Consumption stays low for two straight years as inflation bites

The consumption growth in Bangladesh remained low in the last two fiscal years as people witnessed one of the biggest falls in their spending power owing to stubbornly high inflation.

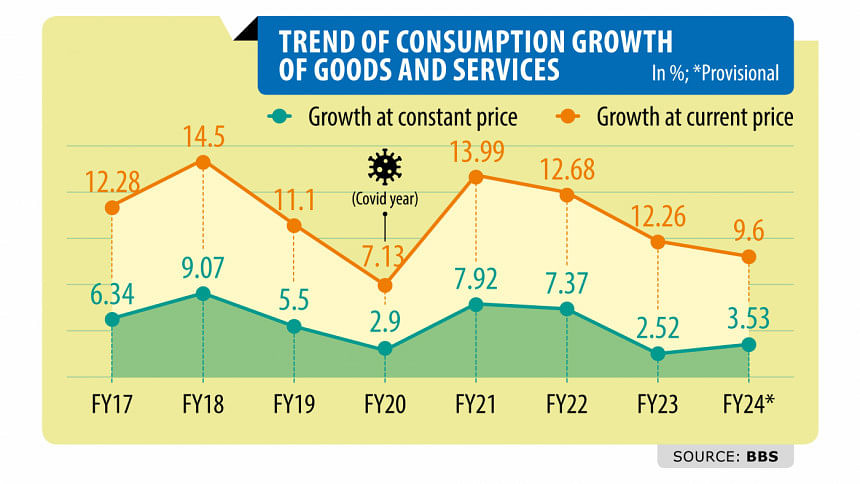

According to a provisional estimate of the Bangladesh Bureau of Statistics (BBS), consumption of goods and services grew 3.53 percent in 2023-24, up from 2.52 percent in the last fiscal year.

Except for the pandemic-hit 2019-20, when the consumption growth rate was 2.9 percent, it was above 6 percent since at least 2016-17.

In Bangladesh, the economy has been under pressure for the last two years owing to an unprecedented depletion of foreign currency reserves and a rapid depreciation of the taka.

As a result, the inflation rate has surged to record levels.

Arman Hossain, a resident in the capital's Pallabi, said that his family has been forced to cut expenses by 30 percent because everything has become costlier.

"However, my salary has not increased in line with the expenditures," said the 30-year-old, who works for a private company.

Zahid Hussain, a former lead economist of the World Bank's Dhaka office, said the low-income group is finding it difficult to keep their heads above water, so a lower consumption growth rate is normal.

"People's purchasing power has been declining for the past two years. On the other hand, the wage growth rate is not rising at the same pace as inflation. Instead, the real wage growth has turned negative," he said.

In 2022-23, the average inflation rate was 9.02 percent, far higher than the average of 6 percent in recent years. The Consumer Price Index grew by around 9.5 percent in the first 10 months of FY24, BBS data showed.

"The elevated level of consumer prices has forced many people to cut consumption," said Towfiqul Islam Khan, a senior research fellow of the Centre for Policy Dialogue.

Since wages and incomes did not rise in line with the prices of essential goods and services, people were forced to adopt a coping mechanism.

"The relatively low-income people are the main sufferers in this situation. As a coping mechanism, they have reduced their consumption and savings and expenses aimed at education and health. The same was seen during the peak of the pandemic," Khan said.

Private consumption is projected to grow by 3.32 percent in FY24 while it was 1.98 percent in the previous year. In 2021-22, the consumption of the private sector increased by 7.47 percent, according to the national statistical agency.

"Because of lower consumption, people's nutrition and future investments will be impacted," Khan said, adding that child marriage and the infant mortality rate may increase because of lower consumption as well.

Sabbir Hasan Nasir, managing director of Shwapno, the largest grocery chain in Bangladesh, said the market is not growing the way it expanded in 2021 or 2022.

"The consumption growth has slowed since 2022," he said.

Shwapno has the data of 1.5 million customers, so it can see changes in consumer behaviour by analysing it, he said.

"Volume-wise, there is massive de-growth in many places."

Helal Uddin, president of the Bangladesh Shop Owners Association, backed the data of the BBS.

"Our sales have declined since many low-income and lower-middle-income households cut back on purchases because the prices of almost all products have gone up. It has continued for a couple of years," he said.

Helal added that the cash-poor people are dipping into their savings to survive.

The government consumption growth was projected to be 5.67 percent in FY24, down from 8.53 percent in the previous year.

Overall consumption in terms of gross domestic product also fell. It stood at 72.39 percent in the current fiscal year, down from 74.24 percent in FY23.

Private consumption slipped to 66.78 percent of GDP from 68.58 percent while the government's consumption dipped from 5.67 percent to 5.61 percent.

"Consumption growth is low if volume is considered. As essential commodities have become dearer, overall consumption has fallen," said Eleash Mridha, managing director at Pran Group, the biggest food processor and exporter.

"If we talk about our company, the growth rate was in double digits in the past. However, it has now slipped to single digits."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments