FY24: A brutal year that gutted stock investors

For stock investors in Bangladesh, the just-concluded fiscal year was the worst in four years, with the benchmark index of Dhaka Stock Exchange losing over 1,000 points.

The last time it was this bad was in fiscal year 2019-2020, when the key index, DSEX, lost 1,395 points to close at 3,989.

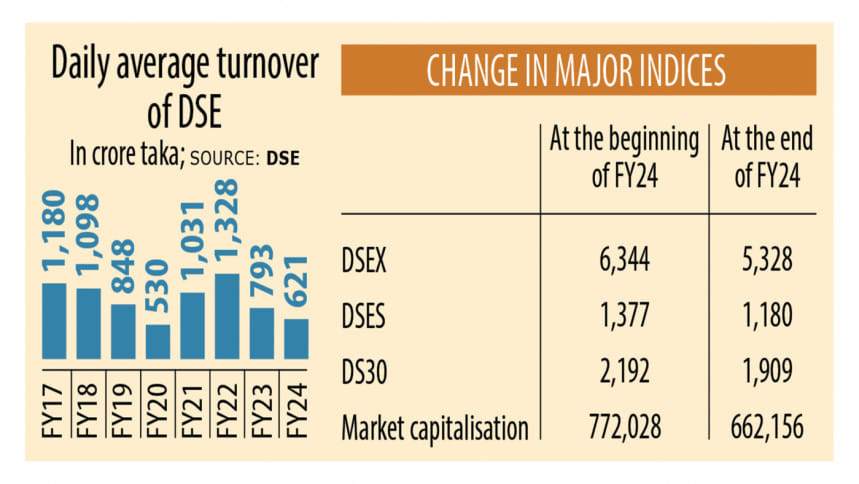

The DSE opens for trading today in a new fiscal year at 5,328. It had started off the last fiscal year at 6,343.

The flow of liquidity into the market has dropped too. Daily average turnover fell 22 percent year-on-year to Tk 621 crore. That means it was Tk 792 crore in fiscal year 2022-23.

The scenario was the same for market capitalisation, or the total value of shares of listed companies at the DSE.

On June 30, the last day of fiscal year 2023-24, market capitalisation stood at Tk 6,62,155 crore.

It was 14.24 percent lower than that on the last of fiscal year 2022-23.

Overall, these translate to a decrease in prices of shares, causing losses for investors who have long been waiting for the stock market to gain some vibrancy.

"It was a bad year for us," said investor Hedayetul Islam.

To him, the market performed well during the first quarter of last fiscal year. No good news came afterwards for most investors.

"Now, the market is in a bad condition…And the situation is deteriorating…I am doubtful whether even one out of 1,000 investors was able to make gains in the last three months," said Islam.

The Bangladesh Securities and Exchange Commission (BSEC) launched the floor price, which is the lowest price at which a stock can be traded, for the second time in July of 2022.

The aim was to halt the free-fall of the indices amid uncertainties brought on by the lingering fallout of the coronavirus pandemic and the Russia-Ukraine war.

The price control could do little to provide investors some confidence, for which the market remained dull, prompting the regulator to lift the restriction in February 2024.

This caused prices to fall amidst persistent economic challenges.

For Asif Khan, chairman of Edge Asset Management, fiscal year 2023-24 had both positive and negative developments.

"On the one hand, we saw most economic parameters like inflation, reserves and growth show a negative performance," he said.

"On the plus side, we are now following more prudent monetary and fiscal policies which should improve things over time. The key to getting back on track is proper reforms," he said.

Throughout the year, Bangladesh struggled to retain a healthy foreign currency reserve, bring down inflation and stop the slide in the value of the local currency, taka, against the US dollar, said Khan.

"The macroeconomic challenge hit the confidence level of both foreign and local investors. It was evident in the selloffs in recent months," he said.

Rajesh Saha, chief executive officer of CAL Securities, said there was a huge impact on the national budget imposing a capital gains tax on investors.

The government plans to impose at least 15 percent capital gains tax on general investors if their income from share trading crosses Tk 50 lakh.

"Now we expect that the market has already come to a situation that it should make a turnaround," he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments