Stock indices plunge as Middle East tensions flare up

Major indices of the stock market of Bangladesh fell yesterday in the face of huge selling pressure as investors are worried the economy could suffer from another global crisis resulting from Iran's attack on Israel.

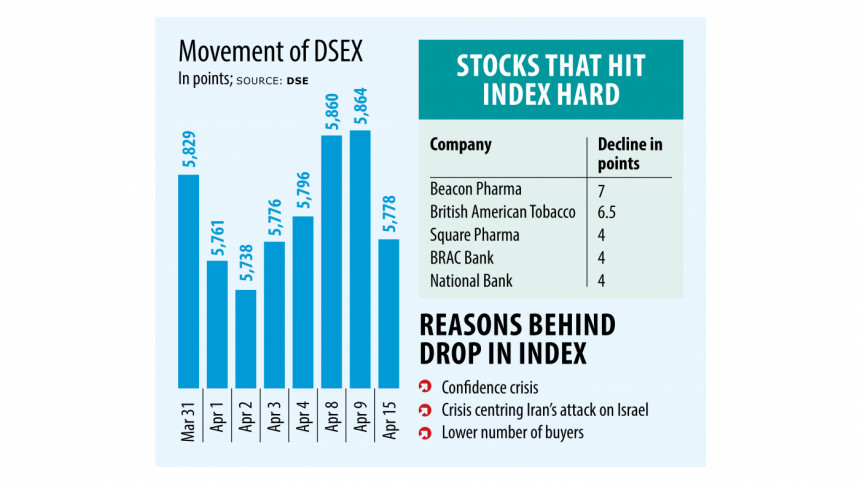

The DSEX, the benchmark index of the Dhaka Stock Exchange (DSE), dropped 85 points, or 1.45 percent, to close at 5,778 on the first trading session after the Eid holiday beginning on April 9.

Similarly, the DSES, an index that represents Shariah-compliant companies, shed 16 points, or 1.26 percent, to hit 1,266. Likewise, the DS30, an index comprising blue-chip stocks, lost 17 points, or 0.86 percent, to reach 2,014.

Saiful Islam, president of the DSE Brokers Association, said general investors had no reason to sell their shares as the attack on Israel was a form of retaliation and not a declaration of war.

"Even though the attack may create some concerns, the situation is not such that people need to panic, especially since the market is already in a bearish trend."

Still, terrified investors were looking to sell from the onset of trading, leaving the market indices to face an early plunge that only deepened as the day wore on.

The plunge was unexpected as the indices were rising ahead of Eid-ul-Fitr following weeks of decline after the removal of floor prices.

"But the sharp fall disrupted the momentum. It was a pure case of external factors at work," Islam added.

Iran unleashed a barrage of missiles and drones in the early hours of Sunday, targeting Israel in retaliation for last week's Israeli strike on its consulate in Damascus.

Mesbah Uddin Khan, CEO of Sheltech Brokerage Ltd, said it was illogical for investors to sell their shares fearing another economic crisis as Iran's attack did not cause any major damage warranting further retaliation.

"So, investors who sold shares out of panic incurred losses that could have been avoided as the attack may not result in an all-out war, according to reputed media outlets worldwide."

Against this backdrop, Khan warned against panic sales and said those who offloaded shares in a hurry will face losses and struggle to recover.

"Instead, make your investment decisions patiently," he advised through a social media post.

Daily turnover of the DSE, which measures the volume of shares traded during a session, dropped 17 percent to Tk 367 crore.

On condition of anonymity, a top official of a merchant bank said many investors were in a selling mood as they feared another global crisis after the attack on Israel.

"The Russia-Ukraine war badly impacted the local economy and the stock market. So, investors are worried that another war may further deteriorate the situation. As such, they tried to sell shares."

Brokers have already assured investors that the attack is unlikely to result in a war and warned against selling shares as the situation could become much more dire if the trend continues.

Regarding the reduced turnover, they said investor participation was low as many have yet to return from their Eid vacation.

Beacon Pharmaceuticals was the biggest drag on the DSEX, responsible for a seven-point decline, while British American Tobacco caused it to fall by another six points.

Deshbandhu Polymer topped the gainers' list, with its share value gaining 7 percent, while that of Fu Wang Food rose 6 percent, Karnaphuli Insurance rose 4 percent and Midland Bank increased 4 percent.

Shares of Anlima Yarn Dyeing shed the most, dropping 8 percent, followed by Maksons Spinning Mills and Metro Spinning Mills with declines of about 6 percent each.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments