Most listed MNCs saw a drop in profits in Oct-Dec

Most listed multinational companies (MNCs) saw a year-on-year erosion of profits in the October to December period of FY25, mainly due to higher financing costs and macroeconomic challenges amid political uncertainty.

Among the 13 listed multinational companies in Bangladesh, nine have so far published their financial reports for the three-month period.

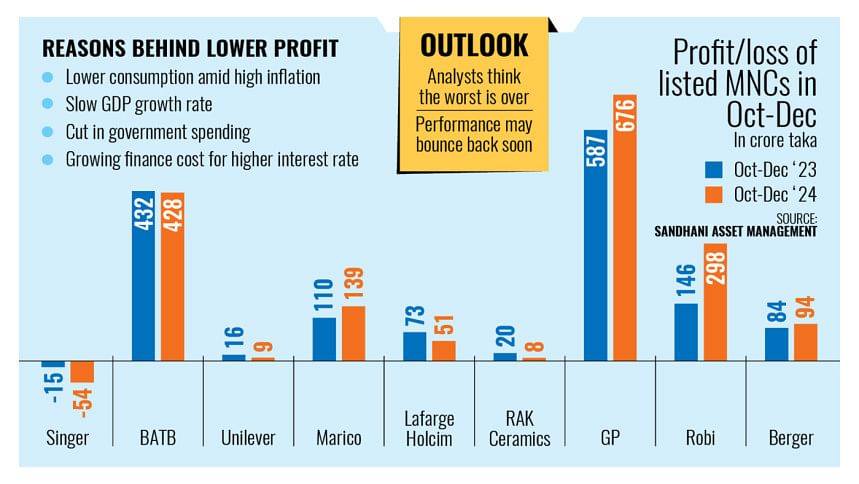

Analysing their financials in the quarter, Sandhani Asset Management found that four of the nine saw their profits drop year-on-year while one incurred higher losses and the rest logged higher profits.

Thanks to the central bank's adoption of tight monetary and fiscal measures, aggregate demand in the country dropped and gross domestic product growth fell. So, the profits of multinationals companies dropped, said Shahidul Islam, CEO of VIPB Asset Management.

"We saw extraordinary policy tightening," he remarked.

VIPB has investments worth hundreds of crores in shares of listed firms, but it selectively invests in companies that are well-governed, such as MNCs.

Shahidul said the profit drop among MNCs was relatively lower than that seen at other listed firms. He hoped that MNCs and well-governed companies would continue to do better in the future as a level playing field is expected to be reinstated.

The performance of MNCs varies depending on their product lines as consumption of less essential products was impacted in recent months amid stubborn inflation, said Mir Ariful Islam, managing director and chief executive officer of Sandhani Asset Management.

Inflation has remained above 9 percent since March 2023, according to the Bangladesh Bureau of Statistics.

Moreover, as government spending on the Annual Development Program was cut, cement producers were impacted, Islam said, adding that the overall construction sector is under pressure in the face of high inflation.

So, all construction-related firms have been impacted.

Profits of LafargeHolcim Bangladesh fell 43 percent to Tk 51 crore in the October to December quarter.

In 2024, the net sales of LafargeHolcim Bangladesh stood at Tk 2,754 crore, a 3 percent decrease from the previous year. However, its net profit plunged 36 percent to Tk 381 crore.

The company claimed that its business was impacted by the political changeover in August last year and the challenging macroeconomic environment.

Singer Bangladesh saw a sharp climb in losses in the quarter, which rose to Tk 54 crore, more than three times the loss of Tk 15 core that it had seen a year ago.

The company attributed the increased loss primarily to a net loss stemming from increased financing costs.

The finance costs for all companies rose as interest rates in the banking sector rose.

At the end of December 2024, the weighted average interest rate at scheduled banks was close to 12 percent while it was around 9 percent one year prior, according to Bangladesh Bank data.

Increased payments for costs and expenses, coupled with stagnant collections from sales, were among other reasons.

Moreover, consumption of electronics and home appliances was also impacted due to high inflation, so Singer Bangladesh was affected.

"Another factor is that local companies have become more aggressive. So, they are grabbing the market at a low margin, impacting the multinational companies," Ariful said.

Unilever Consumer Care also took a hit, especially as the sales of its most popular products are reliant on people having disposable income, which has been eroded due to persistent inflation.

British American Tobacco's (BAT's) profit fell slightly to Tk 428 crore in the recently ended quarter compared to Tk 432 crore compared to the year prior.

Usually, consumption of cigarettes rises during an economic depression, Ariful added. However, maybe consumers moved to products in the lower segment. This may have impacted BAT's profit, he opined.

Regarding the business outlook, the asset manager said it is a good sign that the government's fiscal and monetary policies are working and contributing to easing inflation. Once the macroeconomic situation improves, business will rebound.

"I hope it will take six months to one year for economic indicators to return to normalcy and for the confidence of people to be boosted. If a return to normalcy takes more time, business will take more time to rebound."

Political stability, macroeconomic stability and consumer confidence are crucial for business in the coming months, he added.

VIPB's Shahidul, also a former president of the CFA Society, Bangladesh, said, "The worst is over. I hope performance of the companies is going to bounce back as macroeconomic indicators are already showing signs of improvement."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments