What lower global interest rates mean for a reforming Bangladesh

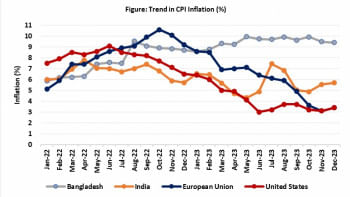

The Federal Reserve Board has recently cut its key lending rate, also known as policy rate or key rate in other economies, by half a percentage-point to the range of 4.75 percent to five percent in its first reduction after more than four years. This signals a global shift towards boosting consumption and job creation, as it follows a European Central Bank (ECB) key rate cut a few months ago. This shift is interesting in the backdrop of an opposite reaction from Bangladesh Bank, which recently hiked its policy rate to curb a high sustained inflation rate. These opposite reactions pose an opportunity for Bangladesh to gain access to more foreign investments, improve its export competitiveness, and bolster its foreign reserve.

The Federal Reserve Board's rate cuts come expectedly following a prolonged period of raising rates, as it aims to battle unemployment before it gets out of hand. The projection for an increasing unemployment rate in the US rose to 4.4 percent by the end of 2024, which is expected to remain the same for 2025 as experts predict further interest rate cuts. A lending rate cut means that banks can access funds from the central bank by paying a lower interest rate compared to before. As banks borrow more money from the central bank, their consequent higher liquidity allows them to provide loans to individuals and businesses at a lower interest rate than before. This in turn prompts more individuals to take mortgages at a lower interest rate to buy houses, or avail car loans at lower rates. In addition, businesses are incentivised to take advantage of lower interest rates by financing business expansion through bank loans. This expansion then leads to more jobs being created, and thus a lower unemployment rate.

Beyond this singular effect, we must look at the broader impact that a lending rate cut can have for the US economy. Generally, lower debt financing leads to domestic consumers having a surplus of wealth to spend. This leads to higher investment into the equity and alternative instruments markets as they provide a higher return compared to government instruments. However, more money at hand doesn't always lead to more investments. For the average person, this usually leads to higher consumption, which eventually increases inflation if not controlled. Moreover, a lower interest rate is viewed by foreign investors as unattractive, which lowers the demand for the US dollar. This devalues the US dollar in the foreign exchange market leading to exports being cheaper and imports getting more expensive in the US. This again can benefit local manufacturers as imports decrease while local consumption increases.

Bangladesh Bank initiated an opposite policy move by hiking policy rates recently to combat a high inflation rate in a reformative Bangladesh. This is expected to be followed by two more hikes in the coming month as mentioned by the central bank governor . A higher policy rate has the exact opposite effects to the ones discussed above. This higher interest rate can be seen by both local and foreign investors as attractive in conjunction with the newly introduced crawling peg rate, and a gradually reducing US dollar value in the future. The combination of these policies can lead to a much-needed increase in the foreign exchange value of the Taka, making imports cheaper. With lower interest rates in the US, global investors often seek higher returns in emerging markets. This phenomenon, known as the "search for yield," could thus lead to increased capital inflows into Bangladesh. This could help revive Bangladesh's struggling foreign direct investment (FDI) inflows, which have been stagnating in recent years. An increase in FDI would be especially beneficial for the country, as it faces a persistent shortage in foreign exchange reserves, which have been fluctuating around $20 billion for the past few years. Strengthening FDI could provide much-needed stability and alleviate pressure on the country's reserves, offering a buffer to manage external payments, especially with imports getting cheaper due to the policy rate hike.

However, the drawbacks must be addressed alongside the opportunities. An excess of short-term capital inflows, known as "hot money," can make the economy vulnerable to volatility, particularly if the Federal Reserve Board changes course and raises rates again. Capital can quickly exit the market, putting pressure on Bangladesh's foreign reserves and currency stability. As consumer demand in the US picks up, it could lead to increased orders for Bangladeshi textile products, which account for a significant portion of the country's export earnings. However, with the policy rate hike making exports more costly, businesses may face lower than expected returns, discouraging exporters and limiting the full potential of this opportunity. Then there is the evident reduction in business expansion and individual consumption as a direct effect of the policy rate hike. So, even if imports become cheaper, there is a possibility that consumer demand might not match it leading to recession.

Thus, while contradictory monetary policies between Bangladesh and the global economy offer a potential boost for much-needed investment in Bangladesh's reforming economy, the associated risks could undermine these benefits. It is crucial to take cautionary measures in evaluating the impact of the policy rate hike, especially as other economies are moving toward monetary easing. A balanced approach will be essential to maximise the inflow of investments while mitigating the negative effects on exports, consumer demand, and economic stability.

Tahmeed Rifa is associate at Innovision Consulting Pvt. Ltd.

Views expressed in this article are the author's own

Follow The Daily Star Opinion on Facebook for the latest opinions, commentaries and analyses by experts and professionals. To contribute your article or letter to The Daily Star Opinion, see our guidelines for submission.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments