A fresh blow to stock investors

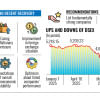

In yet another blow to stock market investors, the government plans to impose a capital gains tax on them from next fiscal year.

Although this has disheartened stock market analysts, they welcomed another move allowing black money into the stock market and increasing corporate tax for listed companies that have not offloaded at least 10 percent of their shares.

The government plans to impose at least 15 percent capital gains tax on general investors if their income from share trading crosses Tk 50 lakh.

Since 2015, individual investors had been exempted from paying tax on capital gains from stocks, mutual funds, bonds and debentures.

However, sponsors and directors of listed companies currently face a 5 percent tax deduction at source on capital gains from share transfers.

The government has increased this rate to 10 percent in the proposed budget.

However, the tax will not be applicable in case of shares transferred as a gift between parents and children and between spouses.

Market analysts fear that the market is losing investors for having been on a bear run for a long time.

The DSEX, the benchmark index of the DSE, dropped by around 1,000 points, or 16 percent, in the last three months.

Against this backdrop, this new tax will not only prompt more investors to leave the market but also discourage large investors from coming to invest.

Although the chief of the Bangladesh Securities and Exchange Commission (BSEC) had earlier assured investors that he had spoken to the National Board of Revenue to keep the tax from coming into effect, this has not happened yet.

Saiful Islam, president of the DSE Brokers Association of Bangladesh, called for reviewing the plan on the capital gains tax as the market was now passing through tough times.

"We are not against the capital gains tax, but the time is not appropriate," he said.

Moreover, he welcomed the move to attract listed companies to offload more shares in the stock market in exchange of getting a corporate tax rate cut.

The finance minister yesterday proposed that listed companies which will offload at least 10 percent of their shares in the stock market and abide by a condition on bank transfers will be able to avail an income tax reduction from 22.5 percent to 20 percent.

The condition is that all types of income, receipts, single transactions of over Tk 5 lakh and all annual expenses and investments exceeding Tk 36 lakh must come about through bank transfers.

If the share offloading is less than 10 percent, the company has to pay income tax at a rate of 25 percent.

However, if this company abides by the bank transfer condition, the income tax rate will be 22.5 percent.Other analysts pointed out that these conditions result in the difference in tax payable by listed and non-listed companies to 2.5 percentage points, but it should have been higher to make it more lucrative to get listed.

Islam also lauded the finance bill allowing black money into the stock market and barring the questioning of investors in this regard, saying it would have a positive impact on the stock market.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments