Huge bad loans force banks to keep higher provision

Most of the listed banks in Bangladesh had to keep higher provisions in the first half of 2022 owing to the bearish trend in the share market and the removal of the relaxed loan classification policy that sent bad loans higher.

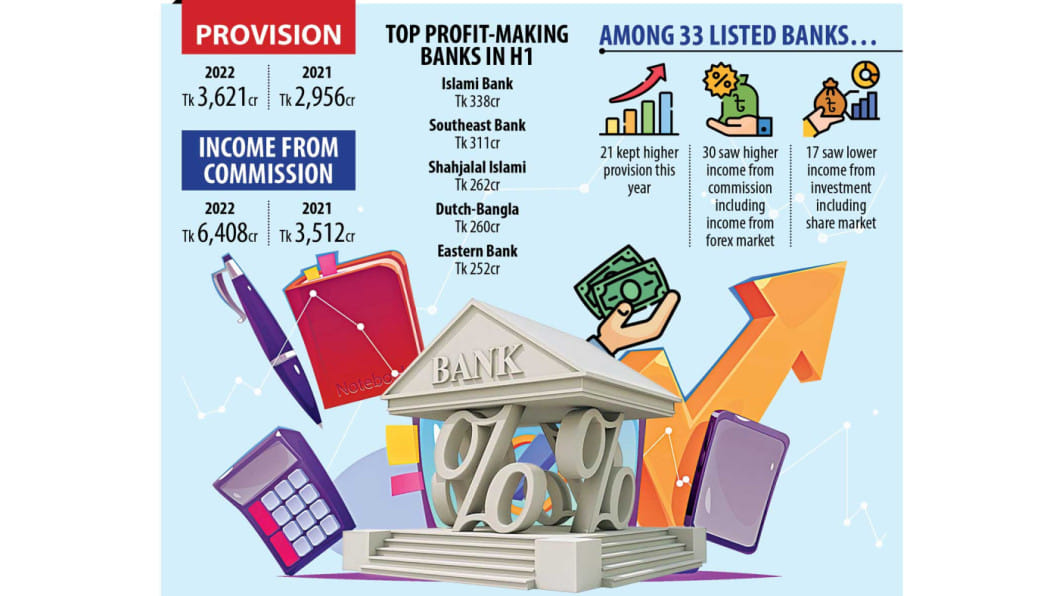

The lenders collectively made a 7 per cent higher profit at Tk 4,899 crore between January and June, their financial reports showed. It was Tk 4,583 crore during the same six-month period a year ago. Twenty-one banks logged higher profits, year-on-year.

But their revenue stream was hurt by the lower income from banks' investment in the capital market amid persisting uncertainty caused by the macroeconomy instability and the volatility in the financial sector owing to the Russia-Ukraine war and the dragging coronavirus pandemic.

Profits from their foreign exchange market operation saved the day for them.

According to the financial reports, 21 banks needed to keep higher provisions during the January to June period compared to the identical period in 2021.

Provisions are balance sheet items representing funds set aside as assets to pay for anticipated future losses.

In Bangladesh, banks have to earmark 0.50 per cent to 5 per cent of their operating profit in provisioning against general category loans, 20 per cent against classified loans of substandard category, and 50 per cent against classified loans of doubtful category.

They have to set aside 100 per cent of classified loans of bad or loss category from the profits as provisioning.

Provisions totalled Tk 3,621 crore in the first half, up 22.50 per cent from Tk 2,956 crore a year ago.

"As the classified loans surged, the provision amount surged as well," said Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

Default loans rose 19.3 per cent year-on-year to Tk 116,288 crore in the first quarter of 2022, the latest for which data from the Bangladesh Bank were available.

It was up 9.84 per cent in March from a quarter ago. The ratio of default loans accounted for 8.53 per cent of the outstanding debts as of March, against 8.07 per cent a year earlier.

The classified loans in the banking industry rose though there was a moratorium in 2020 and 2021.

In order to counter the impacts of the coronavirus pandemic on the economy and businesses, the central bank maintained payment holiday for borrowers. As a result, banks did not have to reclassify the credit status of borrowers, which drove the non-performing loans down.

In June this year, the BB re-introduced a flexible loan repayment facility. Borrowers in large industries would be able to avoid falling into the defaulted loan category by repaying half of the loans payable for the April-June period.

The borrowers must clear 60 per cent of their unpaid loans in the July-September quarter and 80 per cent in the fourth quarter of 2022 if they don't want to be classified as defaulters.

Mohammad Habibur Rahman Chowdhury, a deputy managing director and chief financial officer of Prime Bank, says when banks experience an unrealised loss in their stock market investment, they have to keep provisions too.

"Though Prime Bank had to keep a lower provision this year, many banks had to set aside a significant amount owing to the ailing stocks and higher default loans."

Of the listed banks, 17 saw lower income from their investment in stocks and bonds.

It came after the DSEX, the benchmark index of the premier bourse in Bangladesh, tumbled 6.96 per cent in the first half, data from the Dhaka Stock Exchange showed, reversing the course from a year ago when it went up 9.46 per cent.

The commission income and the income from the foreign exchange market operation of the listed banks rose 82 per cent year-on-year to Tk 6,408 crore in the first half. It was Tk 3,512 crore during the first half of 2021.

Thirty listed banks posted higher profits from their foreign currency businesses, helped by the dollar shortage amid abnormally high imports compared to lower-than-expected export receipts and a fall in remittance flow.

The forex market was hit with volatility in mid-April as the severe fallout of the Ukraine war sent the prices of essential commodities to record levels.

The US dollar traded at Tk 93.45 on June 28 this year at the interbank foreign exchange platform, where banks buy and sell among each other, in contrast to Tk 84.82 on the same day a year ago.

Currently, the platform does not account for a major portion of US dollar transactions since it does not reflect market fundamentals. Rather, banks directly purchase US dollars from exporters and remitters and sell them to importers.

For example, importers had to buy each dollar at Tk 100 in June.

Recently, exporters, importers and business leaders have publicly accused banks of making excessive profits. And their allegation proved justified on Monday when the central bank ordered six banks to remove their treasury chiefs for causing volatility in the forex market.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments