This Bangladeshi app lets you buy, sell and store gold digitally

Gold has always been an object of desire and value. While many prefer to buy gold in bulk for their personal use, others prefer jumping at the right opportunity to exchange money for gold depending on the rising market prices. However, being such a valuable object, storing bought gold or selling it comes with a certain level of risk - one of the main reasons why even the smartest investors are often discouraged from dealing in this pricey metal.

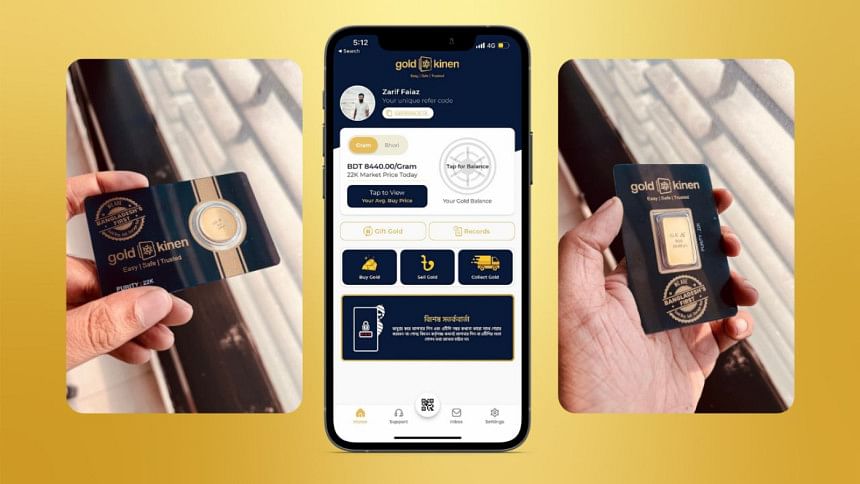

Meet Gold Kinen - a local app where one can buy, sell and store gold using their own personal vault. With Gold Kinen, one can buy 22k (91.6% pure) hallmarked and certified gold, which the app makes available at the official market price. Given the price of gold fluctuates quite often, the app also provides the user with the most updated pricing - in both grams and 'bhori' calculated in Bangladeshi taka.

How it works

According to the founders of Gold Kinen, their aim is to make gold savings accessible, affordable, and convenient for everyone in the nation. Customers can purchase gold in fractional amounts, in the form of coins and bars, through the app, and the gold is delivered and stored in "bank-grade" vaults managed by Securex Pvt Ltd. until the customer decides to collect their gold.

The gold vaults are insured by the country's leading insurance company, Green Delta Insurance Company Ltd. All Gold Kinen products are hallmarked and certified 22 Karat Gold, and a certificate of authenticity from recognized third-party certification agencies is provided with all products and they are delivered securely to customers, whenever they decide to collect the gold.

The starting price for buying gold is set at Tk. 500 and according to the instructions in the app, they have several options when it comes to collecting gold, ranging from 2-gram or 4-gram coins to 1-gram, 5-gram and 10-gram gold bars. The app also has the option to let users gift gold to others, where the recipient will receive the gold straight to their Gold Kinen account.

Meet the team

Gold Kinen's founders, Kamran Sunjoy Rahman, Rafatul Bari Labib, and Atef Hasan, have diverse professional backgrounds. Rahman is a seasoned international banker and has experience in the area of investment and consumer banking. He is actively involved as a Director of Special Olympics, Bangladesh (SOBD), a global organization founded in 1968 that works on sports for people with intellectual disabilities.

Labib, a sales and marketing professional, has a career of more than 8 years, with multinational and local corporates such as Grameenphone, Philip Morris International, and bKash. His last role prior to starting Gold Kinen was in the trade marketing team of bKash's commercial division.

Hasan, on the other hand, has a diversified successful career that started in Accenture, after which he was a Financial Consultant at iFarmer. Prior to starting Gold Kinen, he was the Financial Analyst of bKash in the treasury department.

With a current team size of 35, Gold Kinen is funded by the three founding members and is backed by angel investors.

Navigating regulatory waters

Gold Kinen holds a gold dealing license under the Gold (Procurement, Storage, and Distribution) Order, 1987, which allows the company to deal in gold products across Bangladesh. Additionally, the company holds an approved DBID under the Ministry of Commerce, Bangladesh, which is mandatory to operate any digital or online business in Bangladesh in a regulated manner.

According to the founders, Gold Kinen upholds strict compliance and is working towards maintaining the highest levels of integrity in its operations. The company is currently an active member of relevant trade associations such as the Bangladesh Jeweller's Association (BAJUS), the E-Commerce Association of Bangladesh (ECAB), and the Bangladesh Association of Software and Information Services (BASIS).

Trust, privacy and security

The team insists that the security and privacy of user data on the iOS and Android platforms are ensured by following international standard best practices in terms of securing and managing user data. The founders also state that Gold Kinen complies with all data privacy guidelines of iOS and Android platforms, which enabled the app to be published on their systems.

According to the founders of Gold Kinen, the trust associated with buying, selling, and storing gold digitally will come with time and a shift in consumer behaviour. They understand that it might take some time for people to trust a digital platform for such a valuable asset. However, they are confident that once the service generates good word of mouth and a reputation for being reliable and secure, customers will start to trust the platform.

The founders believe that the key to building trust is transparency and consistency. They have taken several measures to ensure that their customers have a clear understanding of the process and are kept informed throughout the entire transaction. Additionally, they have implemented robust security measures to protect their customers' data and investments.

They believe that as more and more people begin to use the platform and see the benefits of buying, selling, and storing gold digitally, the service will gain widespread acceptance.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments