Consumer financing slows amid economic hardship, uncertainty

Consumer financing has slowed as people are adopting a go-slow strategy for taking loans, considering the increasing trend of interest rates amid ongoing inflationary pressure.

Banks are also being very conservative in providing consumer credit amid the uncertainty surrounding the recent political changeover, industry insiders said.

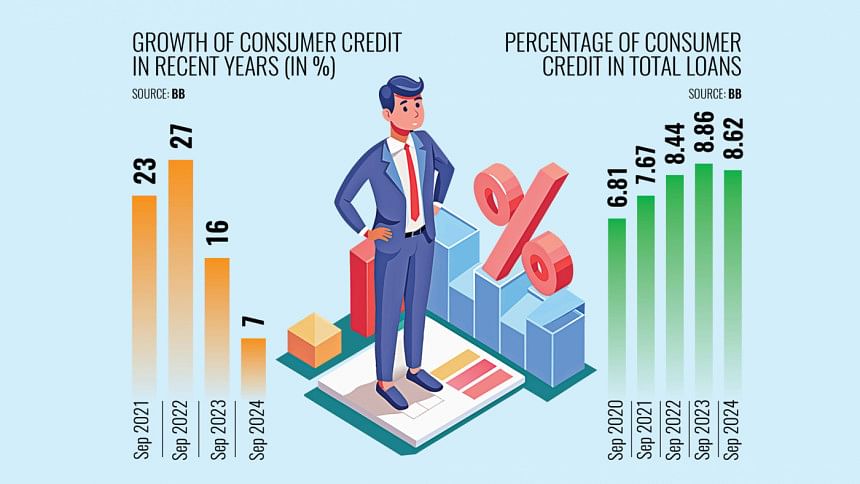

As of September this year, the percentage of consumer credit out of total loans stood at 8.62 percent, down from 8.86 percent the previous year, according to the latest data from the Bangladesh Bank.

Total outstanding loans in the banking sector stood at Tk 1,619,917 crore as of September this year, of which Tk 139,613 crore is consumer financing.

The percentage of consumer credit out of total loans was 6.81 percent in the same period of 2020, 7.67 percent in 2021 and 8.44 percent in 2022.

Consumer credit, or consumer debt, is personal debt taken on to purchase goods and services. For instance, a credit card is one type of consumer credit in finance.

Industry insiders said people take consumer credit mostly for lifestyle and luxury product purchases.

However, they have been forced to cut their spending on luxury products in the face of economic hardships. Still, some people are taking consumer loans to meet their monthly expenses, they added.

From September last year to September this year, banks disbursed Tk 9,103 crore as consumer credit, down from Tk 17,993 crore in the same period of the year prior, central bank data showed.

Bank Asia is continuing to expand its retail loans or consumer financing, said its managing director, Sohail RK Hussain.

Home loans, personal loans, automobile loans and credit cards are the major areas of retail loans.

Credit growth in the retail segment is not substantial and is still insignificant compared to the total loans in the banking sector, said the Bank Asia MD.

People of middle-income and upper middle-income are mainly taking consumer credit, he said, adding that professionals are mostly taking those types of loans.

The housing and automobile sectors were adversely impacted last year due to the exchange loss of the local currency, taka, against the US dollar, Hussain said, adding that the 100 percent letter of credit (LC) margin on luxury products impacted retail loans.

Hussain also said consumer credit or retail loans are expanding on the increased earning capacity of people and changing lifestyles.

From September last year to September this year, banks disbursed cash for purchasing consumer goods, apartment purchases, credit cards loan and salaries, central bank data showed.

Banks are also lending for educational expenses, medical treatment, marriage expenses, travel or holidays, professional loans, transport loans, loans against provident funds, personal loans against deposit premium schemes (DPS), personal loans against fixed deposit receipt (FDR) and more.

M Khurshed Alam, deputy managing director of Eastern Bank, said consumer financing has slowed because of inflationary pressure.

Inflation in Bangladesh hit a four-month-high of 11.38 percent in November this year and has stayed above 9 percent since March of last year.

Alam said Bangladesh Bank is trying to curb inflationary pressure by hiking the policy rate, which pushes up the lending rate. As a result, people are avoiding loans.

Keeping pace with the interest rate of general loans, the central bank recently increased the maximum interest rate on credit cards to 25 percent from 20 percent.

The hike in interest rate of loans against credit cards will impact the credit growth of consumer financing, Alam said.

Few banks are providing consumer credit, which is why this segment is yet to expand, said Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

He said banks are allowed to lend a maximum of Tk 2 crore to each client as a home loan and a maximum of Tk 40 lakh as a personal loan.

Rahman, also the former chairman of the Association of Bankers, Bangladesh, said banks are now very conservative in giving consumer credit as defaulted loans in this segment have also increased.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments