Political violence during election will make economic recovery more difficult

Our economy is already under stress, struggling with macroeconomic crises such as high inflation, balance of payment issues, which is putting pressure on the foreign exchange reserves, inconsistent export and remittance earnings, etc. In the coming months—the rest of the fiscal year or even the next calendar year—there are no substantive predictions that our economy will bounce back. In such circumstances, the ongoing political conflicts/uncertainty will definitely affect our economy. Over the past few days, we have seen how the political programmes—e.g. blockades—are already restricting people's mobility, which I'm quite sure is affecting economic activities. And we don't know how things will go in the next two or three months, especially around the general election. We now know that the election is going to take place, as the Election Commission announced on Wednesday. There are concerns that there may be more incidents of political violence in the time leading up to the election, as well as afterwards. We are already seeing arson attacks on public vehicles, and we fear this situation may escalate further.

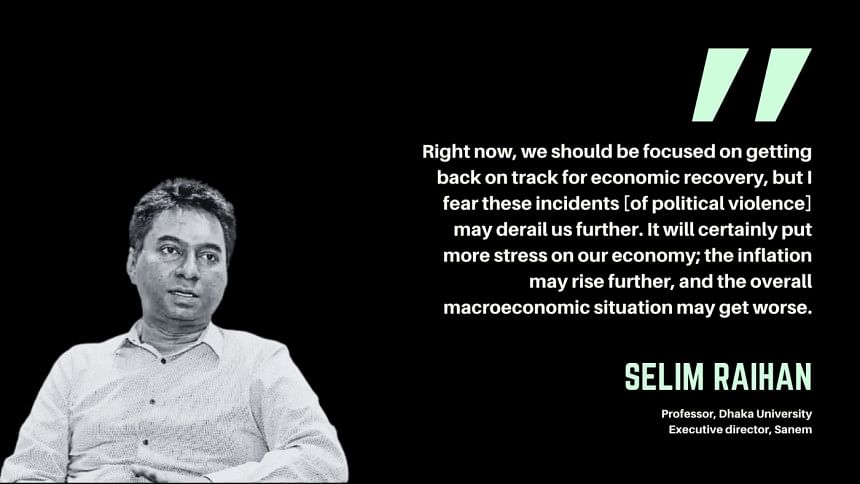

If you look at our economic indicators over the last six months, investment has slowed down drastically; borrowing from banks has gone down, and opening LCs to import raw materials and capital machinery has significantly fallen too. This means investors are currently quite wary about investment. Of course, there are other factors at play, like the dollar crisis. Overall, this situation is definitely not conducive for economic recovery. Right now, we should be focused on getting back on track for economic recovery, but I fear these incidents [of political violence] may derail us further. It will certainly put more stress on our economy; the inflation may rise further, and the overall macroeconomic situation may get worse.

We are seeing added pressure from external forces, too, like the US and European Union, regarding the election. The US, for example, has imposed visa restrictions. We don't know if they will expand the scope for such restrictions, or if other countries will follow its footsteps and impose new conditions. Seeing as the US and EU are our two largest export destinations, we need to be concerned about our future exports. I have spoken to a number of businesspeople, who are equally worried. These are very big concerns given the possibility of the political tension permeating our economic domain.

Dr Selim Raihan is professor at the Department of Economics in the University of Dhaka, and executive director at the South Asian Network on Economic Modeling (Sanem). He can be reached at [email protected].

Views expressed in this comment are the author's own.

Follow The Daily Star Opinion on Facebook for the latest opinions, commentaries and analyses by experts and professionals. To contribute your article or letter to The Daily Star Opinion, see our guidelines for submission.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments