Garment sector sets worst example among industries

After the boom, there comes the gloom.

Big or small, industries in Bangladesh meet an almost identical fate. It happened with jute and tea, and now, a pall of gloom hangs over all manufacturing industries, including ready-made garment, the highest forex earning sector.

Why does a business slip from boom to gloom? There could be a host of reasons, but at the heart of most lies a lack of business innovation.

The challenge is in going to the next level following initial business successes, which is achieved mostly through common sense, intuition and hard work. But most stumble at that stage due to a lack of innovation and new ideas.

Technology has changed the business landscape for good, making research and development (R&D) the most crucial tool for businesses to survive and thrive. As per data from the Bangladesh Bureau of Statistics, the economy has recovered well from the slump years of 2019-20 and is edging closer in 2023 to pre-pandemic growth levels of 12.33 percent.

But the road to recovery has been achieved with little or no investment in R&D.

A recent study by the Centre for Policy Dialogue (CPD) reveals that businesses could not care less about technology, with the R&D expenditure of most standing at next to nothing.

The study, however, did not dwell much on the money that industries spend on R&D. One of the insights is that most firms in Bangladesh spend less than $4.54 (Tk 500) a year per worker on R&D.

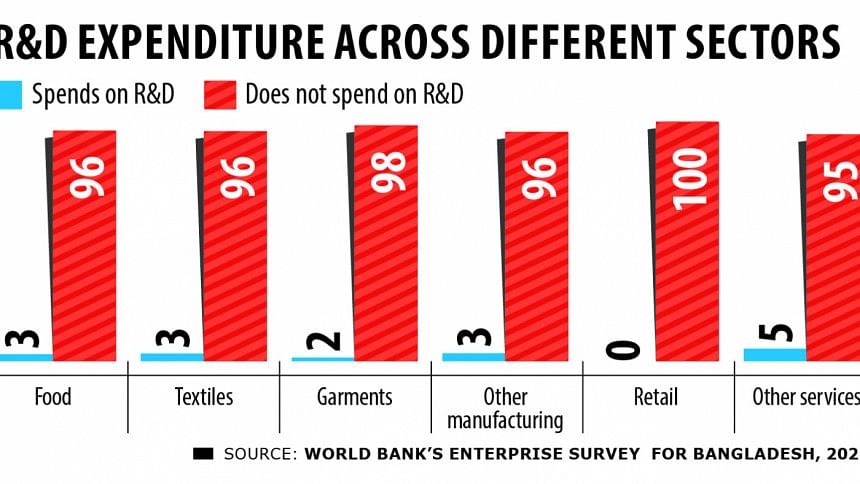

Alarmingly, only five percent of large manufacturing industries spend what is ultimately a rather insignificant amount on R&D, while the rest do not even bother with that.

The number is even more shocking for the garment industry, where only two percent of firms spend on research and product innovation. Bangladesh is the world's second-largest apparel exporter after China, with the sector contributing the most ($46.99 billion in FY2023) to national coffers.

Yet, for decades, a majority of the 4,000-plus garment factories have been limping along with skill sets more reminiscent of tailoring shops, such as cutting fabrics and making clothes. Thanks to the owners' lack of appetite for market research, innovation, and product diversification-development, the sector could not yet graduate from one of the world's cheapest clothing destinations to a high-end product market, where the profit pie is significantly bigger.

Just over two dozen manufacturers, according to industry insiders, have notched phenomenal growth through innovation and value-addition to products. They are no longer tailors but designers, developers, marketers and manufacturers of unique products for the world.

Sadly, the rest of the garment businesses are either barely surviving or nearing the prospect of going out of business. According to the Bangladesh Garment Manufacturers and Exporters Association (BGMEA) and research organisation Mapped in Bangladesh, 450 factories have remained closed since the onset of the pandemic in 2020, while 1,500 others operate occasionally depending on availability of orders or sub-contracting jobs.

Outside Bangladesh, the road to business prosperity is traversed differently, with insights from painstaking research paving the way.

Armed with knowledge from R&D endeavours, smart entrepreneurs assess the market situation as well as strengths and weaknesses, decide how to develop themselves, find ways to achieve success, and research and innovate to sustain or build on that success.

Countries and companies that are most innovative and ruling the world continue to invest heavily on R&D to expand their knowledge base to ensure sustained growth and dominance over competitors.

Thanks to the owners' lack of appetite for market research, innovation, and product diversification-development, the sector could not yet graduate from one of the world's cheapest clothing destinations to a high-end product market, where the profit pie is significantly bigger.

Almost $2.5 trillion was invested worldwide in R&D in 2022 despite the ongoing economic downturn, according to a UN briefing.

Quite predictably, the world's top two economies, US and China, are by far the two largest spenders on the segment, with R&D spending of around $680 billion and $550 billion respectively. Smaller countries with tech-heavy economies such as Japan, Israel and South Korea have also invested larger shares of their gross domestic product (GDP) into R&D.

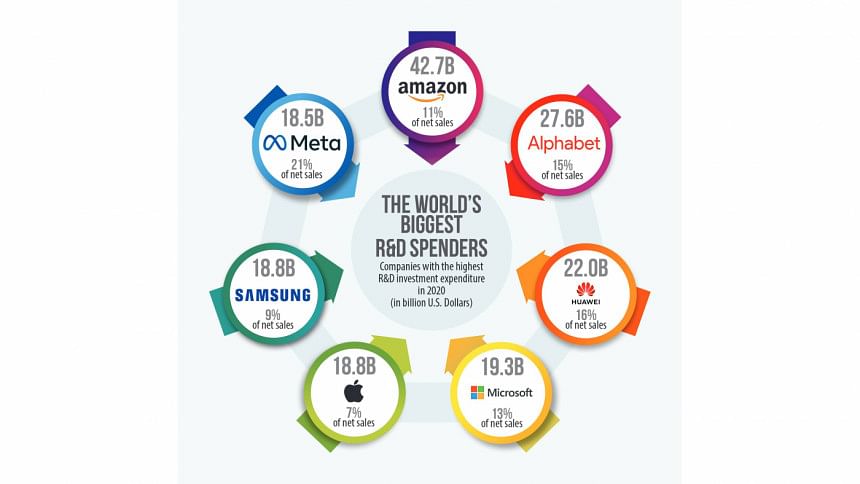

The most valuable companies in the world—Amazon, Google's parent company Alphabet Inc, Huawei, Microsoft, Apple, Samsung and Meta (formerly Facebook)—are also the most generous in their R&D expenditure as they seek to acquire knowledge faster than their competitors to stay well ahead in the race. Together, the seven tech-driven giants dished out $167.7 billion on R&D in 2020, with Jeff Bezos' Amazon being the largest spender at $42.7 billion, which was around 11 percent of its net revenue.

In contrast, Bangladesh, whose national budget size is $70 billion for 2023-24, allocated only 0.03 percent of the GDP in the last fiscal year towards R&D, as per Planning Commission data. In contrast, Vietnam allocated 0.54 percent of its GDP to R&D, India 0.70 percent, and China 2.55 percent, according to World Bank statistics.

The R&D allocation itself is too meagre for an economy like Bangladesh, which has grown at a rate of over six percent for the last decade and will be transitioning from a least developed country to a developing country in 2026. As if it is not bad enough, there are reports that even this sparse allocation remains mostly unutilised every year.

Right now, Bangladesh's economy is in dire straits due to the fallouts of the pandemic, the Russian invasion of Ukraine and weak governance in the banking sector. Research can give policymakers a deeper understanding of what fixes are needed to address structural vulnerabilities in the economy.

For the sake of economic growth and sustainable development, the sooner we do that, the better.

Syed Ashfaqul Haque is the executive editor of The Daily Star.

Follow The Daily Star Opinion on Facebook for the latest opinions, commentaries and analyses by experts and professionals. To contribute your article or letter to The Daily Star Opinion, see our guidelines for submission.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments