Tax receipts rise but fall short of target by Tk 23,200cr

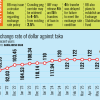

Tax collection soared nearly 14 percent in the first half of the fiscal year (FY) 2023-24, helping the National Board of Revenue (NBR) reach above the minimum benchmark set by International Monetary Fund (IMF) as a condition for its $4.7 billion loan.

The tax collector logged Tk 165,630 crore in total revenue in the July-December period of the current fiscal year, crossing the IMF's indicative targets of Tk 143,640 crore for the period, according to provisional data by the NBR.

The tax collector, however, missed the target it had set for itself for the period by over Tk 23,200 crore, the attainment of which, an analyst said, would enable the government to cut bank borrowing to meet public expenditure.

"The government would not have been required to issue special bonds to clear arrears of private power producers and fertiliser importers had the tax collection grown at higher pace," said Zahid Hussian, former lead economist at The World Bank's Dhaka office.

"The pressure of debt burden and interest rate on the government increases because of the issuance of such special bonds. By issuing bonds against which Bangladesh Bank is providing liquidity support, the government is also fuelling inflation," he said.

The government decided to issue these special bonds, worth around Tk 26,000 crore, to clear arrears to independent power producers and fertiliser importers that have remained unpaid for months.

Hussain said the government earlier committed that it would not create any new money. But now, monetisation is coming through back door, he added.

He said the NBR's collection would be below the structural targets of collection -- additional revenue collection of 0.5 percent of Gross Domestic Product in the FY24 given by the IMF.

The government initially tasked the NBR with the goal of collecting Tk 430,000 crore in tax-revenue for the current fiscal year, before recently revising it down to Tk 410,000 crore.

Until the first half of the fiscal year, the tax authority managed to collect 40 percent of the total target, according to the NBR data.

"Limited revenue collection will definitely constrain public expenditure. The sign was there. The policymakers could realise it from the very beginning of this fiscal year," said Towfiqul Islam Khan, senior research fellow at the Centre for Policy Dialogue (CPD).

"Now, with the new government in charge, it is time to prudently revise the budget," he said, adding that the IMF in its last review also revised the target for tax collection downward.

"The apprehension is that this revised budget may not be attained either," Khan added.

"In the past, good documents were produced. The problem is in implementation. There is a need to involve a broader range of stakeholders both from within and outside the government."

Data by the NBR showed that customs tariff collection grew 9 percent year-on-year to Tk 49,068 crore in the July-December period of the current fiscal year as imports fell.

Collection of Value Added Tax (VAT), the biggest source of revenue, soared 16 percent to Tk 64,737 crore in the first half of FY24 compared to a year ago.

Income tax receipts stood at Tk 51,824 crore in the July-December period of FY24, jumping 16 percent year-on-year, data from the NBR showed.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments