Regulator lifts floor price curbs on most stocks after 18 months

The Bangladesh Securities and Exchange Commission (BSEC) yesterday withdrew the floor price for most of the stocks, 18 months after the measure was imposed, a move that is expected to bring back vibrancy to the market.

The floor will still be applicable for 35 companies, the regulator said in a notice yesterday.

Speaking to The Daily Star, Shibli Rubayat-Ul-Islam, chairman of the BSEC, said: "We organised many roadshows abroad where it was clear that investors want to come to the stock market. Now, we have no fear."

He said the indexes might be hit following the withdrawal of the floor price but they will be stable within a few days.

"We want to absorb the shock, if any, in two phases, so some big index movers have still been put under the floor price."

"We told earlier that the floor price will be lifted after the national election. We have kept our word."

In July 2022, the commission set the floor price, which is the lowest price at which a stock can be traded, for every share to halt the free-fall of the indices amid uncertainties brought on by the lingering fallout of the coronavirus pandemic and the Russia-Ukraine war.

The BSEC lifted the floor price for 169 companies in December 2022. But in March last year, it brought back the price control for all firms as the economy continues to be clobbered by the macroeconomic crisis amid the sharp fall of foreign exchange reserves and the taka's value against the US dollar and an elevated level of inflation.

Owing to the floor, most of the stocks did not see much trading activity while price manipulation involving junk stocks and weak companies was rife.

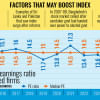

The DSEX, the benchmark index of the Dhaka Stock Exchange, stood at 6,376 in June 2022, before the imposition of the floor. It has hovered around the same level since then and closed at 6,336 yesterday.

Amid thin trading, turnover, another key indicator of the market, fell to Tk 637 crore from Tk 937 crore 18 months earlier, DSE data showed.

Yesterday, analysts welcomed the BSEC move and said the market may see volatility in the absence of the artificial price mechanism. However, it will run on its own strength within a few months.

"It will be good for the market in the long run. I hope market intermediaries will play the responsible role so that investors don't behave abnormally and don't panic," said Saiful Islam, president of the DSE Brokers Association.

In an event yesterday, Islam said around 80 percent of stockbrokers were not able to bear operating expenses due to the low turnover amid the floor price.

Shahidul Islam, chief executive officer of VIPB Asset Management, said the decision would improve market liquidity and give a much-needed boost to the confidence level of investors.

"There should be an explicit communication that the floor prices will not be imposed again. Such communication will attract foreign investors who want the scope to exit the market under any circumstances."

He said many asset managers manage funds for clients who don't have the mandate to invest in countries where price floors or other restrictions are imposed or can be imposed.

In an analysis, BRAC EPL Research said: "We expect liquidity to improve significantly in the immediate term as normal trading will resume for the stocks that will see the removal of the floor price."

"Volatility will increase in the short term, with good bargain possibilities. We don't expect a re-imposition of the floor price at this point."

Khondaker Golam Moazzem, research director of the Centre for Policy Dialogue, said the lifting of the floor price may increase trade in the secondary market.

"However, the measure is inadequate to bring about qualitative change to the capital market and boost investor confidence. As the circuit breaker will still be there, we can't say the removal of floor prices willcreate a market-based mechanism."

"The confidence deficit among investors is likely to persist."

The economist alleged that manipulation, insider-trading and flawed audited financial accounts might still be there.

"Still, the share of the "Z" category (low grade) companies rises unusually. There is weakness in effective monitoring and enforcement. To increase confidence of investors, the regulator and other intermediaries must work for effective monitoring and enforcement."

Mohammad Rezaul Karim, a spokesperson of the BSEC, said thanks to the withdrawal of the price mechanism, liquidity in the market will increase and investors will get handsome returns again.

The upper and lower limits of the circuit breaker will apply to all securities except the 35 companies. This means the companies can rise or fall as much as 10 percent.

He said the regulator has continued the floor price for 35 companies based on some criteria. One of them is a huge volume of shares of the firms are available to sell and they can create volatility.

"Some companies experienced huge sales pressure despite the floor price. These companies have been put under the curb."

The marginable stocks may come under forced sales pressure since brokerage houses may look to adjust margin loans, he said.

The companies that will remain under the floor price mechanism include Anwar Galvanizing, Baraka Power, British American Tobacco, Beximco Ltd, Bangladesh Submarine Cables, BSRM Ltd, BSRM Steel, Confidence Cement, DBH, Doreen Power, Envoy Textiles, and Grameenphone.

The rest are HR Textile, IDLC Finance, Index Agro Industries, Islami Bank, KDS Accessories, KPCL, Kattali Textile, Malek Spinning, National Housing Finance, National Polymer, Orion Pharmaceuticals, Padma Oil, Renata Ltd, Robi, Siham Cotton, Shasha Denim, Sonali Paper, Sonarbangla Insurance, Shinepukur Ceramics, Shahjibazar Power, Summit Power, and United Power.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments