into effect from September 30 this year.

From March 31, 2025 onwards, loans will be treated as overdue the day after the deadline for repaying instalments, according to the BB notification.

A top official of a private bank said the central bank had eased loan classification rules during Covid-19 to stand by borrowers suffering from a slowdown in businesses and economic activities due to pandemic-induced restrictions.

Those rules have been tightened now, he said, adding that banks would start classifying loans as non-performing six months after the due date of repayment from September this year.

From March, 2025 onwards, banks will classify loans as non-performing loans if borrowers fail to pay an instalment three months after the due date.

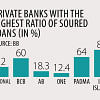

"The new rule will make it difficult for banks that have deferred classification," he said.

In another circular yesterday, the BB barred banks from collecting higher instalments on industrial term loans and home loans taken before July 2023, easing concerns of many borrowers who, owing to rising interest rates, have to pay higher instalments now than they initially appraised.

The BB said banks will have to collect instalments on such loans based on interest rate they had fixed prior to the introduction of the Six-Months Moving Average Rate of Treasury Bills (SMART).

The central bank asked banks to follow the SMART Rate from July last year to fix interest on loans, scrapping the previous lending rate cap of 9 percent, which it had slapped in April 2020.

As interest rates began to rise due to an increasing SMART rate, a number of banks started to slap variable interest on loans, which caused a spiral in instalments, making it tough for many borrowers to service loans regularly.

In its circular, the BB acknowledged the issue and said the capacity of borrowers to repay increased instalments has reduced as the current interest rate, determined based on SMART rate, is higher than the past.

"Under the circumstances, it has become necessary to restructure the tenure of term loans and house finance without increasing instalments," said the central bank, asking lenders to keep instalment amounts unchanged.

To do this, banks will have to consider outstanding balance of loans as of March 31, 2024. The excess amount of instalment should be transferred to interest-free blocked accounts, it said, suggesting banks increase tenure of repayment.

However, the new benefit will not be applicable if a loan is classified, rescheduled or restructured. The new facilities will be applicable for loans which are unclassified as of April 1, 2024, said the central bank, adding that the same conditions will be applicable for Shariah-based banks.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments