Japan: a growing source of trade, investment

It all started in early 2008 when the Japanese government announced the "China Plus One Strategy" to cut its over-reliance on the manufacturing behemoth by setting up business operations in other countries.

The move came as the cost of production in China has climbed and there has been a dearth of skilled workforce in a country known as "the world's factory", which sent the profit margin for Japanese investors in China lower.

The China Plus One Strategy worked so well that the shipment of merchandise from Bangladesh, especially garments, has continued to grow at a faster rate.

Apparels, the country's main export item, posted more than 175 per cent shipment growth between 2008 and 2010, data from the Export Promotion Bureau (EPB) showed.

In 2008, Japan's retail giant Fast Retailing opened an office in Dhaka to source clothing items for its consumers.

Among the Asian nations, Japan was the first export destination for Bangladesh where earnings crossed the $1-billion mark in 2015-16. The shipment stood at $1.32 billion in the year.

The higher export growth to the Japanese market, where consumers have long tended to prefer quality consumption, is a testament to the improving standards of goods made in Bangladesh.

The Japanese markets did not disappoint even during the peak of the Covid-19 pandemic in 2019-20 when Bangladesh shipped goods worth $1.20 billion despite serious disruptions to the global supply chain.

Local exporters registered a 40.74 per cent year-on-year growth to $1.90 billion in 2022-23. It was $1.35 billion in 2021-22.

Garment shipment grew even higher: earnings surged 45.62 per cent to $1.59 billion from $1.09 billion in FY22.

Manufacturers have targeted to generate $10 billion in garment export earnings from Japan by 2030.

Apparel shipment to Japan received a major boost when Tokyo relaxed the Rules of Origin and started allowing zero-duty benefits to the import of knitwear items from the least-developed countries (LDCs) in 2011.

This was a major respite for local suppliers as Japan had maintained a 17 per cent duty on knitwear items for many years to protect its domestic industry. Woven items have been enjoying duty preference for a long time.

Another important milestone for the bilateral ties came when former Japanese Prime Minister Shinzo Abe, during his visit to Dhaka in 2014, unveiled the Bay of Bengal Industrial Growth Belt initiative for Bangladesh.

A MAJOR SOURCE OF INVESTMENT

Over the years, Japan has also emerged as a major investment source for Bangladesh.

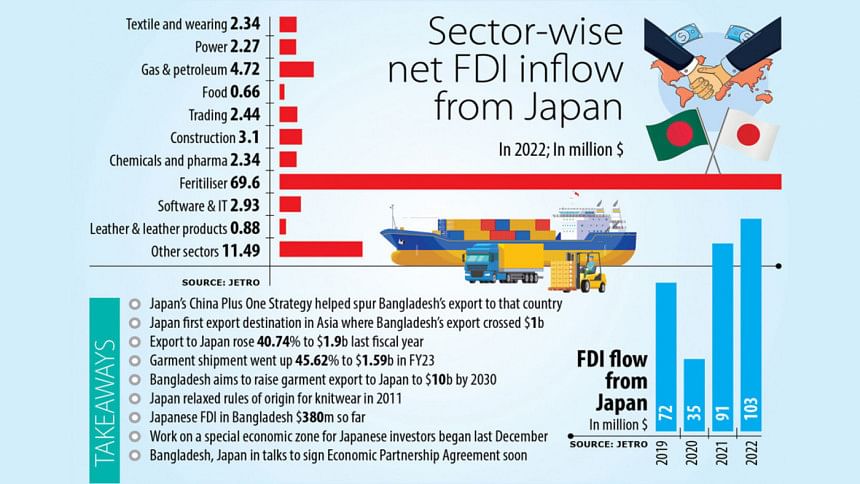

The inflow accelerated between 2019 and 2022 when foreign direct investment (FDI) from Japan grew 7.61 per cent annually to take the total FDI in the country to $380 million.

The FDI came mainly in the garment, engineering, construction, healthcare, and motorcycle sectors.

The amount, however, is just 0.1 per cent of what Japanese companies have invested in Asia, according to data from the Japan External Trade Organisation (Jetro).

Currently, around 350 Japanese companies are doing business in Bangladesh, up from 245 in 2015.

The investment is expected to rise after the government established a dedicated Japanese Economic Zone at Araihazar in Narayanganj.

The zone, owned jointly by the Bangladesh Economic Zones Authority (Beza), the Japan International Cooperation Agency, and Sumitomo Corporation, opened in December last year.

Shaikh Yusuf Harun, executive chairman of the Beza, said they are expecting around $1.5 billion in FDI at the zone.

He hopes that the commercial production at the factories being set up would begin in February 2024.

According to the Jetro, Japanese investments will come in the areas of automobiles, consumer goods, IT, textiles and chemicals.

Bangladesh, however, is yet to benefit from the relocation of Japanese companies located in China. About 33,050 Japanese firms with more than $57 billion in investments have begun moving to various Asian countries and elsewhere, the state-run agency said.

According to a Jetro survey, 44.4 per cent of the companies aim to expand in the next one or two years.

The confidence of Japanese firms in Bangladesh is even higher with 71.6 per cent planning to expand, the highest in the Asia region.

INITIATIVE TO SIGN TRADE DEAL

Yuji Ando, chief country representative of the Jetro, said it would be necessary for the business environment in Bangladesh to be improved by addressing the issues facing Japanese companies through an Economic Partnership Agreement (EPA).

"Local rules should be consistent with international rules in order to promote trade and investment."

Ando is optimistic that by creating a competitive investment climate through an EPA, Bangladesh would be the next investment destination for Japanese companies.

With a view to elevating Japanese investments, a joint study was launched in December to ink an EPA.

The survey showed about 85 per cent of the local and Japanese companies with operations in both nations want their respective governments to sign a free trade agreement so that they can continue enjoying duty benefits after Bangladesh graduates from the LDC group in 2026.

Some local companies say the country would lose its competitiveness in Japan without a generalised system of preferences facility if compared with other countries that have struck FTAs with Japan. This is because the tariff will go up between 7.4 per cent and 10.9 per cent on garment exports after the GSP expires.

At a time when both sides looking to expand trade and investments, Yasutoshi Nishimura, minister for economy, trade and industry of Japan, is scheduled to visit Dhaka today.

During the visit, he will attend a business summit on Bangladesh-Japan trade at the Pan Pacific Sonargaon Hotel.

Nishimura is scheduled to meet Commerce Minister Tipu Munshi to discuss the joint study of the EPA, which covers not only tariffs but also trade and investment components.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments