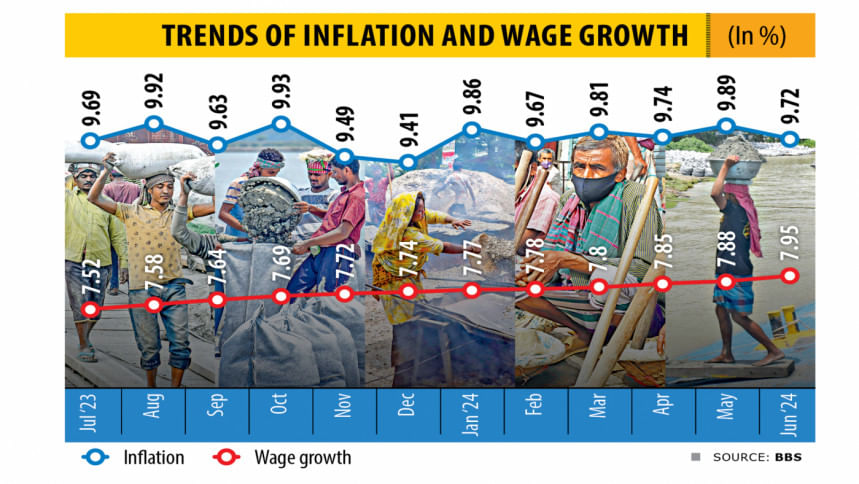

Inflation outpaces wage growth for 29th month straight

Although wage growth in Bangladesh has been slowly climbing since July 2021, it has remained below the inflation rate for the past two and a half years, government data shows.

Wages of low-paid and unskilled workers grew 7.95 percent in June, which was 1.77 percentage points below the inflation rate of 9.72 percent in the same month, showed the Wage Rate Index (WRI) of the Bangladesh Bureau of Statistics (BBS).

This trend has been continuing for the past 29 months, as per data from the BBS.

This widening gap is forcing low-income and unskilled workers to cut consumption amid falling real incomes, according to analysts.

The nominal wage rate growth stood at 7.88 percent in May while the inflation rate was 9.89 percent, it added.

"When high inflation persists for a long time, it will definitely impact the poverty rate and create many new poor," said MM Akash, a former chairman of the economics department at the University of Dhaka.

People who are now struggling to keep their heads above water may be dragged below the poverty line, he added.

Rizwanul Islam, an economist and former special adviser for employment at the International Labour Office in Geneva, said high inflation, especially high food inflation, has been affecting the purchasing power of low-income people.

This also reduces coping strategies and gradually narrows opportunities for low-income and low-skilled people.

"More than 40 percent of the population of Bangladesh is in real difficulty because of continuously elevated inflation, especially food inflation," Islam said, adding that it has been affecting low-skilled, self-employed and middle-income individuals.

In June, food inflation slipped to 10.42 percent from 10.76 percent a month ago. However, food inflation has hovered above 9 percent since May 2023. It crossed 9.5 percent every month of fiscal year 2023-24 except February.

In FY24, the highest rate of food inflation was witnessed in October, when it hit 12.56 percent. If effective trade unions existed, there would have been an uproar regarding the situation, according to Islam.

"But we don't see such issues. Rather, everyone is more focused on how to cope with the situation," he said.

The WRI takes into account the wages of informal workers, who get their payments on a daily basis, across 63 occupations in the agriculture, industry and services sectors.

Asked about the impact on the labour market due to the persistently higher inflation, Islam said there is an inverse relationship between inflation and unemployment as illustrated by the Phillips curve.

"However, in Bangladesh, it's not clear if such a relationship will work because there are other factors such as import compression working that are simultaneously having an adverse effect on growth."

So, one cannot expect employment to grow, he said.

"Employment was not growing even when output growth was normal. That's why the informal sector continues to be the major source of employment," Islam said.

He added that inflation may also adversely affect the labour market situation through the consumption and demand route. Elevated levels of inflation have an adverse effect on demand, which in turn affects output growth in various sectors.

Prof Akash added: "It should be mandatory to provide rations or adjust their wages in line with inflation to give a cushion to the workers."

The economist suggested providing cash incentives to low-income people, similar to initiatives during Covid-19, and expanding social safety net programmes.

He also urged the government to extend support to the urban poor, who usually remain out of safety net, by providing essential commodities and cash support for house rent.

"The nominal wage rate climbed from 7.39 percent in June 2023 to 7.7 percent in December 2023. In April 2024, it was 7.85 percent. Despite being less than inflation, the pay index increase significantly represented the current inflationary wave," the Bangladesh Bank said in its monetary policy review yesterday.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments