Taming the inflation monster in Bangladesh

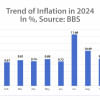

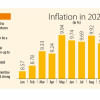

Inflation in Bangladesh has reached its highest level in a decade and has been a persistent problem for more than 18 months, starting from early last year. This situation, I believe, is the result of a failure to implement necessary measures to curb inflation in a timely manner.

Although the Russia-Ukraine war had an initial impact on inflation, it is not a valid excuse after such a long period. Other factors, such as the two rounds of fuel price hikes, have also contributed to this problem. Since fuel is an essential input for almost all sectors of the economy, its price increase affects the cost of most goods and services.

In fighting inflation, there are significant deficiencies in multiple areas coupled with a deficit in policy-making and implementation. First, the rigid interest rate policy of six to nine percent was maintained until the new monetary policy was announced in June this year. The earlier policy was not compatible with the market economy, as it did not adjust to the changing inflationary conditions. Many other developing countries in Asia (India, Indonesia, Vietnam, and even Sri Lanka) did not keep their interest rates fixed when inflation was high. Instead, they used their monetary policies more prudently and reduced the money supply in the market by raising interest rates.

But Bangladesh failed to do this. The move to a flexible regime under the Bangladesh Bank's latest monetary policy remained inadequate. The interest rates were pegged to the SMART (Six months Moving Average Rate of Treasury bill), but this did not allow the rates to rise sufficiently to curb inflation. Therefore, even after the removal of the interest rate cap, the monetary instrument remained ineffective in combating inflation.

The government also contributed to inflation by borrowing heavily from the central bank, which increased the money supply in the market. Moreover, the government adopted a policy of "managed" foreign exchange rate for several years, implemented by the central bank, to keep the dollar exchange rate artificially "stable." This policy prevented the necessary devaluation of the taka against the US dollar when the market conditions changed. However, towards the end of last year and early this year, the taka depreciated by 25-30 percent within a very short time. This sudden and large devaluation also fuelled inflation, as it raised the prices of imported goods in the domestic market. Therefore, the monetary policy was inappropriate and insufficient.

The government could have used fiscal policy to control inflation during this crisis by giving various tax breaks on imported goods. However, it did not adjust the taxes when the prices rose in the global market due to the taka's depreciation. This resulted in higher prices of many products in the domestic market. Additionally, the domestic market has been poorly managed and monitored. There is a state of chaos and disorder. Some unscrupulous traders have exploited the crisis by creating artificial shortages and raising prices without any justification. The government has not taken any effective measure to prevent such market manipulation.

Sri Lanka has been successful in containing its inflationary pressure, on the contrary. The island nation is making a recovery from a terrible situation it has faced in the last two years. One of the main reasons for this is the independent role of Sri Lanka's central bank during the crisis. It has regulated interest and foreign exchange rates autonomously, without any interference from the government. On the other hand, Bangladesh Bank has not been independent in formulating and implementing policies related to interest rates, exchange rates, and government borrowing.

Inflation is the biggest challenge for low-income and middle-class people in the country; controlling it must be the government's top priority. To do this, it needs to ensure an adequate supply of essential goods in the market and import them if necessary, adjust the monetary policy instruments, especially the interest rates, to reduce the money supply, and assess the fiscal policy and reduce taxes on the import of essential items to lower their prices in the domestic market.

Additionally, the government should enforce discipline in market management and take legal action against traders who inflate prices without any justification. It must also introduce a credible threat to market manipulators by allowing competitive import of goods in the shortest possible time if their prices are too high in the domestic market. The market has to be carefully monitored, and free flow of information about the demand and supply of consumer goods must be ensured, and the government should have accurate statistics on how much goods are needed and how much to import. To this end, a market monitoring mechanism should be developed involving representatives from traders, consumers, government authorities, and NGOs at the wholesale, retail, and local levels. Finally, government bodies such as the Competition Commission, which are responsible for regulating the market and preventing anti-competitive practices, must be strengthened.

The main point to remember here is that inflation cannot be controlled by any single organisation or policy. It requires a coordinated effort of sound monetary and fiscal policies, and proper market management.

Dr Selim Raihan is professor at the Department of Economics in the University of Dhaka, and executive director at the South Asian Network on Economic Modeling (Sanem). He can be reached at [email protected].

Views expressed in this article are the author's own.

Follow The Daily Star Opinion on Facebook for the latest opinions, commentaries and analyses by experts and professionals. To contribute your article or letter to The Daily Star Opinion, see our guidelines for submission.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments