Is Islamic finance facing headwinds?

Rabiul Islam, a practising Muslim who works at a private organisation, refrained from conventional banking services for many years as both paying and receiving interest are against his religious principles.

Although he had to maintain a mandatory salary account with a private bank, he did not utilise additional services like loans.

Out of concern about where to safekeep his savings around 10 years ago, he sought advice from an Islamic scholar or Imam and opened an account with Islami Bank Bangladesh Ltd (IBBL).

"I opened the account after getting assurances that all banking activities through Islamic finance are conducted in accordance with religious principles," he explained.

Like Islam, millions of Bangladeshi Muslims have turned to Islamic finance, regardless of financial literacy, boosting its popularity.

Islamic finance began its journey in the country in the early 1980s and evolved into a significant sector within Bangladesh's financial landscape due to the Islamic perspective of risk sharing and ethical investment.

IBBL, the first Islamic bank of the country, was formed in 1983. It offered products like profit-sharing investment accounts (Mudarabah) and financing facilities (Musharakah).

By the early 2000s, IBBL's success had paved the way for the formation of other Islamic banks like Al-Arafah Islami Bank, Social Islami Bank, and Shahjalal Islami Bank.

"Most Bangladeshis are religious. Even those who do not practise actively want to adhere to Islamic principles. Islamic banks are capitalising on this sentiment," said Mohammed Nurul Amin, a former chairman of the Association of Bankers Bangladesh.

The seasoned banker said many people prefer interest-free banking because of religious beliefs.

Another reason for the popularity of Islamic banks is the favourable policy support extended to them from the Bangladesh Bank, which has made the sector more profitable than the conventional banks.

The Islamic finance sector enjoys a lower statutory liquidity ratio (SLR) and higher investment-deposit ratio (IDR) than conventional banks. The SLR is the minimum percentage of deposits that a commercial bank has to maintain in the form of liquid cash, gold or other securities.

As per the central bank rules, traditional banks must maintain 13 percent of their deposits as SLR while Islamic banks must maintain only 5.5 percent, a major regulatory benefit that means Islamic banks have more investible funds than commercial banks.

At the same time, conventional banks have to maintain an ADR (advance to deposit ratio) of 87 percent while Shariah-based banks have to maintain 92 percent.

This means conventional banks can lend Tk 87 against a deposit of Tk 100, while Shariah-based banks can lend Tk 92 against the same.

Amin, also a former managing director of Meghna Bank, said investors and shareholders are very eager to form Shariah-based banks due to such regulatory benefits.

Industry insiders added that the beneficial policy support motivated a growing number of commercial banks to turn into Islamic banks.

For instance, Standard Bank and NRB Global Bank, both commercial banks, transformed into Shariah-based lenders in 2021.

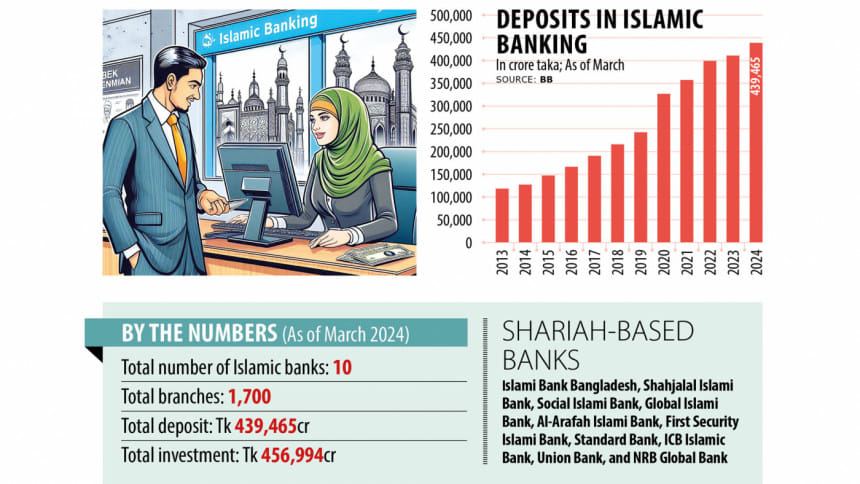

Including those two, there are 10 full-fledged Islamic banks in the country. The others are IBBL, Shahjalal Islami Bank, Social Islami Bank, Global Islami Bank, Al-Arafah Islami Bank, First Security Islami Bank, Union Bank and ICB Islamic Bank.

These banks have around 1,700 branches in the country.

However, the central bank has been selective in approving the introduction of Islamic financing windows in most conventional banks.

Besides, many commercial banks have introduced Islamic windows and branches. This has enabled them to reach customers who otherwise wouldn't have availed their services.

A total of 15 commercial banks have opened 30 Islamic banking branches while 16 banks are running 624 Islamic banking windows to provide services.

Also, some non-bank financial institutions and insurance companies are also providing Islamic finance services like Islamic bonds (sukuk), Islamic insurance (takaful), and Islamic microfinance.

Sukuk has become an alternative avenue for raising funds for infrastructure and development projects, while takaful offers a Shariah-compliant insurance solution to individuals and businesses.

Islamic microfinance institutions have played a crucial role in providing financial services to the unbanked and underbanked population, contributing to financial inclusion and poverty alleviation.

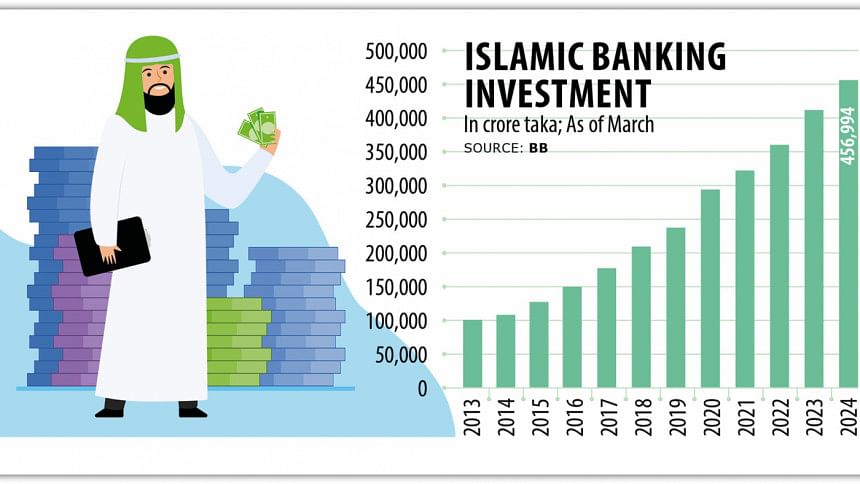

The wide adoption of Islamic banking has contributed to phenomenal growth and expansion in the sector until 2022.

At the end of September 2022, total deposits in this system reached Tk 421,375 crore and investment stood at Tk 386,221 crore. Besides, the IDR stood at 0.92 while excess liquidity reached Tk 17,525 crore.

However, total deposits at the Islamic banking industry rose to Tk 439,465 crore till March of this year and total investment stood at Tk 456,994 crore, as per the latest data from the central bank.

As of 2023, Islamic banking assets accounted for over 25 percent of the overall banking sector's assets in Bangladesh.

RECENT CRISIS

However, despite the impressive growth and potential, the sector has been facing a significant crisis since the middle of 2022 due to loan irregularities, scams and a lack of good governance in some Shariah-based banks.

At the end of 2022, the Islamic banking sector faced some headwinds as the asset quality of a dozen Shariah-based banks deteriorated and a number of loan irregularities came to light, impacting the growth and liquidity indicators of the sector.

The deposit growth of Islamic banks dropped to 2.9 percent year-on-year in 2022 from 20.1 percent a year ago, according to the central bank's Financial Stability Report 2022.

Presently, six Shariah-based banks are facing a huge liquidity crisis as depositors have withdrawn their funds, adversely affecting the whole sector.

Recently, Fitch Ratings said that Bangladesh's Islamic banking sector was still being affected by a liquidity shortage as it is more vulnerable than the conventional banking sector.

The American credit rating agency added that Bangladesh's Islamic banking sector has been stagnant for the past two years despite having a sizable market share.

The liquidity crisis has been so severe that the ICB Islamic Bank, one of the affected banks, recently failed to repay depositors' money.

Excess liquidity in the sector plummeted to Tk 1,518 crore at the end of March this year, a 91.3 percent drop compared to September of 2022.

Amin accused those who were involved in loans irregularities and scams of forming Islamic banks solely to make profits instead of for ideological reasons. "If ideology was the driving force, then how come one person can own six to eight Shariah-based banks?" he questioned.

STRUCTURAL ISSUES

There are some structural issues in the sector, such as the lower number of Shariah-compliant instruments that allow banks to borrow money from the call money market, which has worsened the liquidity crisis, according to industry insiders.

Besides, except for a set of guidelines issued by the central bank, there is no specific law or policy framework for the Islamic finance sector in Bangladesh despite the fact that countries with dedicated frameworks have seen the sector grow substantially.

The central bank recently revised its Shariah banking guideline, but is yet to publish it.

Mustafa K Mujeri, a former chief economist of the central bank, recently told The Daily Star that simply revising the guidelines would not be enough. Strict action must be taken in case of violations, he said.

Mujeri, also an executive director of the Institute for Inclusive Finance and Development, said most Islamic banks are worse off than before as the rules are not being followed.

Industry insiders emphasised forming supervisory committees in banks with people who are efficient in both banking and Islamic law. In most cases, bankers lack knowledge about Islamic jurisprudence while Islamic scholars have limited to no practical banking knowledge.

Hence, strict monitoring by the central bank is mandatory in order to bring discipline to the sector.

WAY FORWARD

Good governance and accountability are key to navigating the current crisis and ensuring sustainable growth, according to experts.

This requires the implementation of internal controls, independent audits, and transparent reporting mechanisms as well as strengthening the role and independence of Shariah boards in overseeing compliance with Islamic principles.

The central bank should review some Shariah-based banks and, if needed, the board of directors of those banks should be reformed, Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, told The Daily Star.

A chief executive of a Shariah-based bank, seeking anonymity, said there is a need for a concentrated effort from regulators, banks, and stakeholders to enhance governance, better manage risks, and restore public confidence.

An Islamic banking law is needed to ensure compliance as the sector can play a vital role in the country's economic development and financial inclusion once it overcomes the current crisis, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments