NBR receipts up 15% in 11 months

The National Board of Revenue (NBR) logged a year-on-year tax collection growth of nearly 15 percent in the first 11 months of the current fiscal year.

As of the end of May, the board was still short by over Tk 85,000 crore of the government's revised goal for raising Tk 410,000 crore by the end of fiscal year 2023-24, which ends on June 30.

Similarly, it might be tougher to meet International Monetary Fund's collection target for indicative tax revenue, meaning both the NBR revenue and non-tax revenue, of Tk 394,530 crore in FY24.

The revenue administration collected Tk 324,378 crore in the July-May period of fiscal year 2023-24, which represents 79 percent of the revised target for the fiscal year, according to the provisional data of the NBR.

"Even after this month's revenue is collected, the tax collection target is likely to be missed by a big margin," said Ahsan H Mansur, executive director of think-tank Policy Research Institute of Bangladesh.

The overall collection may come to stand at Tk 375,000 crore at the end of June, increasing by up to Tk 50,000 crore in the last month, he told The Daily Star yesterday.

However, the government has set a target of Tk 480,000 crore for FY25, which is an increase of 17 percent compared to this year's target and which exceeds the NBR's average annual revenue growth of 11 percent over the past five years.

"In this situation, this target is really optimistic as well as a difficult task for the revenue board," he said.

In Bangladesh, the tax-GDP ratio remains among the lowest in the world, at an estimated 7.38 percent in fiscal year 2022-23. "This situation has come about as our tax administration is weak as well as corrupted," Mansur said.

They still follow the traditional ways for collecting revenue as had been under British rule. There is a lack of automation and a proper database, he said.

On the other hand, many of the officials of the NBR help dishonest people evade taxes, he said.

In this regard, Mansur also spoke about Matiur Rahman, president of the NBR's Customs, Excise and VAT Appellate Tribunal who was transferred to the finance ministry's Internal Resources Division following a recent controversy over his wealth.

Matiur has come under the scanner over allegedly amassing crores of taka despite having a basic monthly salary of Tk 78,000.

Funds must be invested to bring about the NBR's digitalisation and there must be proper coordination. It is also essential to focus on enhancing the capacity of the officials and adoption of technologies, according to Mansur.

Echoing Mansur, Towfiqul Islam Khan, an economist and a senior research fellow at the Centre for Policy Dialogue, said, "It looks like there will be a major shortfall by the end of June."

"However, the NBR's revenue growth is relatively good compared to its historical growth. But this growth is not enough for the higher target that was set for FY25," he said.

Commodity prices and the foreign currency exchange rate were high and those, together with the introduction of a new income tax law, helped increase the NBR's tax revenue mobilisation in the current fiscal year, he said.

But not much revenue could be generated from other sources, which is also known as non-NBR tax, he said.

About the revenue shortfall, Khan said, "When the revenue shortfall becomes large, it squeezes the government's fiscal space, leading to low implementation of the government's development budget."

The economist spoke on the government's tax measures in the proposed national budget for the next fiscal year, saying it was largely focused on revenue mobilisation.

The revenue board should have focused on the tax evasion and good governance for eliminating corruption, he said.

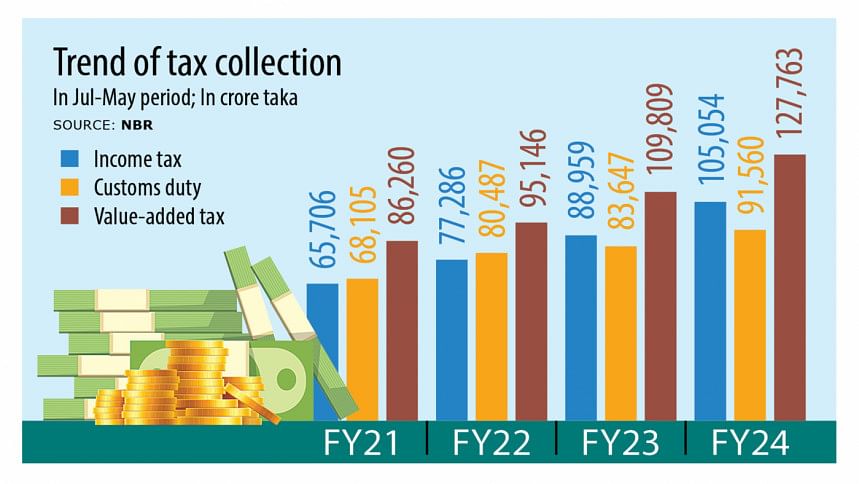

The NBR data showed that tax collection from international trade grew just 9.46 percent year-on-year to Tk 91,561 crore in the July-May period owing to a fall in imports.

This is due to the fact that the government has put in place curbs to save US dollars amid a protracted foreign exchange reserve crisis.

Income tax receipts rose 18.09 percent to Tk 105,054 crore, while the collection of value added tax, the biggest source of revenue, grew 16.35 percent to Tk 127,763 crore.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments