Foreign funds in stocks on the wane

Foreign investments in the Dhaka Stock Exchange have maintained a downward trend since 2018 despite the regulator's efforts to retain existing investors and attract new ones.

Global investors are distancing themselves owing to their long-held fear of a massive depreciation of the local currency against US dollars and repeated changes in policies that hurt listed firms. The worry related to the currency deepened first by the coronavirus pandemic and then by the Russian war in Ukraine.

Since 2020, the Bangladesh Securities and Exchange Commission (BSEC) has organised roadshows in the United Arab Emirates, the United States, Switzerland, the United Kingdom and Japan in a bid to attract more foreign investments. The initiatives are yet to bring about any major visible positive impacts.

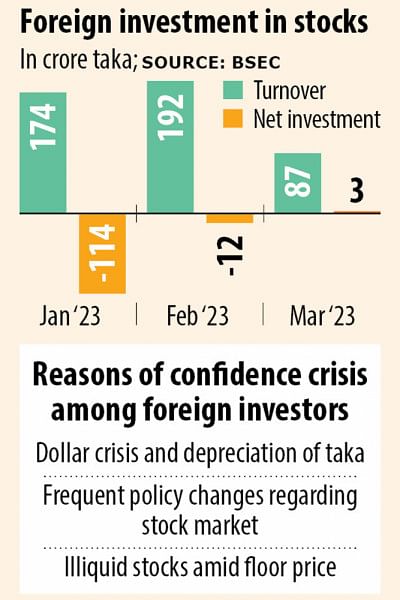

Amid the lower participation of international investors, the turnover of foreign investors plunged to Tk 87 crore in March, the lowest since August 2012 when it stood at Tk 68 crore, BSEC data showed.

In March, foreign beneficiary owner account-holders bought shares worth Tk 45 crore and sold securities involving Tk 42 crore, giving a net investment of Tk 3 crore.

In February, foreign investors traded shares worth Tk 192 crore while their net investment was a negative Tk 12 crore.

The turnover was Tk 174 crore in January while the net foreign investment was Tk 114 crore in the negative.

"Foreign investors will not flock to our stock market even if the regulator invites them through roadshows," said a top official of a brokerage firm, preferring not to be named.

"Rather, they will look at the potential and problems of the market. The regulator should fix the problems first."

One of the challenges, the broker said, is foreign investors face a confidence crisis.

"Changes in policies were a major obstacle that spooked the confidence of external investors. Policy continuity is necessary."

In recent years, regulators have brought in a number of policy changes that were most unexpected.

In 2018, the BSEC approved the extension of the tenure of closed-end mutual funds from 10 years to 20 years and handed over the power to asset managers, much to the dismay of investors because many of them had been waiting for the liquidation of the funds and booking profits.

Closed-end mutual funds are investment funds that gather a fixed pool of money for 10 years from investors and re-invest them into stocks, bonds and other assets.

In 2015, the energy regulator -- Bangladesh Energy Regulatory Commission -- slashed the distribution charges of Titas Gas. As a result, the market value of the state-run gas utility fell more than Tk 3,000 crore in the five months to February in 2016.

In 2019, the telecom regulator declared Grameenphone as a significant market power, dampening the confidence of foreign investors.

As an SMP, higher charges are applied to GP, which might squeeze the business growth of the leading mobile phone operator in Bangladesh.

The Bangladesh Telecommunication Regulatory Commission also banned Grameenphone from selling SIMs in June last year. The restriction was lifted in January this year.

"When regulators take any abrupt decision and it goes against listed companies, their profits take a hit. As a result, companies' capacity to invest is squeezed. Investors don't like to be in such a situation," said the broker.

The fear of a drastic depreciation of the local currency had always been in the minds of investors as the central bank had kept the taka stronger against foreign currencies for long through artificial support.

However, the central bank finally allowed the taka to fluctuate late last year after the foreign currency reserves started to fall fast owing to an escalation of import bills against moderate export and remittance earnings.

The taka has lost its value by about 25 per cent against the American greenback in the past one year.

"The depreciation of the taka was one of the drivers behind the continuous sell-off by foreign investors," said the broker, adding the central bank should introduce a market-based exchange rate so that investors should not worry much about any currency swing.

The last nail in the coffin was the imposition of the floor price by the BSEC twice to stop the free-fall of stocks, said the chief executive officer of a merchant bank.

"As a result, we don't know about the direction of the market. Not only foreign investors, but local institutional investors are also reluctant to invest in the market."

In March 2020, the stock market regulator introduced the floor price on all stocks to stop the index from sliding after the coronavirus pandemic struck the country.

In order to prevent a freefall of stocks, the floor price, the lowest price at which a share can be traded, was brought back on July 29.

On December 21, the stock market regulator lifted the artificial support measure for 169 companies, only to bring back the regulatory measure in March this year.

The floor price disheartened foreign investors as they always prefer a liquid market, the CEO said.

"Investors don't want to invest because of the exchange rate volatility."

Speaking to The Daily Star, Mohammad Rezaul Karim, spokesperson of the BSEC, said: "Roadshows are organised jointly with other regulators to attract foreign portfolio investments as well as foreign direct investment. The initiatives will pay off in the long run."

"Roadshows boost foreign investors' confidence as they highlight the potential of the country and allow us to know the problems investors face."

According to Karim, regulators have already resolved many problems. For example, the central bank eased the process of opening non-resident investors' taka accounts.

"The BSEC is working with the National Board of Revenue so that foreign investors, general investors and institutional investors all enjoy the same dividend tax."

Karim is hopeful that the foreign portfolio investment will increase in the upcoming years.

The fall of portfolio investments is not just a local phenomenon.

For example, amid multiple shocks, global portfolio investment asset holdings decreased by 15 per cent in the first half of last year, the most since 2008, according to the International Monetary Fund.

Elevated risk aversion amid increasing energy prices, heightened geopolitical and inflation risks, and tightening monetary policies in advanced economies weighed heavily on capital markets and portfolio investments, it said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments